What Really Makes a Moat?

This quality-factor ETF has performed well, but it’s missing my favourite measure of competitive advantage

Regular readers will know that I find quality investing a fascinating topic. Most of my career was spent in finding crap to rent – buying out of favour stocks and hoping they would go up a lot. I only really focused on quality when I started picking stocks and running portfolios part time for a wealth manager. But it has become a more important criterion for me in my personal portfolio and I have been focusing on it more in this column.

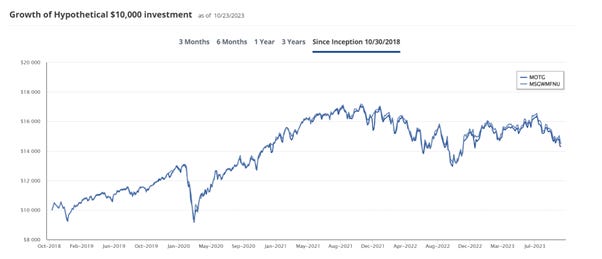

Last week, I happened upon a quality ETF, the VanEck Morningstar Wide Moat ETF. Its 45bp management fee looks quite high for an ETF, but the performance has been pretty good:

VanEck Morningstar Wide Moat ETF

Source:VanEck

That ETF only invests in US stocks. There is also a global version whose performance chart looks like this, although there is no benchmark for comparison:

VanEck Morningstar Global Wide Moat ETF Performance

Source:VanEck

The global ETF’s performance is less exciting in spite of having over half its assets in the US currently, by my estimates. I want to focus here on the US ETF, ticker MOAT, but I was amused by the international ETF’s ticker, GOAT.

The MOAT ETF’s main qualification is “Wide Moat” ratings assigned by Morningstar analysts. They define wide moat as being a sustainable competitive advantage in one of five categories:

Switching Costs

Switching costs give a company pricing power by locking customers into its unique ecosystem. Beyond the expense of moving, they can also be measured by the effort, time, and psychological toll of switching to a competitor.

Intangible Assets

Though not always easy to quantify, intangible assets may include brand recognition, patents, and regulatory licenses. They may prevent competitors from duplicating products or allow a company to charge premium pricing.

Network Effect

A network effect is present when the value of a product or service grows as its user base expands. Each additional customer increases the product’s or service’s value exponentially.

Cost Advantage

Companies that are able to produce products or services at lower costs than competitors are often able to sell at the same price as competition and gather excess profit, or have the option to undercut competition.

Efficient Scale

In a market limited in size, potential new competitors have little incentive to enter because doing so would lower the industry’s returns below the cost of capital.

Regular readers will recall that many of the presenters at a recent quality stocks conference talked about this concept of a sustainable competitive advantage. I respect the Morningstar system – it’s one of the only sell-side research firms which uses quality as the cornerstone of its process. But in my view, these descriptions are out of date and inappropriate. I use different criteria in my Analyst Academy online course to evaluate quality.

To illustrate this further, let’s take a look at the examples which VanEck/Morningstar use:

Switching Costs

Salesforce.com Inc. (CRM) is a leader in providing cloud-based solutions that address many aspects of customer acquisition and retention. According to Morningstar, its salesforce automation application is “mission-critical software that helps drive revenue for users.” Morningstar notes the high organizational risk of moving away from the platform, as well as the time, expense, and lost productivity associated with the implementation of a new application.

They also use Stryker, the orthopaedic implants manufacturer as an example of switching cost moats. These seem good examples to me.

Intangible Assets

Eli Lilly is one of the examples here which is surely a better example than their other one, Starbucks:

Starbucks “boasts a wide economic moat, with brand strength (evidenced by pricing power), attractive unit-level economics, successful international replication, and strong results in the retail channel underpinning its brand intangible asset.” Morningstar adds, “The firm’s ability to generate excitement and traffic, evidenced by impressive comparable sales growth in the core U.S. market, while spending less on marketing than category peers, reinforces the importance of the brand and its impact on results.”

I recognise that Starbucks has a strong brand but I would argue that it doesn’t have much of a moat. Its brand doesn’t truly confer a sustainable competitive advantage. That doesn’t make it a bad company, and at least it has lost some of its recent premium valuation – last time I looked it was on dizzying multiples. Now it’s just dear – 17x EBITDA, falling to 16x is probably a more relevant parameter than its 26x P/E.

Starbucks is on over 3x sales for a $36bn prospective revenue base, going into a likely economic slowdown. Maybe the unemployed will spend more time in coffee shops. Maybe. Probably not.

Starbucks Valuation

Source: Sentieo

Network Effect

I don’t believe that an additional user can have an exponential effect on valuation as described above but the example of Visa is a good one. They also use Google as an example and I disagree with this thesis:

“Alphabet (GOOGL), with a global share of over 80%, leads the online search market. The company’s network effect comes primarily from its Google products, which includes search, Android, Maps, Gmail, YouTube and more. In Morningstar’s view, “Google search’s large and growing user base has created a network difficult to replicate.”

I don’t agree with this concept of Google’s user base being a network. The concept is presumably that more people searching and choosing results allows Google to refine the algorithm and give users better results. I am not sure this is a network. Google has a technological advantage in search which may or may not be sustainable, depending on the AI arms race currently underway.

Alphabet Valuation

Source: Sentieo

There was a considerable amount of consternation when Alphabet reported exceptional results last week and the stock fell (as did Meta similarly, incidentally). To value the company, you need to adjust for the cash burn on various projects like Waymo and similar – the underlying valuation is lower than in the table. It’s also much lower than at the start of the week, with a price fall from my first draft of 12% and earnings upgrades starting to trickle through.

AI represents a massive risk to the main Google search business, so I don’t expect the stock to enjoy much of a rerating. It will more likely be driven by earnings which are recovering, but online advertising may be affected by less VC money floating around for start-ups to burn on advertising and any economic slowdown which develops. What happened to that recession that every commentator was predicting last December?

Advantage

VanEck uses two examples here - Walmart and Cintas, the uniform business whose “infrastructure dominates the U.S. with 11,500 delivery routes (in over 330 cities), over 3 times more” than its closest competitor, according to Morningstar. “Increased customer proximity allows drivers to maximize the number of customers they serve on a given route, significantly decreasing the cost of transportation, including labor and fuel, which account for around one third of the total expenses Cintas incurs. Consequently, Cintas has over 10% better gross margins than its closest competitors.”

Cintas has a gross margin of over 45% whereas UK peer Johnson Service is at 38%. Cintas also has an over 10 point lead in EBIT margin.

Nevertheless, I wonder to what degree this qualifies as a sustainable competitive advantage? A company engaged in an adjacent area, towel rental or indeed any similar B2B service might be able to develop the local infrastructure network to compete.

Efficient Scale

This is something of a misnomer because the label applies to companies involved in telecommunications, utilities, railroads, pipelines and airports.

Few cities can support more than one major airport. The financial incentive to compete with an existing airport is limited as without a sharp increase in demand (unlikely), reduced market returns would not justify the initial capital necessary to build another airport.

This characteristic would in my view be better named local monopolies. The examples offered are railroad Union Pacific and cable operator Comcast. Monopolies are usually attractive businesses and in the past we have mentioned the Mexican airport (both here and on the podcast).

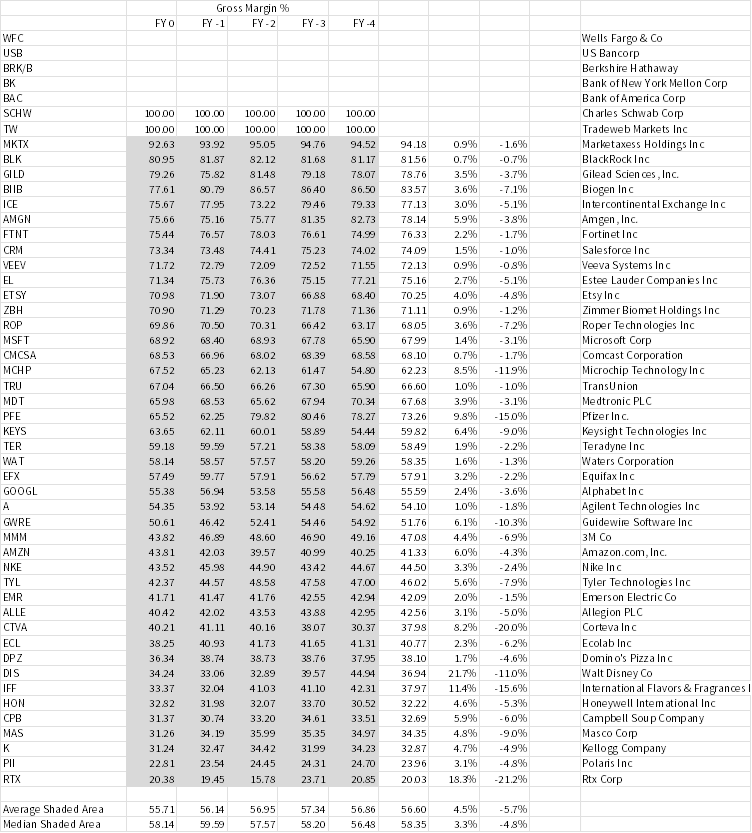

Here are the US MOAT ETF’s current holdings:

MOAT ETF Current Holdings

Source: VanEck

The rationale for the weightings is estimated upside to the Morningstar fair value and there are some complicated explanations around the construction of the related indices, but I was surprised to see several financials and some banks on this list.

There are lots of familiar names – Salesforce, Amazon, Estee Lauder, Domino’s Pizza.

There are some less obvious but still quality businesses – Ecolab, Waters Corp, International Flavors.

There are several healthcare names, as might be expected – Amgen, Pfizer, Zimmer Biomet.

There are more financials than I expected – Blackrock and Intercontinental Exchange seem more obvious than Wells Fargo and US Bancorp.

My preferred way to think about moats

I prefer to look at this through a slightly different lens. I look for companies with pricing power and they tend to have

High absolute gross margins

Gross margins which are often better than peers

Gross margins which are stable

Here are the MOAT ETF holdings ranked by gross margin with the related history:

MOAT ETF Constituents Gross Margin Record

Source: Behind the Balance Sheet from Sentieo Data

Companies at the lower end of this list would need a stronger justification to be included in a quality basket from my perspective. RTX is an aerospace company and it’s unclear why the gross margins are this low but it could well be a definitional issue; similarly with International Flavors. Kellogg and Campbell Soup seem unlikely to be in the top 50 US companies by quality – both sell into a powerful and concentrated customer base.

Another way of framing this is to look at variations in gross margin.

I have looked at a 5 year period for simplicity and have highlighted those companies with a higher variability. It’s worth noting that the period covers the pandemic. In practice, I would use a longer time frame and go rather deeper in my investigation.

Quality Basket with Stability Outliers Highlighted

Source: Behind the Balance Sheet from Sentieo Data

Clearly, the lower the gross margin, the less likely it is to be stable, but the stocks highlighted warrant further consideration as to their merits and whether they are worthy of inclusion in a quality basket.

What criteria do you use to determine quality? – email me at info@behindthebalancesheet.com and I shall return to the discussion with some of your ideas.

Premium subscribers can read on for an important qualification around the use of gross margin as a parameter. Strangely, many professional analysts are not aware of this.