The ETF Revolution: Is $20 Trillion the End Game?

How ETFs are reshaping global markets, challenging mutual funds and keeping me amused

Introduction

This week, a word about my podcast and a look at ETFs.

Next week, I am in New York for two conferences, one value, one quality growth. So expect around 25 stock ideas next Sunday which I shall write up in greater detail in coming weeks. Premium subscribers get an update today on one of the stocks tipped at Sohn which is looking even more interesting now.

Last week’s piece on finance Substack proved rather popular, especially among Substack writers, perhaps less so among my professional investor audience. One gripe from them is how do they identify which Substacks they should subscribe to. And a gripe from some writers is they get one payment from an institution, but many users read the content. One client asked if I could create an institutional newsletter which:

aggregates the best content on Substack

allows the entire institution to access the content at a fair price

pays the writers a fair price without dilution on their regular subscription.

If you are either a writer or an institution who would be interested, please reply to this email and I can gauge interest.

1 Podcast

My podcast this month is with George Michelakis. He was a top 3 global under-20 chess player and is the founder and CIO of Gladstone, a $2bn long short equity hedge fund with a simple philosophy but a highly impressive track record.

This is particularly interesting because chess has been man plus machine for decades and George believes that investing is moving into the same framework. And amazingly, his longest short has been running for over 10 years!

Upcoming Webinar

Join me on March 24th at 12 PM ET for an exclusive Hedgeweek & AlphaSense webinar where I'll break down why traditional pricing power models fall short and how AI-driven research is helping investors uncover real opportunities. We'll also explore how to identify companies with real pricing power advantages.

What You’ll Take Away:

Beyond Margins: Why relying on gross margin stability alone can lead to missed opportunities.

ETF Pitfalls: Hidden risks in ETF selection and how to spot them.

Market Opportunities: Where valuation declines are creating strong investment prospects.

AI-Powered Research: How cutting-edge tools like AlphaSense give investors an edge.

2 Introduction to ETFs

Burton Malkiel, author of A Random Walk down Wall Street, probably innovative at the time but curiously still selling well, wrote an op-ed in the Financial Times yesterday, entitled “Passive investing wins again”. The hook was an S&P report highlighting that 2024 was a bad year for active managers with 65% of all active large-cap US equity funds underperforming the S&P500.

Percent Active Funds Underperforming the S&P 500

Source: S&P Global

Now I am not condoning the failure of active managers to beat the market. But it’s a shame that the chart doesn’t go back to 1999 as I would bet that the percentage was similar to 2021. Last year, the top 10 stocks, 34% of the weight, contributed 63% of the index’s return. Concentration is a major issue, although recently, it has started to correct.

Malkiel writes “When you compound the results over 20 years, about 90 per cent of active funds produce inferior returns to low-cost index funds and indexed exchange traded funds.” Not good, obviously, but I suspect that these trends might be about to reverse.

Malkiel rejects the argument that passive investing is creating bubbles (eg in AI stocks) and that when this unwinds, and when fundamentals become more important again, active managers will outperform. He writes:

“Even if 99 per cent of investors bought index funds, the remaining 1 per cent would be more than sufficient to ensure that new information got reflected in stock prices.”

Now I don’t know at what point passive grows to such an extent that it distorts market prices. Some would argue that we may have already passed that point. But the idea that the market would be efficient if it were 99% passive seems ludicrous to me. And it’s interesting to think about such an extreme, when trying to evaluate where the danger point might be.

I did a few back-of-the-envelope sums on Berkshire Hathaway which suggested in that situation, it would trade only $70m a day on fundamentals - a $1.1tn company. Imagine…

I wouldn’t recommend the FT article, but it’s probably important to watch the ETF industry. ETFs have grown significantly and global AUM managed in ETFs reached $15tn at end-2024.

Global ETFs Industry Assets ($bn)

Source: ETFGI

The global ETF industry had over 13k products then, with over twice that number of listings, and assets of $14.85tn. ETFs from 814 providers were listed on 81 exchanges in 63 countries. LSEG puts the equity proportion at 78% and bonds at 17%. The rest is 1.6% commodity, 1.5% alternatives and money market/other.

Growth

Growth forecasts vary and Invesco’s number of $20tn in 2028 in the chart below is not that helpful – clearly the value of global ETFs will depend on what stockmarkets do and I doubt many of the big firms have much clue about that. But ETFs are still under 15% of investable assets globally so it would be daft to assume that growth is over.

Global ETF Market Projections

Source: Invesco

EY put the year-end number at $14.8tn and estimate inflows of $1.88tn in 2024 – measuring inflows seems a more sensible way of assessing the market to me. Oliver Wyman split the two impacts out in a report a couple of years ago and suggested that by 2027, ETFs would reach 24% of fund assets vs 17% in 2022 ($6.7tn ETFs vs $32.1tn in mutual funds):

ETF Market Forecast

Source: Oliver Wyman

Geography

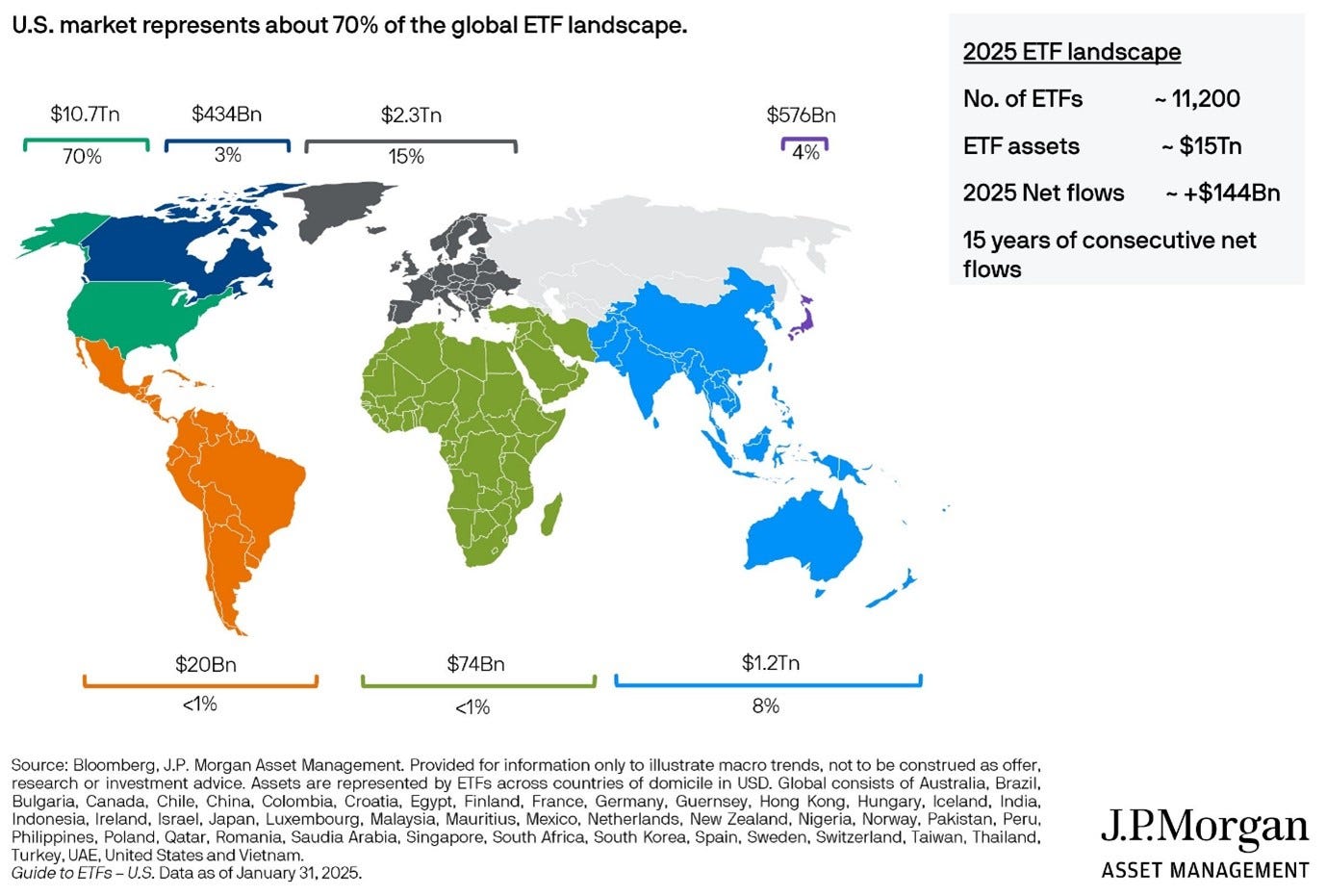

The US remains the largest market, and broadly consistent with relative capitalisations, it’s about 70% of the global ETF market, per JP Morgan Asset Management. I would have expected an even higher number, given the number of derivative ETFs and active ETFs in the US which are likely lower elsewhere. LSEG data suggest North America is 76%, Europe 16%, Asia Pacific 8.3% and LatAm/Africa 0.2% of assets.

Geographic Split

Source: JP Morgan Asset Management

Active ETFs

There remains a significant market for ETFs to conquer as the US mutual fund industry is still twice the size of the ETF market – this is not consistent with the passive overtakes active narrative which we have become accustomed to, but the JPMAM data suggests that ETFS have 34% of the market and active funds 66% of the market, up from 21%:79% 5 years ago and 14%:86% 10 years ago. Here are the main categories of index funds with the US large cap dominating.

AUM by Category

Source: LSEG Lipper

Index trackers represent $7.7tn, factor exposure and similar are a $2.1tn market and active ETFs are a $958bn market, where the top 5 issuers have 53% vs 92% in the index trackers. Active ETFS are on the rise and now number 1910 vs 2028 passive.

Investors are redeeming active funds at an increasing rate and transferring to ETFs:

Mutual Funds are Losing out to ETFs

Source: JP Morgan Asset Management

This is supported by the asset management industry – a State Street survey found that 25% of managers plan to convert at least one mutual fund into an active ETF.

Active is almost 2/3 equity, 1/3 fixed income. Attractions include favourable tax status and low cost to the end investor. Large asset managers are cannabalising their own fund businesses:

Self-Disruptor Asset Managers

Source: JP Morgan Asset Management

Ironically, there is a better than average case now for active managers as the opportunity has become more attractive. The chart below shows the US opportunity set for alpha capture. The lower degree of correlation should afford active managers a better opportunity to outperform the US index. The same situation applies in Europe where there is a massive alpha opportunity spread according to this month’s podcast guest George Michelakis, a highly successful long-short manager.

Alpha Opportunity

Source: JP Morgan Asset Management

Flows into active ETFs are 47% of the total and index weighted are 51% with factor ETFs just 2% last year. Blackrock have lower numbers for the active inflow proportion but are bullish on the outlook, estimating that global active ETF AUM will hit $4tn by 2030, ie more than quadrupling.

Active ETF Trend

Source: Blackrock

Blackrock classify active ETFs into three style buckets:

Alpha targeting (80% AUM/75% inflows) – fundamental and systemic strategies which seek to beat a benchmark using some particular insight.

Outcome-based (17% AUM/22% inflows) – income, protection and growth strategies using derivatives to target specific investment objectives.

Exposure-based (3% AUM and inflows) – covering non-index strategies, like commodities or leveraged and inverse products.

It’s interesting that the exposure-based strategies are so small as they get a lot of attention. Active ETFs are getting an increasing representation in more and more model portfolios and are also seeing a rising number of individual investors – investments of $56bn last year vs $9bn in 2019.

The individual active ETF categories are smaller in AUM than I would have expected. Per JPMAM, 57% of the $0.6tn total is large blend (I assume large cap equities). Categories like small cap value, large cap value, large cap growth are each in the $35-50bn and thematic is under $20bn. These will surely increase.

LSEG uses slightly different definitions and puts factor ETFs at 20% of the total. These comprise:

Factor ETF % Split by Category

Source: LSEG Lipper

I am curious about the accuracy of these categorisations as I would have predicted momentum to be a more powerful strategy than say dividends.

Oliver Wyman classify by purely passive, smart beta, thematic and purely active and their report illustrated that active was still relatively small but fastest growing:

ETF Market by Active vs Passive Segments

Source: Oliver Wyman

Since the launch of Chat GPT, tech has gained share from other sectors with over $40bn of ETF inflows. And there has been a big increase in the number of thematic ETFs in the last few years. The data in the chart below showing nearly $100bn of thematic ETF AUM is inconsistent with the earlier JPMAM data showing $18bn – I still have to do some more work on all these sub-categorisations.

Thematic ETFs

Source: JP Morgan Asset Management

ETFs as Hedging Tools

ETFs are an effective way of hedging and in each crisis, they represent a high proportion of the total volume – this could be retail investors panicking out, or greater use of ETFs as a hedging tool, or both. ETFs were 40% of total volume in peak Covid, vs 28% of volume as an average – still high.

A recent academic study (By Andrew Clare of London Business School and colleagues) suggested that:

ETF growth has improved the efficiency of stock pricing at the market level, a concept dubbed “macro-efficiency”, reducing the prevalence of mispricing.

This greater efficiency is most pronounced during periods of volatility, a time when defects in market structure are most likely to be exposed.

The improvement in pricing efficiency was “largely absent” in emerging markets, where uptake of ETFs is typically far lower.

I am sceptical as the growth in ETFs has come at the same time as markets have gone up, there has been ever more short term trading, data quality and availability have seen major improvements, trading infrastructure has been bolstered and many other developments have taken place, all of which could have contributed to any efficiency improvement. And the DM vs EM difference may also be partly driven by liquidity factors. And past academic papers have had more mixed views of ETFs.

Fixed Income ETFs

In fixed income, where the active performance vs benchmarks is much better than in equities, active ETFs now outnumber passives. Passive ETFs total $1.5tn, or 5 times active’s $0.3tn. There is a bigger opportunity here as global fixed income markets are significantly larger than equities - $141ttn vs $115tn per JPM.

Bond ETFs are more liquid than the individual securities with ETF’s share of trading hitting almost 50% in periods of panic. I find this puzzling. Although a collective could be more liquid than its constituent securities temporarily, in the long run, and certainly likely in a downturn, it’s bottom-up liquidity which may be the key driver.

Fees and More

Although higher added-value ETFs are increasing share, the trend in fees is a race to the bottom:

ETFs are already much cheaper:

Management Fees by Class

Source: Oliver Wyman

There are considerations beyond fees, as highlighted in this graphic:

ETFs vs Mutual Funds –Investor View

Source: Oliver Wyman

ETFs are increasingly being used by institutional investors:

The Majority of Institutional Investors Are Heavy Users of ETFs

Source: State Street

Conclusions

It’s clear that ETFs are here to stay. It’s worth watching what happens to index ETFs if we enter a bear market, especially for the Mag 7 stocks which have been driving the market, and perhaps the equal-weighted S&P index ETFs will become more popular. Certainly there have been times when the market weighted index and its largest constituents have been driven by flow and momentum as much as fundamentals.

At the hedge funds, I found that sector, thematic and factor ETFs can be a really useful way initially to exploit a theme which you have identified but will take time to research, or a theme which you don’t want to research but want exposure to. I was surprised that these were not larger. I was also surprised that global ETF data was less readily available than I had expected (I believe Bloomberg is better) but surely that will improve over time.

The now slightly out of date Oliver Wyman report highlighted a number of key trends:

Increase in retail investor demand expected to continue, in addition to continued institutional adoption, thanks to increased visibility and greater availability on digital wealth platforms. More impact is expected in Europe from a lower base.

Retail investors are increasingly cost sensitive and aware of cost differences.

Active mutual fund managers in the US are increasingly converting mutual fund strategies into ETFs and launching new ETFs.

Demand for thematic ETFs as asset allocators increasingly look for such funds.

Direct indexing which allows harvesting of capital losses at the single-security level may impact ETF growth outlook.

Premium subscribers can read on to learn what is keeping me amused in this space and an update on that past stock idea: