It feels like we’re living through a chunk of stock market history that could go down as a ‘big one’. In this week’s article, we’re going to look at how bear markets have evolved over time. I’ll also reveal which period of history I think could turn out to “rhyme” most with what’s coming next.

Bear Market Trends

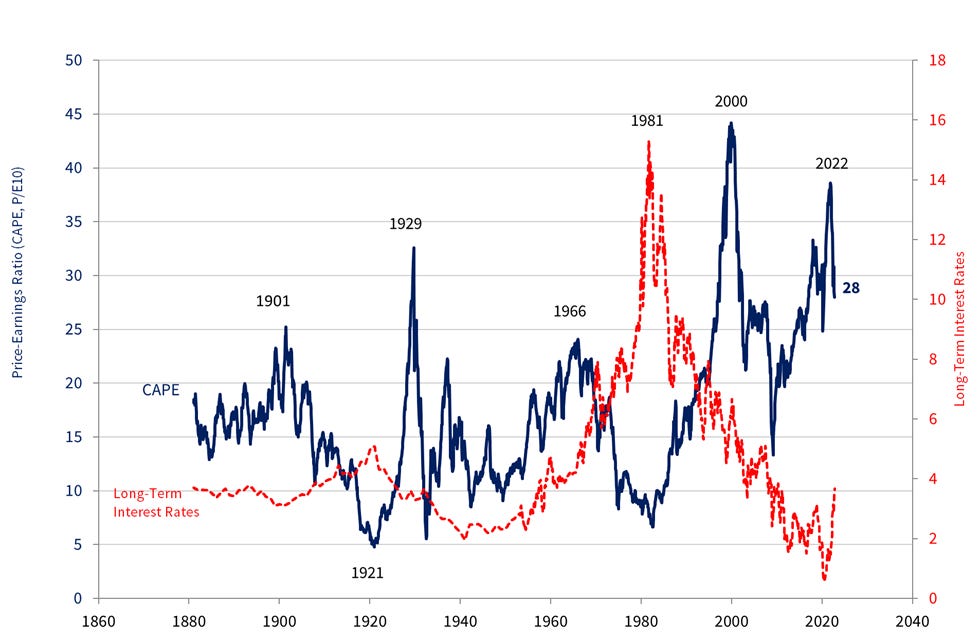

The chart shows the long term valuation of the US equity market against the long bond yield. In the period of the chart, some 140 years, there have been several bear markets.

Long Run US Stock Market and Bond Market Valuation

Source: Behind the Balance Sheet from Shiller Data

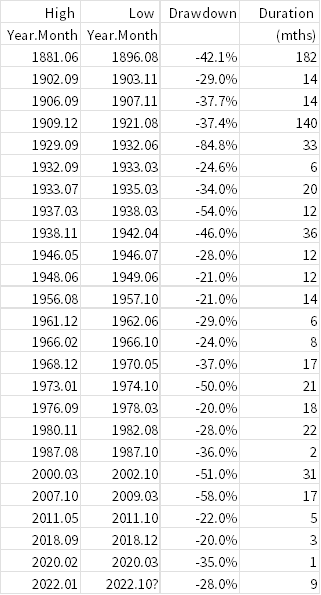

Using the Shiller data is imperfect as the dataset is monthly. This is obviously pretty useful for data going back to 1871, but less so for more recent times. Here are my calculations of the bear markets in the last century and a half from that data:

Bear Markets Last 150 Years

Source: Behind the Balance Sheet from Shiller Data

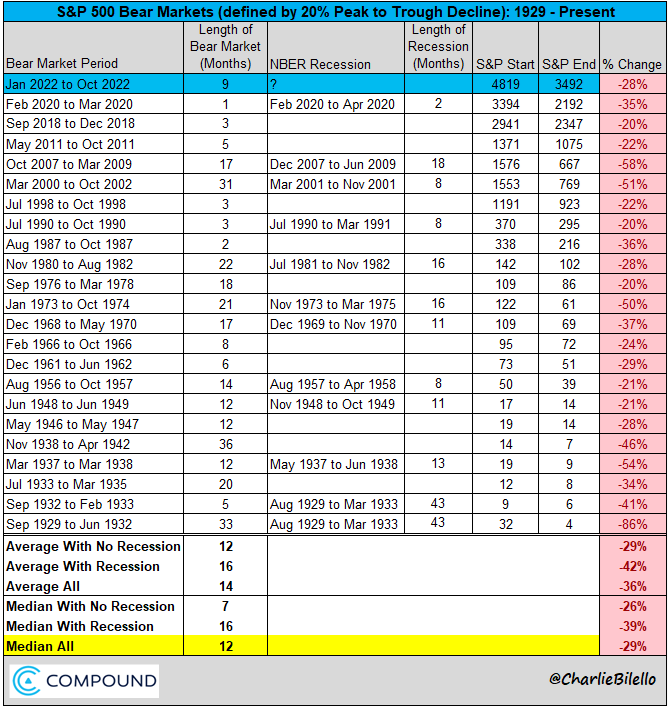

As you can see it’s not brilliant as it omits this year for example – the monthly averages have not quite entered bear territory in 2022. I have therefore used Charlie Bilello’s data. He certainly must be better at Excel macros than I am – Henry, if you are reading this, I need a maths/Excel lesson please so that I can do this type of analysis more quickly (we can do it in the pub). Here is Billelo’s analysis:

More recent bear markets have been shorter and gentler, although obviously the GFC and the bursting of the dot.com bubble were painful. The Bilello data “only” goes back to 1929, so it’s easier to consolidate everything into one dataset. The result is this table:

Bear Markets Severity and Duration

Source: Behind the Balance Sheet from Shiller Data and Charlie Bilello

This chart makes it clear that the duration of bear markets has fallen markedly in the last century and a half:

Average Bear Market Duration

Source: Behind the Balance Sheet from Shiller Data and Charlie Bilello

The bear markets of 1881-1896 and 1909-1921 were brutal, not because of the severity of the falls but because of their long, drawn-out grinding nature. Why did these last so long? I don’t know. Of course, today information travels much more quickly so it would be fair to expect more instant reactions. But what about today’s bear market?

Nobody knows how the 2020s are going to turn out, certainly not me. But I keep hearing the same mantras being trotted out and I am convinced that many commentators - who believe that the future will be like the recent past – will be wrong.

The last 40 years were an exceptional period in which stockmarkets benefited from:

Falling interest rates – from a peak of above 15% to below 0

Favourable demographics

Increase in the labour force through immigration and woman entering the workforce

The import of cheap products from China creating disinflation

Deregulation

A technological revolution

The addition of c.2bn consumers to the global economy

Technology will of course continue to improve and the growth of the middle class in Asia will continue. I don’t know if many others of these tailwinds will persist.

We may get a dividend from cheap energy as renewables and technology improve; that will certainly help, but it’s probably not a near term prospect. Given concerns about inflation and low starting yields the 1966-1982 period may well be a useful reference case.

The US Stockmarket from 1966 to 1980

Source: Behind the Balance Sheet from Shiller Data

The chart shows that the period from the mid-1960s to the end of the 1970s saw a decline in the stockmarket in real terms and extended phases of bull and bear markets. That period saw 5 bear markets, with drawdowns of 20% to 50% and durations of 8, 17, 21, 18, and 22 months. So over that time the market was in a bear phase for 86 months or roughly 43% of the time.

The period also saw a long rise in yields from a low starting base and high inflation which led to negative real 10 year annualised returns from both stocks and bonds.

Real Returns in the 1960s and 1970s

Source: Behind the Balance Sheet from Shiller Data

Why am I telling you all this? Well I suspect – and of course, nobody knows - that this bear market may be a bit longer than some of the others. Or that bear markets may be more frequent than we have become accustomed to recently, like they were in the 1970s.

If that hypothesis is correct, then we can expect:

Shorter economic cycles

Shorter market cycles

A need to be more nimble with our money

A limit to protection from a 60:40 mixed equity and bond portfolio

A failure of passive strategies to keep pace with inflation

I don’t mean to sound TOO bearish as there are lots of interesting opportunities in stockmarkets – as long as you have a sufficiently long time horizon – but I believe that too few people understand that we have had a change of paradigm.

What has worked in the recent past is unlikely to work in the future.

Paying subscribers can read on to find out my recommended strategy.