Unveiling Multi-Bagger Secrets

Analysing Market Titans

You might think this week’s title is less snazzy than usual.

And you would be right.

My friend and colleague, Joseph, who has edited this newsletter, produced my sales pages and most of my marketing blurb, has moved on. For various reasons, he has taken a full-time job.

I shall miss him. So will you, I suspect, as catchy titles are not my forte. But I would like to thank him publicly as he has been a brilliant colleague and I wish him luck in this new chapter. Thanks, Joseph.

Introduction

I wrote last year about a study of 10-Baggers by Jenga Partners, as I was curious about their research and interested in their findings. I wanted to dive a little deeper and as I mentioned then, to follow up by looking at a second study, conducted by interns at Alta Fox Capital.

I was prompted to revisit the subject now, after spotting the cover of a sellside research note on 10-Baggers on social media. I also discuss that below.

Alta Fox Study

In the summer of 2021, three interns at Alta Fox conducted a study of the best performing stocks over the previous 5 years, to try to identify what makes for a multi-bagger. The deck is 645 pages long (!) so I thought you might prefer a summary.

They analysed the best performing stocks in the US, Canada, Western Europe and Australia over the previous five years and tried to identify the common characteristics. They then concluded five high-level takeaways and developed a framework to screen for future multi-baggers.

They started with a Bloomberg screen in these geographies, excluding energy, materials and financial sectors. The main elements of the screen were:

Total Shareholder Return (TSR) from 6/8/2015 to 6/8/2020 greater than 350%.

Market Cap at 6/8/2020 in range $150M - $10bn

Average daily value traded over $200k

And two criteria which I doubt made much difference:

The latest fiscal year year-on-year revenue growth was positive

Positive trailing 12-month EBITDA

For each stock, they compiled an industry overview and developed a bear case – asking why the company was overlooked five years previously – they included criteria like minimal room for growth, poor competitive position, high valuation, lack of coverage, etc. – and outlined why that turned out be wrong.

Sector Winners

Source: Behind the Balance Sheet from Alta Fox Capital Data

Tech, unsurprisingly, was the big winner – the team cited characteristics such as high margins, operating leverage and scalable business models. Medical device companies did well in healthcare.

Geographical Winners

Source: Behind the Balance Sheet from Alta Fox Capital Data

I was surprised to see that Australia was the best place to go fishing for multi-baggers and was amazed that the US did not fare better. The European breakdown is below:

Country Winners in Europe

Source: Behind the Balance Sheet from Alta Fox Capital Data

I have excluded Luxembourg, Ireland and Austria as one winner can distort the picture. The Scandinavian countries often produce big winners – Sweden, for example, is liked by a future podcast guest, an investor who focuses on such multi-baggers. The UK does surprisingly well; this is not a reflection of private equity bids which have been in focus lately, as these companies continued to be quoted.

Company Size

Source: Alta Fox Capital

Unsurprisingly, smaller companies tend to feature more frequently but they highlighted companies above $1bn market cap, such as Etsy, JD Sports and Entegris. There were only 21 stocks which started at a $2bn market cap and delivered a return of over 3.5x. The next chart shows the breakdown of returns by the buckets above for the winners:

Returns by Category

Source: Alta Fox Capital

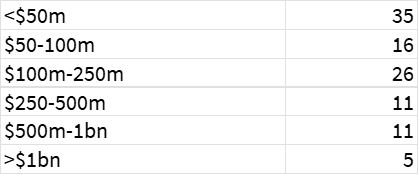

In terms of revenue, these were mainly small companies, as shown in the table.

2015 Revenue Breakdown

Source: Alta Fox Capital

Only 15 of the 104 winners had a starting EBITDA of over $50m.

In the period examined, the S&P 500 had a total return of 56% and the average return of the winners universe was 922% and the best performer, Zynex Medical, returned 9.2x.

The interns reckoned that EBITDA growth and multiple expansion had roughly similar impact on the performance – their data showed that on average, EBITDA growth contributed 59.8% and multiple expansion 44.8% with dividends adding 1.6% - a couple of the charts and tables had totals which didn’t add to 100%, which I found a little confusing. Multiples actually contracted for 11 companies.

80% of companies had more shares outstanding in 2020 than in 2015. 23% of companies diluted by >50%, and 11% diluted by >100%. Presumably, this reflects equity issued for acquisitions.

The following chart shows the levels of revenue and EBITDA growth.

Winners Revenue and EBITDA Growth (over 5 years)

Source: Alta Fox Capital

The study concluded that the prime drivers of returns were:

Acquisitions: 56% of winners made acquisitions which were deemed key to the performance. Of these, 19% made a transformative acquisition:

New products: 27% of the group launched transformative new products

Major contracts: 17% of the companies won major new contracts which drove performance

Covid Winners: 17% of companies were positively impacted by the pandemic

The interns thought that 91% of the companies had moats, in the form of network effects, switching costs, intangibles or lower costs, while 42% of companies had high barriers to entry and 38% medium barriers based on technological complexity, regulatory barriers like FDA approval, human capital or patents.

I am not sure how much weight to give to these more subjective conclusions, but the valuation multiples are factual. The following charts show the forward valuation multiples of the winners.

NTM EV:Sales Multiples

Source: Alta Fox Capital

Clearly a large part of the performance has come from companies at under 3x sales being re-rated to over 5x sales.

NTM EV:EBITDA Multiples

Source: Alta Fox Capital

Some of the EBTDA multiples here look pretty steep – there were relatively few starting bargains. A large number (43% of the end multiples are over 20x EBITDA.

NTM P/E Multiples

Source: Alta Fox Capital

A similar pattern is shown if earnings are used as the basis for comparison – 61% of companies performed well, partly because they ended with a forward P/E of over 30x.

Conclusions

The sample size is surprisingly small and I wonder how reliable the conclusions, whether qualitative or quantitative, might be. Paying subscribers can read on for the full list of stocks in the study and a further analysis from a sell-side research firm whose work I respect.