I attended my first Berkshire Hathaway AGM last weekend. I have not been before because it’s livestreamed and watching it at home seemed a more comfortable option. But Mario Gabelli encouraged me to attend (also kindly inviting me to his conference) and I thought this could be my last chance.

So I booked at very short notice and I enjoyed some legendary hospitality from my American friends. A particular thank-you to Chris Bloomstran who took me to various events. This was me at dinner with Chris, Guy Spier and a host of other interesting people. Everyone I met at these events was so nice, it really was a wonderful atmosphere.

Dinner at Johnny’s Cafe

Source: Tyler Howell

Buffett’s Opening Commentary

Buffett opened in jocular style, mentioning the other popular TV show that day, the Coronation of King Charles III, but quipped “We have our own King Charles”, gesturing to Munger. This was the tone of the meeting – fun.

Buffett kicked off by going through the Q1 earnings which has already been heavily covered. I was more interested in his comment that most Berkshire companies will report lower earnings this year. Insurance and the much higher yield on cash will mean Berkshire should grow earnings overall. But Buffett talked of the former period being extraordinary and that the climate was different from 6 months ago. Several managers have over-ordered and will need to have sales to get rid of stock.

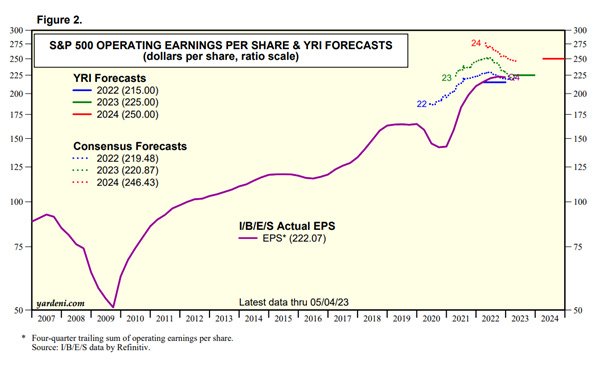

I thought Buffett was flagging a high degree of caution – I wonder if S&P500 forecasts are low enough? See the chart below.

S&P Operating Earnings Forecasts

Source: Ed Yardeni

Buffett talked of Berkshire’s $125bn of cash yielding 46bps last year. Higher rates should convert that $50m-ish of income into c.$5bn! He bought $3bn of bonds last week yielding 5.9% - likely the 4 week bill auctioned the previous Thursday with demand depressed by debt ceiling worries. Why the debt ceiling would dampen demand for bonds so much is a curiosity – some US investors are just so short term. But it’s definitely worth considering company balance sheets and the interest rate induced benefit to income on cash or increased costs of floating debt.

There were some striking numbers on Berkshire’s size:

Float is now $165bn

Net worth is $504bn (larger than any other US company and I imagine the highest in the world – Aramco is $386bn)

Retained earnings should be $30-35bn this year

Cash is c.$125bn

Cash flow was c.$7bn in April alone!

Berkshire is a giant.

The arena for the AGM was also huge – the crowd was over 5x larger than the concert I attended at Wembley Arena the previous week! And the two old men, drinking Coke with Munger eating peanut brittle were on amazing form.

A Walk Through Apple’s 10-K

It’s often said that Warren Buffett spends most of his time reading 10-K reports. And if you want to learn how to read a 10-K properly, you’ll love my new training, A Walk Through Apple’s 10-K.

Not only will you learn a lot about Berkshire’s biggest holding. In just a few hours, you’ll learn a process you can use to study any public company. As one of my Substsck readers, you can claim a $100 launch discount code until May 31st with the code FREESUB. Paying subscribers get an even better deal. Enjoy!

My AGM Notes

GEICO – will take 2 years to get back on track

BNSF – post pandemic, supply challenges and labour issues are problematic in getting the business reset for the longer term.

Commercial real estate – we are starting to see the consequences of borrowing at 2.5% and finding that purchases made then don’t work at current rates – ie problems in store.

Value investors – there are too many of them and they need to get used to making less. I think this was a reference to markets being unlikely to deliver past returns going forward as there don’t seem to be that many value investors left!

Energy transformation - they have $70bn of such projects over the next 10 years.

College – Buffett stated that he never looked at where a potential hire went to school.

Insurance – if there is a hurricane in Florida, they could lose $15bn (5% of $300 bn capital). If there is not, they should make $7bn.

Continuous learning – I lost count of the number of references Buffett made to the fact that they continue to learn all the time. This to me is the duo’s most laudable characteristic and one we should all copy – stay humble, keep learning and keep improving.

Apple – Aswath Damodoran criticised the concentration of the Berkshire equity portfolio and said that Apple was too large a part. Buffett doesn’t think of it that way – he views Berkshire’s exposure including all the subsidiaries. He views Apple as a far better business than the subsidiaries and given the share repurchase program, Berkshire’s ownership keeps growing – Buffett cited the buyback required for Berkshire’s holding to reach 6% of Apple off the top of his head!

OEMs competing in insurance - Had Cathie Wood attended, she would have learned that GM has been doing this for decades and that a lot of data is needed on the driver. Buffett watched Uber doing insurance for its gig workers and thought that they would get their head handed to them until they did a deal with an insurer. We already knew that the ARK valuation for Tesla insurance is more than ambitious. Margins in auto insurance are 4% and if new competitors come in, they will shrink; the last new idea in insurance was State Farm in the 1920s; as a mutual they took 20% out of the cost and nobody has improved on that system.

Banks – Berkshire owned a bank in the 1960s and thought it was a more attractive industry with more opportunities than insurance but the Bank Holding Company Act forced them to divest.

Kids asking questions – the crowd love a 13 year old at her fifth meeting asking a really good question. I hope it was penned by a parent or we should be worried. She asked if we should be concerned about the national debt and China et al moving away from the dollar. Buffett joked that she should be answering the questions rather than asking them. This is all theatre.

Munger made a good point in response, that at some point printing money to buy votes will become unproductive.

Buffett pointed out that the best defence against an uncertain future is your own earnings power – if you are the best doctor or best lawyer in your community you will always make a good living. And that the best investment you can make is in yourself!

Life lessons – in response to a 15 year old’s question at his fourth meeting about the major mistakes to avoid in investing and in life, there were some gems:

Write your own obituary and try to live up to it

Don’t make any mistakes that can take you out of the game

Spend less than you earn

Buffett cited Tom Murphy who advised that you can always tell someone to go to hell tomorrow and that you should praise by name and criticise by category.

Buffett has never known anyone kind who died without friends.

Munger repeated the spend less than you earn advice and suggested that you invest wisely and avoid toxic activities and people

Streaming – BRK owns 94m shares of Paramount which cut its dividend the previous day. They are not in the business of giving stock advice – there are plenty of people who know nothing about stocks doing a lot of that. But they pointed out that a lot of companies are doing streaming and that eyeballs are not increasing nor is the time spent viewing going to increase. They therefore think it may be difficult to increase prices. Munger highlighted that the movie business is tough because the talent gets all the money.

Climate change – there is a lot of nonsense talked in this field. If you like nonsense, this is the field for it.

Occidental – they will not take control

Fun – part of the fun of investing is the mistakes. If you play golf, it would be no fun if every shot was a hole in one.

Cheap – Munger used to fly coach to the AGM from LA. A lot of people flew to the AGM in Coach and when Munger got on the plane, they used to applaud him. “I liked that”.

Autos – EVs have a huge capital cost and that’s a risk for the OEMs. Ferrari is in a special place but production is only 11k cars pa.

“EBITDA was bad enough but now it’s earnings before everything”

Accounting – Buffett wants the balance sheet to show the market value of securities with gains and losses taken through other comprehensive income, for all companies, including banks. I totally agree – it makes no sense for Silicon Valley Bank not to show unrealised losses in its balance sheet while Berkshire is forced to book equity gains through the P&L. According to Buffett, this is “bonkers. I don’t know what the accountants were thinking when they made this change”. I agree - the accountants have totally lost the plot.

On a Lighter Note

Jazwares, a toymaker owned by recently acquired insurer Alleghany Corp., unveiled special Warren Buffett and Charlie Munger soft toys at the weekend – apparently, they were sold out at the show. I would ask who buys this stuff but I know Whitney Tilson was one of the customers.

Soft Toys

Source: Jazwares

And my favourite quip:

Buffett: “I have grown smarter over the years”

Munger: “You needed a lot of help”.

Conclusion

The meeting itself was good fun but it was the associated events and the people which made the weekend for me – more on this next week.

Paying subscribers can read on for my thoughts on Berkshire’s governance and something I feel could be Buffett’s biggest blind spot. Next week paying subs will hear about some of the stock tips I heard over the weekend.