Regular readers will be aware that my main business is running Forensic Accounting Courses for institutional investors. It’s a lot of fun and clients get a lot of benefit - I teach not only how to be more effective at the analysis but also how to be more efficient, how to cover the ground faster.

Started in 2018, we shall hit 700 students on that course in a few weeks. A more recent development is a new course for younger analysts with 2-4 years’ experience. My clients understand the importance of the financial statements and want their younger analysts to develop a proficiency in modelling and in basic financial analysis. The introductory course covers

The basics of financial analysis

How to spot accounting red flags

How to build a 3 statement financial model (plus LBO and merger modelling)

I enjoy these courses because it’s nice working with young people and they are always super grateful for the knowledge they acquire. But I have been surprised at some of the gaps in the knowledge of some analysts with 2 years’ experience, even those who have passed two sets of exams as part of the CFA programme.

The first gap is a concept that anyone with basic accounting knowledge should be familiar with, yet I’ve had to explain it to more than one analyst. When I did explain it, one of my students thought that doing this was fraudulent!

Accrued Income

Accrued income is the practice of booking estimates as revenue, without sending an invoice to a client. It’s particularly common when companies are engaged in long term contract accounting – say in the construction industry when you are building an office block and booking profit on a percentage of completion basis. Shipbuilding is a similar activity.

But accruing income is not confined to the practice of physical manufacture. At year-end, every lawyer and accountant will estimate the revenue to be billed to customers, based on the time sheets completed by staff. My students didn’t like this idea.

I pointed out that I generally bill for my courses in advance. For these courses, where the length is variable, we bill in arrears. Therefore, as my year-end is October, if I complete a course in October, but only invoice the client in November, I will have accrued income in my year-end accounts.

The accounting red flag to watch for would be accrued income days. If you see a jump in accrued income as a percent of revenue, it indicates that a higher proportion of revenues are the result of management estimates and this is a concern for two reasons:

- In a construction business, the level of accrued income will vary from year to year, but a spike in the accrued income days could indicate that management are being aggressive.

- In my example above, my accounts will show accrued income for the first time and it will look as if I have decided to make my revenues look larger than they really are.

Obviously, in my case, I would have no reason to exaggerate my revenues.

In contrast, my profits tend to be as conservatively reported as possible, consistent with showing a true and fair view. But quoted company management are often incentivised to show the best possible growth and accruing income aggressively is a simple way of boosting growth.

Enterprise Value Mistakes

Calculating enterprise value accurately is one of the key building blocks in valuation. But with large quoted companies, the business structures are often complicated – there are investments, associated companies, joint ventures and minorities. These introduce complications into the valuation and even into the basic accounting for profits and cash flow. We teach students how to navigate all this, but I was surprised that some of my students had not encountered these issues. I discuss a few of the points we covered below.

Associates and JV Profits

Confusingly, the associates and JV profits are included in a company’s IFRS accounts on a post tax basis, even though they are included in the pretax profit.

The example we used was Diageo, which helpfully highlights that this is indeed post tax. Unilever describes this as share of Net Profit from Associates which is a clearer description because it is also after interest.

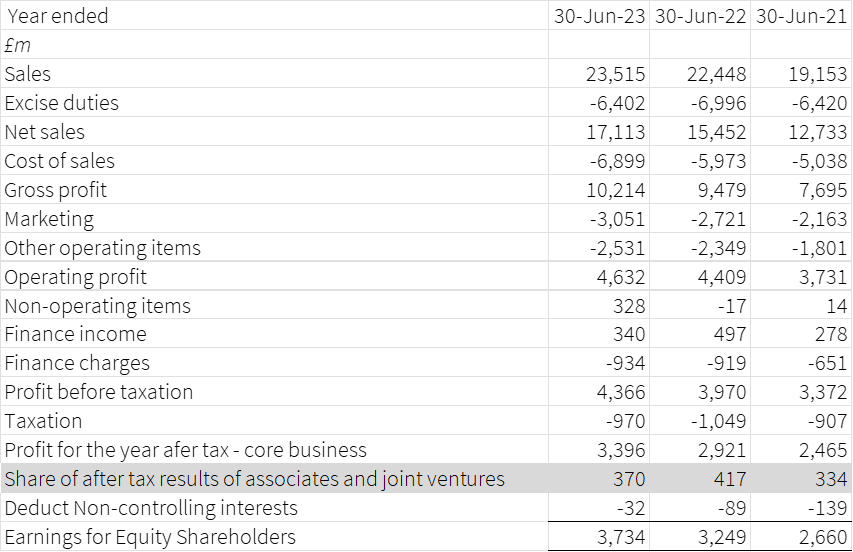

Diageo P&L

Source: Diageo 2023 Annual Report

The minorities are shown as a note to the profit for the year and I prefer to show minorities as a deduction. I have reframed the Diageo P&L the way I prefer to look at this. If I were head of the Accounting Standards Board, accounts would be a lot easier to understand:

Diageo P&L Reframed

Source: BTBS from Diageo 2023 AR

The P&L looks clearer with the simple change of moving Associate and JV Profits below the Profit after Tax line. Of course, I make many other changes but this simple move makes it clearer to see the trend in the core business – surely this is a better method?

I have also highlighted the deduction of the minority interests at the bottom of the P&L.

Companies reporting under IFRS generally show this separate note highlighting what is attributable to ordinary shareholders and to non-controlling interests. I prefer to shorten and simplify and use a presentation similar to US GAAP:

Exxon P&L

Source: Exxon 2022 10-K

In my training sessions, we spend considerable time on this, on the related cash flow entries and on the valuation of associates and minorities, which can be critical components of enterprise value for many companies. We cover issues like:

- Loss making associates and minorities

- How to value when you cannot identify the businesses

- Valuable associates and minorities

- Lowly valued associates and minorities

Premium subscribers can read on for a further discussion of some of these concepts.

🧠 Learn More

For beginners, take a look at my Accounting Basics Course

Develop your financial analysis skills with our course on How to Read the Financial Statements

US readers may prefer to try How to Understand a 10-K.