Polar Capital is a UK listed equity asset manager with a market cap of around £500m/$600m. The firm offers a wide array of funds aimed at wealth managers and retail investors. This week, they held their annual investor day in Mayfair where managers present on their funds. I attended for the first time.

During the day, several managers presented on their funds and there were some interesting takes on various parts of the stock market. I attended 5 fund sessions:

Japan Value

UK Value

Global Tech

Smart Energy

European Income

I want to focus on Japan and tech, with a quick mention of some others. Paying subscribers get a brief description of Polar Capital stock at the end.

A Quick Note on Macro

Although there is no “house view” at Polar, and we were told to expect individual views on inflation and the economy to differ, a surprisingly narrow consensus emerged from the meetings I attended:

Short term choppiness in markets

Inflation has peaked

Interest rates don’t have much further to go

A more benign outlook after a torrid 2022

You have to take some of this with a pinch of salt. After all, these were sales pitches – and some of them were pretty punchy. I am not sure if they told their investors to cash in at last year’s event, but I am guessing not.

The UK manager likes his portfolio, sees it as cheap and thinks the FTSE 250 which has been a dog will catch up with the FTSE 100. I agree it’s cheap and small caps should benefit if investors become more confident in the outlook. Longer term, that cheapness should drive positive returns.

But I was unconvinced that Bellway, a small UK housebuilder was particularly cheap at a 10% discount to assets. The manager contended that the UK housing market is giving positive signals, and that quoted builders are positive on visits and contracts so far this year. In my opinion, it’s early to be bullish - interest rates and consumer confidence are critical drivers.

Things certainly look brighter than say six months ago, but energy prices could easily pick up, rates could rise further and confidence could slip. I am not suggesting that is a central case, but it’s clearly a possible scenario and not one in which Bellway would be a profitable idea. With some research, I could probably make a plausible short case.

I should add that my friends in retail are positive about the UK consumer. This partly reflects a reduction in supply, as Covid caused some weaker players to disappear plus opportunity for self-help.

Japan Value

This was a really interesting session – it’s a small fund ($150m-ish) but the manager is experienced and battle hardened (I imagine most Japan fund managers are world-weary). He made one fascinating comment about the Tokyo Stock Exchange which continues with its mission to improve governance and make Japan a more attractive place to invest.

The latest development is an edict which requires companies whose stock is trading at below book value to publish a plan to improve their valuations.

Astonishingly, the manager estimates that 50% of Japanese stocks trade below book and he thinks this new initiative will be really significant. Of the 47 stocks in his portfolio, 8 began buybacks in Q4 2022. Corporates are already the net buyer of equities:

Japanese Equity Flows

Source: Polar Capital

The manager was also bullish on opportunities in tourism as Chinese visitors return. This will clearly be a major benefit to certain stocks, although I would imagine it should largely be priced in.

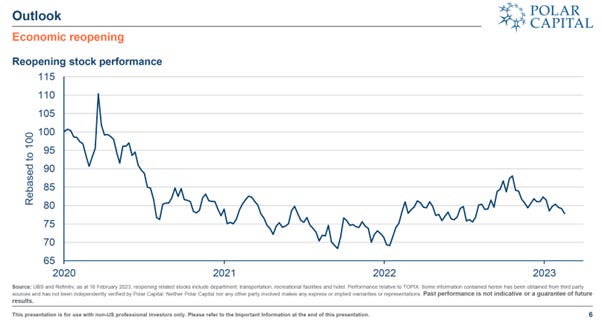

He also sees opportunities in reopening post-Covid where experience has been different in Japan. Interestingly, he suggests that this is not priced in, as you can see from the chart:

Japan Stocks Reopening Plays Opportunity

Source: Polar Capital

I don’t have much experience of investing in Japan. I recall a meeting with the President of a Japanese company which was a comp for one of my holdings. I asked him if he was putting up his prices in response to restricted capacity and increasing demand. He responded that his customers would not like a price increase , which put me off investing in Japanese stocks.

While these stocks were not shareholder friendly then, this may be changing and I should be doing some work.

Tech

Polar claim to have the largest buyside tech team in Europe. They manage a $4.5bn global tech fund, a $3.4bn closed-end fund and a $350m-ish AI fund. The manager opened with a bullish pitch, to the effect that

Higher growth stocks used to be on 70x sales and they are now on 13x sales (ie they must be cheap).

80% of software is trading at multiples which are less than private equity transaction values (stocks usually trade at a discount to acquisition prices).

He referenced Orlando Bravo of Thoma Bravo which has just raised $32bn for private equity tech funds (bullish, but Cathy Wood is still seeing inflows).

There were some important takeaways from the presentation and the team are clearly knowledgeable about tech. They see AI as being a clear step change in technology. And while they don’t have a strong view on inflation, they see tech as well-placed for the next several years. They also perceive value, highlighting that cloud-based software stocks are trading at 5.5x sales vs 13-21x in the pandemic period. Before the pandemic, these stocks used to be on 4-8x sales.

Polar play tech in six main themes or buckets:

Online advertising/commerce;

Data Economy/AI;

Cloud Infrastructure/Security;

Software;

Connectivity/5G/IoT; and

Mobility/EV/Clean Energy.

They are downplaying their 7th theme, Digital Entertainment where they are less enthusiastic (examples include Activision, Tencent, Apple and Microsoft). There is an 8th theme emerging, Metaverse/AR (think AMD, Nvidia, Microsoft, Meta, Roblox).

Their valuation analysis and earnings outlook interested me. They estimate median valuation at 6.8x EV:sales (2023) and are expecting 28% earnings growth for their stocks:

Tech Valuation – 31/1/23

Source: Polar Capital

I was pretty surprised by this and I have a fun bet (a beer) with one of the PMs, Nick Evans, who is convinced that their portfolio will deliver this rate of growth. I am not sure how I am going to prove that I won this bet, but I bring it to your attention because:

These are decent size funds and I would imagine they own at least some of the bigger players.

Earnings growth of 28% would take their PE multiple down from 26.2x prospective to 20.5x next year. This clearly would be attractive for stocks growing at that pace.

I had assumed there would be some significant fallout in tech from the whole VC bust – if ventures think it’s going to be more difficult to achieve the next raise (it will be), then they will rein in spending. That surely has an impact on the whole tech eco-system.

Against that, daft pay awards are receding. A tech recruiter I spoke to recently told me that some of the Twitter engineers in London were on crazy money – he interviewed 2 who were on basics of $1.2m pa. And of course many had fantastic stock option benefits. Clearly that will unwind and the redundancies should help 2023 eps growth.

So my main takeaways from the global tech presentation were the managers’ confidence in earnings growth and their excitement about the opportunity in AI.

Although Alphabet stock has been badly hit by the Chat GPT excitement (classic hype cycle) and Microsoft’s association with it, they rightly pointed out that it was too early to write-off Google as an AI loser. Given that they bought Deepmind some years ago, they must have expertise in the space, even if there are early teething troubles. People don’t remember Ask Jeeves, MySpace and other early movers – they remember the winners but they aren’t always (or even usually) the first movers.

Geo-Political Commentary

There were also some general sessions which included a keynote from the former head of MI5 and Chair of the Wellcome Trust, Dame Eliza Manningham-Buller. She is not positive on Russia and made some interesting observations on the parallels between decision making in investing and in intelligence – you are always making a decision based on imperfect information. Her advice to investors?

Use a red team

Investigate the results of your decisions afterwards.

These conferences are useful, irrespective of my views, because I always learn something and I hope readers find these summaries interesting and I welcome your feedback (as well as any events you would like me to cover).

Paying subscribers can read on for a quick look at Polar’s stock, the links to the full presentations described above and a new section, In the News, where I hope to add even more value for paying subscribers. This week I discuss the astonishing revelations in UK fintech darling Revolut’s 2021 audit report, released this week.