The World’s Most Profitable Business You’ll Never Own

Inside Only Fans, our 130 Stock Tips Ranked and 2 Dreadful Sectors to Avoid

Introduction

This week’s piece is a little different – and perhaps a little controversial. I dive into the finances of OnlyFans, a hugely profitable, largely overlooked social media business that quietly raked in $1.3bn in revenue last year and paid its owner a $472m dividend.

For premium subscribers, I’ve compiled the 130 stock picks highlighted here from past conferences—ranked by performance—and reveal two sectors that are consistent money-losers. If you're allocating capital (your own or someone else's), you'll want to see which ideas worked and which were disasters. Overall performance ex those two sectors has been particularly impressive.

Substack

Special thanks to Substack for their London summer party. I met co-founder Hamish Robertson who explained that finance is the #2 category (after Politics!) and that Substack now has 50 writers earning over $1m pa. I am not one of them, so please feel free to subscribe:

Before we get into OnlyFans (OF), a quick offer from me, I am New York in July to deliver a course to a major institutional client and I now have a day open on Thursday, July 24. After the success of last November’s event, I shall again run my Forensic Analysis Workshop in a midtown location. Spaces are limited so please sign up early:

Let me know if you have any questions.

Introduction to OnlyFans

The potential sale of the US arm of TikTok has attracted a lot of attention; Elon Musk’s tweets often catch the public eye; and Instagram is constantly in the press. But one social media platform garners less comment, but is also hugely popular.

OnlyFans is, for all practical purposes, a porn site - though it prefers the term ‘creator platform’, and it has over 300 million users. It generated $6.6bn of revenue in fiscal 2023 for the 4m creators on its platform of which it took $1.3bn itself, allowing it to pay owner Leonid Radvinsky a $472m dividend and increase its cash in the bank to $678m at the 2023 November year-end.

Ukraine-born Radvinsky lives in the US and bought the business in 2018 from Guy Stokely when its revenue was under the $6m threshold for filing full accounts. The amount paid was not disclosed.

I decided to take a look some time ago, on learning that the parent company was a UK vehicle and therefore accounts had been published. At one time, Behind the Balance Sheet specialised in generating industry data using a combination of quoted and unquoted company financial information – for example, we produced reports on the UK supermarket sector and on the UK’s main universities for one hedge fund client and on the Premier League for general consumption.

I thought it would be fun to take a look at OnlyFans as it’s a standalone social network and perhaps there might be some takeaways for some of the quoted companies in the sub-sector. And recently the FT ran a story on OnlyFans being bought by a private equity fund, so it’s topical. There is limited company financial information and no call transcripts obviously, but let’s dive in and take a look.

OnlyFans Finances

The platform was already growing strongly pre-Covid but the pandemic was rocket fuel, as for all online platforms and activities. But in contrast to say paid online courses, where revenues have fallen by half from the Covid peak according to one course platform, the number of OnlyFans creators has continued to grow:

Creator Numbers

Source: Behind the Balance Sheet from Company Filings

As would be expected, the pattern is similar in the number of customers, although the growth in the last couple of reported years has been slower, but still pretty impressive, at over 25% on a 200 million base. Of course, this doesn’t tell you the number of active users which is the key driver of both creator interest and revenue.

Customer Numbers

Source: Behind the Balance Sheet from Company Filings

The number of active users appears to have grown much more slowly, given the per user revenue trend:

Per User Revenue Trend

Source: Behind the Balance Sheet from Company Filings

I have no idea what the average person spends on the platform but it will be significantly higher than this average which is depressed by the number of free and inactive users.

Revenue Per Creator Trend

Source: Behind the Balance Sheet from Company Filings

There is probably a lower proportion of inactive creators, although for sure the revenue distribution will be highly skewed to a few top creators, as we saw in my recent Substack analysis, with a long tail of accounts eking out a marginal return. Creators did well when people were at home during Covid and unit revenues are down 30% from the peak – that would be the logical pattern. The figures in the chart are gross, before payment of the 20% commission to OnlyFans which would take the average in 2023 to just over $1450, based on average creator numbers.

This is an incredibly profitable business. The platform takes 20% of revenues vs Substack’s 10% take, which I think is quite high and could be vulnerable to disintermediation. For OnlyFans, security and maintenance of copyright is a far bigger issue and its 20% take is similar to most peers and much less than some alternative outlets in the porn sector.

Platform Sales $000

Source: Behind the Balance Sheet from Company Filings

The growth in total revenue (split 80:20 creator:platform) is astonishing – at over $5bn, it was still growing at 20% p.a. and obviously the Covid growth numbers are off the scale (hence the table rather than a chart).

Only Fans Revenue by Category

Source: Behind the Balance Sheet from Company Filings

OnlyFans’ take has risen in line with the overall throughput and the mix has become much more transaction oriented, going from 60:40 in favour of subscription to the reverse. Transactions are described as “messaging and access to content”.

Geographical Breakdown

Source: Behind the Balance Sheet from Company Filings

The US is the largest market, followed by the UK which has grown significantly – a 5x in 3 years. US users account for 2/3 of revenue.

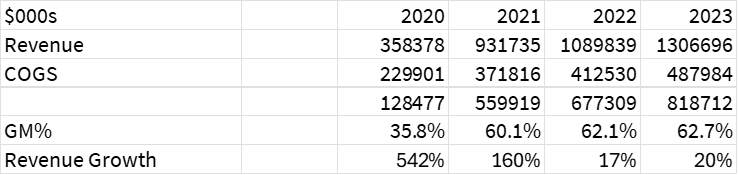

Somewhat surprisingly, given the nature of the business, gross margins are lower than I would have expected:

Revenue and Gross Margin Trends

Source: Behind the Balance Sheet from Company Filings

I am surprised that hosting and servers (perhaps some advertising is included here?) would be this expensive – half a billion dollars annual operating costs seems a lot. Although here is the chart of Meta’s and Snapchat’s gross margins – obviously there may be differences in the definition of cost of goods sold:

Social Network Gross Margins

Source: Behind the Balance Sheet from AlphaSense Data

Snapchat’s gross profit was a larger loss than revenues in 2015 and it has not come close to Meta’s level since. Apparently, the difference is largely down to the cost of the server capacity for videos being significantly higher. There is probably a pricing/ad effectiveness element also at play here, as Meta has considerably grown its video content but gross margins have been stable.

There could also be differences in definition and for OnlyFans, related parties provide some of the services, such as media backup and server storage so these could be more expensive than an open market solution. But although lower than some software companies, not many businesses enjoy a 60% gross margin.

In 2016, Snapchat had 158m active daily users and had cost of goods sold of $450m. Only Fans had 305m fan accounts at the end of the year and likely a lower number of active users than Snapchat and had 10% higher COGS.

The OnlyFans filing refers to the development of their on-demand video streaming platform which hosts only safe for work videos including fitness, cooking, comedy, music and reality TV. This could be impacting the COGS number. I am not sure that I understand the strategy.

EBIT Margin Trend

Source: Behind the Balance Sheet from Company Filings

EBIT margins are impressive at just under 50% and have been pretty stable in the last three years. Administrative expenses are up, although employee numbers have been declining from 59 in 2021 to 51 in 2022 then 41 in 2023. Average pay per employee was c.$215k in 2020 and 2021 and it looks like a large bonus was paid in 2022 when average pay rose to $550k. Last year it fell back to just under $500k, if I assume severance is not included in the total. The company seems to be well-managed, looking at the revenue and profit per employee, which are outstanding:

Per Employee Measures ($m)

Source: Behind the Balance Sheet from Company Filings

In spite of large cash balances, finance income has been pretty negligible, although the company has been dabbling in crypto and will have booked a large gain in 2024. There was a $31m write-down of an investment in 2021 and 2023 profits after tax came out at $486m ($404m).

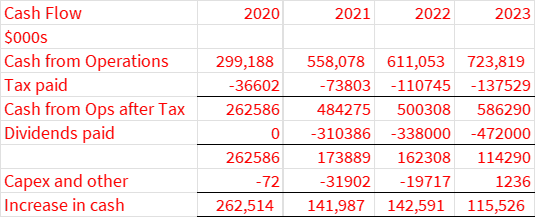

Cash Flow

Source: Behind the Balance Sheet from Company Filings

The cash flow is really powerful because:

1) they only pay the creators after they receive the cash from the users so the company has a massive benefit from negative working capital – around $560m in 2023;

2) there is a small element of deferred income;

3) capex is negligible – the bulk of the spend looks to have been bitcoin investments – there is just $542k of fixed assets.

The largest item on the balance sheet is cash - $678m at last year-end out of total assets of $813m and that’s after they paid a $472m dividend. The dividend appears to be paid monthly with a schedule of payments one year from February to August of $25m, $28m, then $35m each month for 3 months then $309m then $45m. There probably is a seasonal dip in the summer.

Conclusion

I wish that the owner, Leonid Radvinsky, was floating this stock on the market – it would be a classically cheap deal as institutional investors would shy away from it – it’s embarrassing, it might upset female staff, and it’s perhaps a little distasteful. I love this type of setup, as the cash flow will dictate the ultimate return to the owner.

I have no idea if this is a fad or if the creator economy is here to stay, but I am guessing that pornography will endure and many young women will continue to find this a way to earn a good income. OnlyFans is the biggest player with classic network advantages.

Instead, it’s likely that the business will be sold to private equity. The FT reported that the owner is in talks to sell the business for $8bn, probably to a group led by LA-based investment group Forest Road Company. That might prove a bargain.

Radvinsky should hedge his bets by selling part to the investment company, floating part on the market, and keeping a stake. Simply redomiciling the company will save a fortune in tax (nearly $250m was paid in the last two years to the UK Inland Revenue) and excluding that payment, there would be a 9% FCF yield.

Premium subscribers can read on for that list of 130 stocks, by sector and by performance (annualised). The fascinating takeaway is that by taking out two sectors, the average returns almost doubled and the annualised returns more than doubled. There were 28 stocks here, whose performance ranged from +39% to -69%. Even the short idea lost money, although to be fair, the presenter didn’t anticipate a timeline this long.

Professional investors reading this may decide that these industries are just too hard. Private investors should definitely ask if the risk-return in these sectors is worthwhile.