Why Value Might Catch a Bid

One of my favourite Charlie Munger-isms is:

Show me the incentives, I’ll show you the outcome

Which is why we might look back on this chart as momentous:

Private Capital Drypowder by Class

Source: pwc

Private equity funds have trillions of dollars of capital waiting to be deployed - I estimate the equity component of the total to be between $2.5 and $3.0 trillion.

Their General Partners or GPs are highly incentivised to put this money to work. And a lot of it will likely be used to take public companies private. Especially if stock markets pull back.

This isn’t the only interesting dynamic in private equity at the moment.

Allocators are short of distributions from prior private capital invested.

Allocators Expect to Recycle Distributions, but May be Short

Source: Blackrock, Deallogic

This suggests that there could be a boom in secondaries where asset owners liquidate positions in prior funds to fund commitments to new funds.

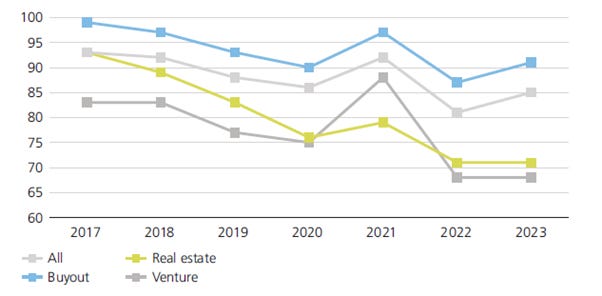

Secondaries Pricing (% of NAV)

Source: Jefferies, UBS at 31/12/23

That would not be good for allocators and for pension fund deficits, given the discounts prevailing in the chart. Although 2023 saw a bounce back, higher volume on offer could affect pricing. It could also affect appetite for new funds, which are already struggling:

Buyout Capital Raising Trend

Source: Bain & Co Global Private Equity Report 2024

The number of funds closing in 2023 declined by over 50% per Bain & Co although larger firms and larger funds did better. Ironically.

Today’s post is a taster for an upcoming series on private equity. Premium subscribers will get the full series in the coming weeks and they can read on today for where private equity may strike.

Happy Easter!