Instead of publishing the third instalment of our Amazon Cash Flow review (in case you might get bored with that), I decided to take a break this week and tell you two things that you need to watch out for this year:

Companies with low tax rates

Governments across the world are highly indebted. Corporate margins are extremely high. Corporations lobby of course, but they don’t vote. I think companies with sub-normal tax rates could be targeted and I would look closely at any stocks you own which have low tax rates and ask yourself what the valuation would look like if they had to pay 30% tax.

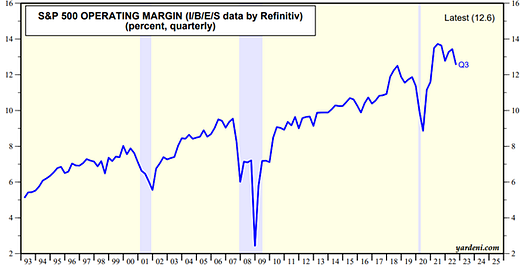

Corporate Profit Margins have Already Peaked, but Remain High

Source: Ed Yardeni

I am not saying this will happen but It’s definitely possible and actually probable in the medium term. You can still own such stocks of course, but allow something for this risk in the valuation and ask yourself if the low tax rate is derived from high investment or washing royalties through an offshore centre.

Paying subscribers can read on for a similar and related risk which I think could undermine a whole sector of the market. Russell Napier, no less, agrees these companies are at risk, although he has a slightly different take.

Before you go, just a quick reminder that our first Forensic Analysis Bootcamp starts Monday February 6. For 8 weeks, I shall be training a small group in how to improve their analytical skills and to be more proficient at reading balance sheets and spotting opportunities, risks and possible frauds. This content is based on my Forensic Accounting Course which has been delivered to over 450 investors at some of the largest and most successful institutions across the world. You can sign up here for the few remaining places until February 3. Please only sign up if you are serious about investing and about taking yourself to the next level.