Why This Cycle Could Be Different

My Favourite 2024 Outlooks + A Free Way To Improve Your Investing Toolkit

Last week you got the first half of my thoughts on 40-50 outlooks from large banks and asset managers. This week I’ll go through the other half, which I thought turned out to be more interesting. At the very bottom, paying subs will also hear about the one bet I’ve been confident enough to make in my personal portfolio.

Before that, I have some news for any of you who want to improve your fundamental analysis. On Monday January 29th, I’m running a free 40 minute class on why and how to add forensic accounting skills to your investing toolkit. There’ll be real-life examples, time for questions and 90 seconds (I promise) on our upcoming Bootcamp.

If that sounds like something you’d enjoy, please go here to register.

Now, onto the outlooks…

JP Morgan Asset Management

A cautious outlook:

“Even though Western economies may be less rate sensitive than in the past, we expect that the “long and variable lags” of monetary policy transmission are at least part of the better explanation for the economic resilience seen so far. It's too early for central banks to declare outright victory over inflation, and rate cuts in 2024 are unlikely to pre-empt economic weakness. Interest rates could therefore be set to fall later than the market currently expects, but eventually they may also fall further. Investors should focus on locking in yields currently on offer in the bond market.”

Reasons JPM are more cautious include increasing personal interest payments, a stalled US housing market and cooling US Labour market:

US Labour Market

Source: JP Morgan Asset Management

Elections may seem like a big deal at the time, but historically have had little bearing on what path the economy and market ultimately take.

Their private bank’s outlook is summarised as:

· Inflation will settle, but you should still hedge with equities or real assets.

· Yields on cash are attractive but this is as good as it gets.

· Bonds are more competitive with stocks and it’s time to consider locking in higher yields.

· Equities seem to be on the march to new highs - AI is a game changer.

· Investors should consider capitalizing on stressed real estate and private credit.

Their bullishness on equities is notable:

“In 2024, equities offer the potential for meaningful gains. Even as economic growth slows amid higher rates, we think large-cap equity earnings growth should accelerate, and that could propel stock markets higher over the next year.

Why do we anticipate improving corporate earnings? It’s partly because we believe the U.S. large-cap corporate sector has gone through an earnings recession already (nine of the 11 major sectors in the S&P 500 reported negative earnings growth for three consecutive quarters in 2022–2023).

They have emerged with leaner cost structures, which should help them face a still resilient (if slowing) demand environment in 2024. Indeed, since 1950, earnings per share has been accelerating about 25% of the time when GDP growth has been decelerating.”

I think this is an out of consensus view and hence interesting. While there have been pressures on earnings in some areas, I simply don’t have any evidence of leaner cost structures and would expect inflation to erode already high margins.

They are also positive on valuations:

“The S&P 500 trades at above-average valuations on a price-to-earnings basis, while U.S. mid-cap and small-cap stocks (and European, emerging market and Chinese stocks) all trade at a substantial discount”.

JPM Private Bank Equity Valuations

Source: JPM Private Bank

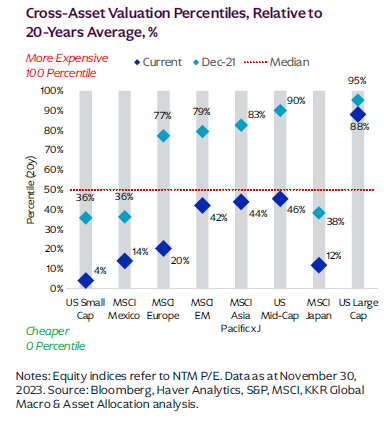

US small cap looks cheaper per the KKR chart below.

KKR

I like the KKR team and their report is titled “Glass Half Full”, which tells you everything.

They see inflation as structural which argues for reduced exposure to government bonds, although they “are finally forecasting below consensus inflation for much of the next 12 months”. As a result, tactical investors may want to position their portfolios to take advantage of this temporary disinflationary impulse. That said, our longer-term thesis about a ‘higher resting heart rate’ for inflation this cycle remains robust”.

They see this cycle as different:

Different This Time?

Source: KKR

They have a neat chart summarising global macro:

Macro Headwinds vs Tailwinds

Source: KKR

KKR expect a rebound in earnings but are less positive than JPM.

“The earnings recession is behind us, as net margins have already declined for five straight quarters. In fact, on an ex-energy basis year-over-year, EPS was already back in growth territory in 2Q23. Confirming this view, our Earnings Growth Lead Indicator has inflected higher after troughing in 2023. That said, we are not as bullish as the consensus. Specifically, we expect six percent year-over-year EPS growth ($235 per share) in 2024 while the bottom-up consensus is much more robust at 11% year-over-year ($246 per share).

Equity Markets Valuation

Source: KKR

Highest conviction areas thematically are “Security of Everything thesis, Digitalization, Industrial Automation, Intra-Asia Connectivity, and Global Infrastructure”.

Security of Everything: Maximum bullish. CEOs around the world tell us that they want to know that they have resiliency when it comes to key inputs such as energy, data, transportation, and pharmaceuticals. Regulators and executives in the financial services industry feel strongly that cyber protection spending should accelerate. This theme also ties into rising temperatures around the world. With government spending initiatives/tax incentives like the IRA, a lot more government support will be targeted at the intersection of climate and supply chains.

Industrial Automation: In Japan, capital expenditures are hitting record highs as companies search for new ways to drive productivity. A similar story in China and Germany where companies are trying to use technology and automation to deliver more efficiency.

Intra-Asia Connectivity: Asia is becoming more Asia centric as more trade occurs within the region than simply with developed markets in the West. The share of Asian trade with regional partners (versus with the West) has increased massively to 58% in 2021 from 46% in 1990. Intra-Europe trade stood at 69% in 2021. Key areas include transportation

assets, sub-sea cables, security, data/data centers, and energy transmission.

Interestingly even the private equity players are less bullish on private equity – here is their assumption:

Excess Return from Private Equity vs Public Markets

Source: KKR

Lazard

Key points here are the Fed engineering a “soft landing” and avoiding a US recession; China sentiment improving; Eurozone and UK teetering on the brink of recession as sticky inflation precludes easing; Japan exiting yield curve control and negative interest rates.

Echoing other commentators, Lazard reflect on 2023 with US growth surprising on the upside as consumers depleted much of the over $2.25tn of excess savings accumulated during the pandemic.

On China, they believe sentiment has become too negative, given the array of recent stimulative measures and the sharpness of the decline in new housing construction, which implies stabilisation in 2024. But real estate typically comprises 60-70% of assets for the median household in China, so prices have a major effect on psychology.

It’s obvious that there is at least a risk of a massive overhead supply as all those families with 2, 3 or more unoccupied homes take a view that prices can fall as well as rise and derisk. I am not sure what the authorities can do in the face of that and that could create a downward spiral. This stuff is above my pay grade but the risks are obvious and the knock-on effects given the significance to the economy, notably municipalities’ dependence on land sales for income etc. Commentators I respect including Chris Wood and James Aitken are relatively sanguine but this is obviously something to watch closely.

In my Polar Capital piece, I commented that the Tokyo Stock Exchange had ruled that companies whose shares trade below book value for a prolonged period were required to announce how they plan to resolve the issue, or face delisting. “When the policy was announced, ~50% of all companies trading on the TSE were trading at or below book value. The policy change has led to record levels of share buybacks and increased dividend payments as companies strive to avoid this ignominious outcome”.

Japanese Equity Valuation

Source: Lazard

Lombard Odier

Path to a soft landing remains challenging but they believe in corporate results stabilising and see US stocks as a core portfolio holding in 2024. They expect earnings growth of 6% against their perceived consensus of 12%. They see “positive equity returns as a feature of late stage economic cycles” but don’t mention that this is a post-pandemic cycle and the market has already gone up!

They prefer high quality bonds, DM investment grade, like cash and long dated bonds and are buyers of equities on weakness, with a preference for the US.

Morgan Stanley

The headlines are clear: “The end of hikes and start of cuts mean high grade bonds outperform, USD stays strong, and EM assets lag. US stocks see positive returns but risks are front-loaded. With markets pricing in a smooth macro transition, there's little room for error”.

On equities, they like Japan and see an earnings recovery in the US. “Japan reflation and ROE improvement are secular positives while Europe and EM growth likely disappoint. We expect US earnings growth to trough in early 2024 and rebound thereafter. We recommend a barbell of defensive growth and late-cycle cyclicals. We see the S&P 500 at 4,500 at end-2024. ”

On sectors, they are positive on global industrials and healthcare, seeing healthcare as a “late-cycle outperformer given its defensive and growth properties, and prefer industrials relative to broader cyclicals. Valuations remain attractive versus history, and earnings revisions see an inflection.”

Healthcare seems a popular choice among the banks, probably because of its defensive characteristics.

The MS market valuations and earnings forecasts are shown in the table. Note that their bear case for the S&P500 is 3850 and their bull case is 5050. In the base case, “near-term uncertainty should give way to an earnings recovery as we progress through next year. For December 2024, we forecast a 17.0x P/E multiple on 12-month forward EPS (2025) of US$266, which equates to a 4,500 price target ~12 months from today. Our 2024 earnings forecast of US$229 (+7%Y) assumes 4-5%Y top-line growth in addition to modest margin expansion as labor cost pressures ease“.

MS Equity Market Targets, Earnings Forecasts and Valuations

Source: Morgan Stanley

In government bonds, they are long duration biased and forecast UST 10Y at 3.95%, DBR 10Y at 1.80%, and JGB 10Y at 0.90% by the end of 2024.

They like the dollar because of its defensive characteristics which puzzles me somewhat. If the US was ahead of the curve in hiking and hence strengthening the dollar, and if it’s ahead of the curve in rate reductions, why would the dollar not weaken?

In commodities, they expect Brent to remain around US$85/bbl as rising demand meets non-OPEC supply. MS are constructive on copper on the back of stronger than expected China demand . Apparently, Chinese copper imports have been strong in spite of the property travails, perhaps supported by EV production – I haven’t studied this.

They had an interesting table on returns around rates peaking:

Returns when Rates Peak

Source: Morgan Stanley

As you would expect, the market enjoys the hope of the last rate hike but by the time banks get round to cutting, there is pain being felt in margins and earnings and stockmarkets fare less positively.

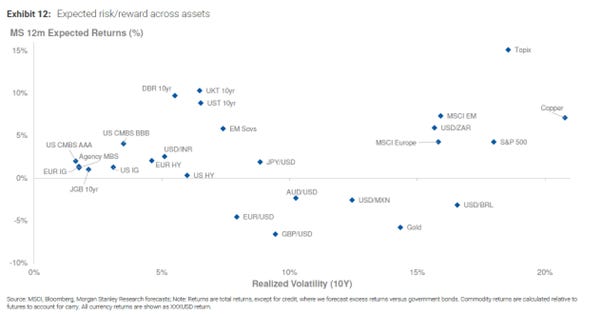

They are pretty bullish on copper, Japan and the S&P 500 as shown in this chart:

12 Month Expected Returns

Source: Morgan Stanley

I have a few more but am reaching the Substack limit. So I shall add in the rest to a supplementary post in the middle of next week. I know this isn’t entirely satisfactory, but Substack doesn’t like longer posts ie 2000 words if they have lots of charts and pictures.

That’s all for now. Premium subscribers can read on for the one bet which I have been confident to implement.