A unique conference and 5 pieces of content you'll enjoy

Highlights from a busy couple of months at BTBS

After a busy couple of months, today’s post gives you a chance to catch up with some recent highlights from this Substack and other Behind The Balance Sheet channels.

New Podcast Episodes 🎙️

I knew the podcast would be fun but I’ve enjoyed interviewing guests on my podcast even more than I thought I would. And judging by the reaction we’ve had, our last couple of guests went down a treat.

● In October, top value investor Bill Smead gave us a clinic on how to buy fantastic businesses when they are out of favour. The episode is full of great insights, but I particularly enjoyed his primer on the similarities between handicapping greyhounds and picking stocks. (Long time listeners may recall another greyhound aficionado investor). Find the episode here.

● Earlier this month, Sebastian Lyon taught us how Troy Asset Management minimises downside risk and identifies quality companies to invest in. Sebastian’s track record is sublime and he’s one of the best at distilling big investing ideas simply – a must listen. Find the episode here.

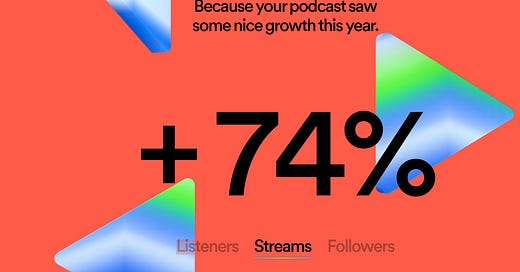

I have recorded December’s (scheduled for the 21st but we may release early) and my guest is amazing. We should beat our previous best quarter for downloads. And if you enjoy the podcast, do me a favour, please leave a 5* rating on Spotify or Apple Podcasts.

It all helps me grow the show - the image is from Spotify Unwrapped 2023. We have room for another sponsor, let me know if you want to reach 1000s of professional fund managers every month.

Sohn London

The 10th Annual Sohn London Investment Conference returns to the London Marriott Grosvenor Square on Wednesday 6 December with a stellar line-up of speakers presenting their stock ideas. All of the money raised from this unique conference will go towards paediatric cancer research.

Book tickets here. See you there?

Popular Recent Substack Posts 📈

Recent posts you may have missed that have been particularly popular:

Why you should read the audit report

Professional Investor Training🎓

It’s also been a busy time in my training business, including our second in-person workshop in the Middle East and our second Forensic Analysis Bootcamp for professional analysts.

The Bootcamp isn’t just a lot of fun. It gives you the downside detection skills you need to avoid big losers and stand out as a top analyst. If you’d like to stay in the loop regarding future editions, you can sign up for updates here.

Or if you’d rather learn at your own pace…

A Special Offer

As usual, we’re celebrating the anniversary of my book launch (now three years old!) with an offer on two of my online courses. If you’d like to give yourself or a loved one an education that goes far deeper than investing books and Substack posts, look no further.

● How To Read A Balance Sheet teaches you how to read all three financial statements, using a European company as a line-by-line example.

● How To Pick Winning Stocks gives you an A-Z process for generating stock ideas, analysing companies and evaluating their investment potential.

Until December 15th, you can use the code BF23 to save £100 on either course (or both!). Premium subs can find an even bigger saving at the bottom of this post.

Learn More About How To Read A Balance Sheet

Learn More About How To Pick Winning Stocks

And Finally…

Most of you will have a dozen Substacks in your inbox commemorating Charlie Munger. Clearly, he was a genius and an inspiration. We are lucky to have had him for 99 years. His was a life well-lived, an exemplar.

I have nothing to add.

Read his brilliant Psychology of Human Misjudgement

Munger quotes and further reading

Some of Charlie’s best one-liners:

"In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time – none, zero."

"Spend each day trying to be a little wiser than you were when you woke up."

"It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent."

"The best thing a human being can do is to help another human being know more."

"I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help, particularly when you have a long run ahead of you."

"The big money is not in the buying and selling, but in the waiting."

"The first rule is that you can’t really know anything if you just remember isolated facts and try and bang ‘em back. If the facts don’t hang together on a latticework of theory, you don’t have them in a usable form."

"The best armor of old age is a well-spent life preceding it."

I was further saddened to read of the death of Henry Kissinger. Like Munger, he was a voracious reader and stayed lucid, even at 100. Another amazing man, although highly controversial. Notably, he was a director at Theranos and reportedly “invested” $3m.

Alastair Darling, former Chancellor of the Exchequer, also died this week, aged 70. He warrants a mention here - as the Chancellor during the Global Financial Crisis; as the head of the “No” campaign in the 2014 Scottish Independence referendum; and as a minister who in the summer of 2008 described economic prospects as “arguably the worst they’ve been in 60 years”.

Next week will hopefully be better.

It will be for premium subscribers who will receive my notes from the Sohn Conference in London. Some good ideas are practically guaranteed. Otherwise, you will hear from me in 2 weeks in my final Substack of this year.