So Netflix reported results and subscriber numbers beat their conservative projections after their difficult Q1 report. Surprise!

The company made much in the release of the adverse impact of a stronger dollar on their results which depressed revenue growth by four percentage points, from 13% on a constant currency basis to a reported 9%. It’s helpful when companies explain this. (Spoiler: when it’s in their favour, disclosure is less frequent).

Balance Sheet

Rather than go through the company’s explanation, I want to start, as is my process, with the balance sheet. The quarterly balance sheet in the release is much less informative than the full year accounts with the notes, but there are a couple of things that are noteworthy.

Netflix Balance Sheet

Source: Behind the Balance Sheet from Company Data

Content assets – the net asset continues to grow as more content is purchased than amortised. Regular readers will know that this is a serious issue for me as I believe that the content amortisation is understated and as a consequence, Netflix’s margins are overstated.

Property and equipment have declined – unusual for a growth company and the first quarterly decline. Has Netflix sold assets?

Accounts payable has been falling in the past two quarters, but it appears to have been significantly boosted at year-end, which of course helps both the year-end net debt and the free cash flow. This now seems to be unwinding.

Deferred revenue has declined relative to sales. I would expect this number to be flat, although it would be influenced by the strength of the dollar. The chart shows that it has been marginally declining consistently each quarter. This could just be the dollar’s strength although it’s a long duration and steady decline. If the company were massaging its sales numbers, this is the pattern I would expect to see, although of course there could be another explanation. I am sure the bulls will be writing to me.

Deferred Revenue Trend

Source: Behind the Balance Sheet from Company Data

Content liabilities – these are likely to jump around from quarter to quarter. They increased significantly at the year-end and have fallen somewhat. This suggests that Netflix is not accelerating the investment in content.

Treasury stock – the treasury stock is carried at cost, but has been acquired $500m in Q2, 2021, $100m in Q3, 2021 and $224m in Q4, 2021. It would have been difficult to buy back stock at a worse time. This is always a concern for me. Capital allocation is the single most important skill for top management and they should know what their own company is worth. To be fair to the Netflix team, they have built an amazing business from scratch, and it’s hard to critical of that achievement, but I wouldn’t pay too much attention to their own personal activity in their stock.

Operational Performance

Next step in my process is to look at the operational performance in order to understand the revenue changes. This is perhaps the most important element of the analysis and in the case of Netflix, there are quite a lot of moving parts and I don’t pretend to know them all. The key drivers are the number of subscribers and the rate of growth.

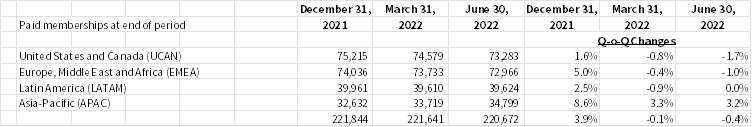

Netflix gave guidance that subscriber numbers would be down and the actual results were slightly better than their projection. This is hardly a surprise – having been kicked in the teeth by the market two quarters in a row, management were unlikely to be ambitious. The table shows that subscriber numbers were down everywhere except Asia Pacific.

Netflix Subscriber Trends

Source: Behind the Balance Sheet from Company Data

Netflix revenues were bailed out by pricing. Here is the table of average revenue per member:

Average Revenue per Member

Source: Behind the Balance Sheet from Company Data

Asia Pacific members were up but the average price in dollars has fallen. The company commentary mentioned price rises in the region, but the unit price in dollars clearly fell. The company estimates that average revenue per member fell by 9% year-on-year but by 2% excluding currency, ie foreign exchange (fx) was a 7% year-on year drag. It’s probable that underlying revenues fell quarter on quarter, but it’s hard to be precise without company data.

The bottom line here is that a customer in Latin America or Asia Pacific is worth a little over half a US customer. And that US revenues were up because of a price hike, but the company lost 1.3m subscribers in the quarter, almost twice the Q1 rate. Expect this attrition to continue and that yields will be further diluted by password sharing initiatives and initially by the lower priced ad-supported service, although I expect that to be revenue neutral eventually.

Netflix Quarterly P&L

Source: Behind the Balance Sheet from Company Data

These are the summary figures with -1Y and -2Y comparisons and below is a snapshot of the changes both -1Y and -2Y (useful for a fast growing company as quarterly growth rates can vary a lot, so this is a useful check).

P&L Changes -1Y and -2Y

Source: Behind the Balance Sheet from Company Data

Revenue growth slowed in Q2 but the cost of revenues (mainly amortisation of content) picked up. This is pressurising gross margin, which I consider to be overstated relative to the true long term picture because of the content amortisation policy. Note the chart of gross margin in the past few quarters. It dropped sharply in Q4 last year, which could be a sharp increase in viewing hours over the Christmas period, or it could be the company revising the assumed viewing life of the content assets.

Netflix Quarterly Gross Margin Trend

Source: Behind the Balance Sheet from Company Data

This is quite unusual, and I thought worthy of further examination so I rolled back a few more years to get the chart below.

Netflix Quarterly Gross Margin Trend

Source: Behind the Balance Sheet from Sentieo Data

Using the Sentieo history, a similarly striking pattern is evident in Q4 2018. Interestingly, gross margin is not mentioned once in either the Q4 2018 or the Q4 2021 analyst call transcript. But in further investigation, in a January 2, 2019 8-K filing, Netflix revised its classification of certain personnel expenses; this had the impact of reducing the 9M 2018 gross margin from 40.6% to 37.7%.

It appears that the adjustment has been applied entirely in Q4 in the Sentieo system which as a consequence has understated the Q4 2018 gross margin. I could have adjusted for this and not shown this “mistake”. But I have left this in here, as I think walking through my process and illustrating this type of “funny” is useful – as an analyst, I would always do my research from the primary financial statements and I would usually type in the data manually, cell by painful cell. This sounds mad and a complete waste of time, but it prevents exactly this type of issue.

If you are trying to replicate this, you will find a similar error in Q4 2016 and Q4 2017 as it appears that Netflix revised the annual data to reflect the accounting change but not the quarterly data.

Incidentally, I don’t have my job on the line and hundred million dollar positions at stake in this newsletter. So you can expect me to skip the manual work, take shortcuts and to make the occasional mistake as a result. But I know you have all read the disclaimer and do your own research.

Below the gross margin line, the costs are all headed in the wrong direction. Only General & Admin (G&A) was flat as a percent of sales and I would expect this to fall in the next quarter as there have been press commentary of rationalisation at Netflix and these may take some time to feed through, with the cost of redundancies affecting the Q2 figure.

Marketing saw a slight increase relative to turnover while technology saw a much larger jump. Marketing expenses are mainly advertising and payments made to marketing partners. Technology and development expenses are mainly the cost of personnel plus the cost of general use computer hardware and software.

The transcript (attached for paying subscribers) barely discusses cost, although the company notes that content spend will be about $17bn this year and that “As we look forward, 2023, next couple of few years, say, we're probably in about the right ZIP code.” They also reiterate their margin guidance of 19-20% but I would like to have a more granular picture of the line items.

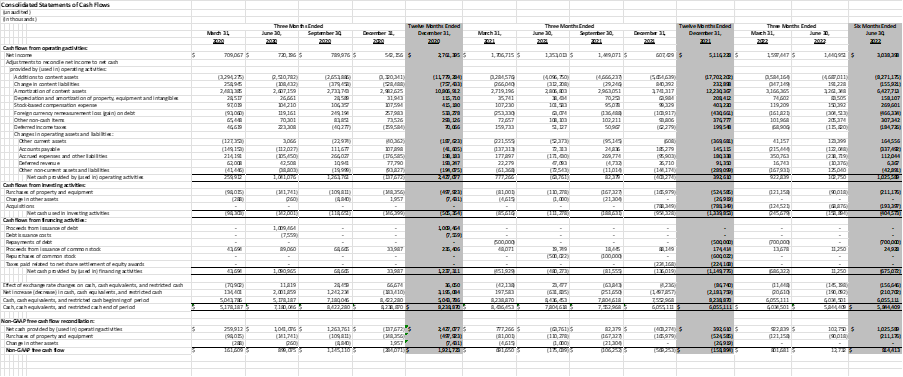

Cash Flow

The quarterly releases provide only a summary cash flow which is not that helpful but we can pick up some highlights. The table as presented is very noisy:

Netflix Quarterly Cash Flow

Source: Behind the Balance Sheet from Company Data

I prefer not to focus too much on quarterly cash flows – this analysis game is complicated enough and I like to keep things simple. Quarterly cash flow projections were rarely necessary in my role as an analyst, only if a company is in a distress situation and you need to check whether it will manage without fresh equity. Here is that table summarised to look at the trailing annual cash flows:

Netflix TTM Cash Flow

Source: Behind the Balance Sheet from Company Data

I find that relating the cash moves back to revenue is useful, as most financial transactions scale with revenue and it helps to spot anomalies. A few elements to note:

Content spend is up nearly 40% although the rate of increase has slowed

More of that spend is being financed on credit, as content liabilities have increased

Content amortisation is running in line with revenues

The fx move on the debt is a non-cash item; Netflix has benefited in that the dollar value of its overseas debt has fallen with the strength of the currency; this improves profitability but because the cash flow does not include debt, it is an add back here. This is a major weakness of the cash flow statement, a subject which I shall return to in an later article.

Working capital overall has been an inflow vs an outflow last year – I have not investigated this in detail.

But one important element is that deferred revenue is well down. Subscriptions in advance from customers contributed $158m in the previous 12 months but only $28m in the last 12 months. This is a major change and one which should be investigated. There was not one question on the call – if I were in charge, these sell-side analysts would be tied to that bull sculpture on Wall St on a Friday lunch time and investors would be invited to pelt them with rotten tomatoes.

Source: Wikipedia

Have a better idea for suitable punishment for sell-side analysts? Email me and I will give a prize to the best suggestions.

Mainly because of the higher content spend, cash from operations has fallen from 6.7% of revenues to 2.3% - a drop of two-thirds, and a concern.

Capital expenditure has risen but is relatively minor at Netflix.

Taxes paid related to equity issues to employees is treated as a financing element which is curious. I would have expected this to be a deduction from operating cash flows, but have not investigated - $225m is not huge in the context but it’s worth understanding.

Note that this item is excluded from the company’s definition of free cash flow, which is often derived in an unduly favourable fashion. I recommend investors always independently check this number, as it’s rarely calculated in a correct and conservative fashion. For Netflix it has collapsed from 5% of revenue to 0.5% which is a major decline, but the company has guided that FCF will be great in 2023 so nobody seems to be worried about what has actually been delivered.

In my experience, past performance is an important benchmark for likely future results and has often been a more reliable predictor than management’s promises, especially after a significant share price decline.

So that’s my quick run through of the Netflix results. Paying subscribers can read on to hear what I think of the shares and get the call transcript.

This post is longer than usual, so the email may be truncated. Apologies, but please do read to the end.

PLUS!

Watch out for my upcoming new course – a walk through Netflix’s 10-K. Paying subscribers will get a special discount and even free subscribers may get a coupon.

Before that, you will receive a marketing email from me, inviting you to our all-new 3 day Stock Idea Challenge, a fun exercise for the summer, when I may take a break from writing.

And check out my latest podcast, the first with a US investor. Chris Pavese of Broyhill Asset Management is not that well known, but is full of common sense. But don’t take my word for it, here is what Herb Greenberg had to say: