Some readers might be getting a bit bored with my conference summaries, but you shouldn’t be. These conferences are all expensive – the cheapest was the MoneyWeek conference last week which was £225 – and they usually take all day. Your correspondent has done all the hard work for you – eating the sandwich lunches and those awful canapes, drinking the cheap wine which is usually served, and listening to some awful boring panels so that I can bring you a few nuggets that I took away.

I hadn’t attended the MoneyWeek affair before and the original plan was to fit me in on one of the panels, but it was all too short notice so I went along as a regular guest. There were some really interesting sessions and I have summarised the best ones for you here.

Russell Napier/Financial Repression

Russell Napier was the keynote speaker and he gave his usual session on the need for financial repression. I have heard the presentation several times (Russell is a friend), but he always manages to refresh the content and make it interesting. Of course, since I last heard it, the debt numbers have all gone up. Russell, in contrast to the modern monetary theorists, looks at a country’s debt as the sum of Government debt and corporate (non-financial sector) debt.

If you are an MMT enthusiast, you probably know that I don’t understand the theory – please email me and explain why the Government doesn’t solve all our problems by mailing $1m through everyone’s letterbox. (I shall probably regret this).

The problem is self evident from the chart, especially when you consider that debt servicing costs are exploding to the upside, from an all-time low. The global average is extremely high and the UK, US and Euro area are all ahead of that high average. What the gap between France (very high) and Germany (relatively low) means for the future of the ECB and the Euro is hard to predict, but I am guessing it’s not positive for the stability of the Euro and warm relations between the two main participants. The gap has grown from 12% at the formation of the Euro to over 150% today – a useful illustration of how unusual, recent history has been; more on this later.

Global Non-Financial Debt to GDP

Source: Behind the Balance Sheet from Russell Napier, The Solid Ground

It’s quite clear from this chart that there is more risk in DM than EM, especially if you consider that the EM indebtedness falls below 200% if China is excluded. This is where Napier thinks you should put your money. Paying subscribers will learn later where I have put my biggest bet. Russell’s rule number 1 in a financial repression is simple: get your money out of the UK or the US and look at Asia.

Economic Outlook Panel

Bill Dinning, Waverton. James Ferguson Macro Strategy. Alex Chartres, Ruffer.

Other than the energy and property focus, the panels were similar in content, and this one focused less on the economy and more on the impacts, which was a positive. I was surprised to hear that in inflation adjusted terms, UK equities were unchanged since January, 1969. This was not a statistic which I had heard before and it really surprised me.

We have had countless takeovers in the last 50+ years, more than in the US, often by foreign acquirers and I would guess that we probably had more in cash than in say the US.

When a stock gets taken out at a fat premium, that’s good for returns and the majority of investors will simply recycle that cash back into the market. So if that statistic is true, it’s an incredibly bad result. If it’s not true, then an economic commentator should really be called out for it. I obviously need to check.

There was a consensus on inflation having peaked. This is hardly contentious, given recent reporting and still very high levels. Supply chain constraints will be largely lifted when China opens up and energy prices have already eased. But the panel saw inflation as a risk in that the market is sanguine about the prospect of inflation in the US and UK. This is a risk, given wage inflation pressures and the potential for energy shocks. Inflation may be built in now with cold wars seen as inherently inflationary because of the duplication of supply chains. There was agreement that money market funds were not a bad place to hide short term. There was less consensus on the longer term outlook.

How to Find Real Income in an Age of Inflation

Duncan MacInnes, Ruffer. Laura Foll, Janus Henderson. James Harries, Troy AM.

Going forward we should expect lower and more volatile returns, with a shorter and more volatile economic cycle. Dividends should thus be a more important component of returns and this should lead you to slightly safer and stronger companies.

Obviously if you invite two equity income fund managers, you should not be surprised by such a conclusion. But to be fair, I think there is a lot of truth in this argument.

I have never liked owning stocks for dividend income as it often leads you to bad companies paying out too much of their earnings. This can eventually lead to a dividend cut – think Shell, or Vodafone. I have not changed my view that dividend yield is a dangerous parameter if used as a valuation measure, but I think having some dividend aristocrats in a portfolio might afford some protection in the more difficult conditions we face over the next decade.

I would emphasise dividend growth and resilience over starting yield.

Geopolitics and markets – the Upside

Dr Pippa Malmgren

I hadn’t seen Pippa speak before and she was brilliant. She explained that people need personal experience of markets and of inflation; that the new interest is in workhorses with unimpaired, genuine cash flows, rather than unicorns; and she explained that the rest of the world looks at the UK and sees quality on sale; even if people here are frustrated with the general disarray (especially politically).

She covered a lot of ground, much of it defence and space related – honestly, I think the talk of asteroid mining seems like science fiction and far from economic reality (except perhaps for a few super rare green minerals that we cannot get enough of on earth). She believes crypto is not dead and looks forward to IPOs of virtual companies issuing tokens instead of shares. This is certainly possible, albeit implausible near term, a bit like the asteroid mining.

There was much more in this half hour talk, and if you have the opportunity to listen, I would recommend Pippa – she will make you think.

Property

This was a session on the outlook for UK residential prices and the estimated likely fall was -10% to -35%. If UK property prices fall 10%, there will likely be a rush to the exit by buy to let and there will be a lot of forced selling from people who cannot afford a 4x on their mortgage payments as their initial cut-price rates roll off. I don’t see how a 10% fall is possible and there is scope for massive knock-on effects here.

But the UK probably isn’t the major problem here, as highlighted in an article in last week’s Economist. They write

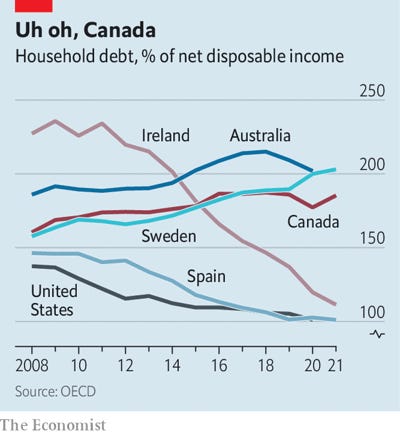

“As a share of disposable income, such debt sits at 185% in Canada, 202% in Australia and 203% in Sweden.”

Top of the list for impending trouble is Canada – Dylan Grice has been writing about this in his excellent newsletter. The Economist reckons that

Canadian households added $150bn in mortgage debt last year

one in six homeowners in Ontario (including Toronto) own two or more properties

over a quarter of new lending in early 2022 was at over 4.5x debt to income.

Apparently RBC are forecasting a 14% drop in house prices. Such predictions of 10-15% price corrections seem bizarre to me – as an economist, you might as well predict a 50% fall, generate some interest and you are more likely to be closer to the actual result if an overheating market corrects.

Overheating Property

Source: The Economist, 25/11/22

The UK is certainly not immune and I wonder whether the US is insulated from housing problems, in spite of having more robust, long term mortgage arrangements.

Energy Panel

This was a great panel as there was an active argument between traditional investor Tim Guinness and Barry Norris, founder of hedge fund Argonaut Capital and a climate sceptic. Paying subscribers can learn about his largest position at the end. Norris was dismissive of the green energy bandwagon, considering green hydrogen a waste of time. He was also highly sceptical of battery storage as not having enough scale and provided several datapoints that suggest our reliance on hydrocarbons will have to continue much longer than the greens would like.

Norris pointed out that apart from the problem of it being intermittent energy, the cost of a wind farm for example has increased by 50% in the last two years while the cost of its financing has probably tripled. Needless to say, he was more positive on traditional energy producers.

Interview with 2 Investing Legends

Jim Mellon, Burbrae. Peter Spiller, CG Asset Management

Mellon is well known in the UK, having made a fortune of several hundred million in markets. Peter Spiller has achieved 15% pa compound growth over 40 years with only 1 down year, when he lost just 2%. I confess that I had met him before but had no idea of his track record – I would have been invested with him otherwise.

Some takeaways included that world debt is 300% of GDP so if rates go up 3%, debt servicing costs rise by 9% of GDP. This makes today a very risky point, and Spiller sees the greatest risk being where leverage is highest – in private equity. He is also concerned about derivatives exposure; it has not grown but at $680tn, there remains a potentially massive counterparty risk.

He thinks the world will look a lot like the late 1960s/early 1070s. Business cycles will be shorter, in contrast to the great moderation. He has nearly half his portfolio in index-linked bonds which “will keep your money whole”.

Mellon echoed the 1960s/70s reference and sees the last 30 years as an aberration, an extraordinary period. He has been buying perpetual bonds issued by the big banks and thinks that US SPACs, often down 90%, have a lot further to fall. He has been selling Tesla and buying traditional auto manufacturers. He thinks Musk has taken his eye of the ball, that the competition is catching up and that Tesla could even be terminal. He likes nuclear exposure and shares the enthusiasm for UK index linked bonds.

Where to Invest Now

Simon Edelsten, Artemis. Anna Macdonald, Amati. Nick Greenwood, Premier Miton. Charlie Morris, ByteTree. Tom Bailey, HANetf.

This was the concluding panel, and Edelsten was relatively upbeat. He is a manager I have known for some time and respect. He thinks we may have persistent 4% inflation but that’s not the end of the world and good companies can cope with it. Anna MacDonald thinks the UK is at an inflection point as bad results no longer crater stock prices. Charlie Morris favours a contrarian approach, looking for exposure to EM as it has been awful for 10 years. Nick Greenwood is an investment trust expert and mentioned various Investment trusts which are trading at discounts of over 20%, sometimes far higher.

Edelsten also likes Japan and is largely out of US tech, considering Microsoft and Apple still overvalued. Morris likes gold and dividend recovery stocks in the UK, citing WH Smith, Marks & Spencer and Rank Group; I wasn’t convinced on those choices, to be honest, but I have been out of those positions for some time (I was short Marks for a long time and bought WH Smith when it fell over 70% on Covid but sold it after the bounce).

Conclusions

So that was a skate through my day and some of the salient points. I hope this sort of round-up is helpful. My goal is to help your decision making by providing insights form a range of sources rather than just my own thoughts. Paying subscribers can read on for two potential money-making ideas.