I recently spent a few days in Las Vegas as part of our US family vacation. This leg of the trip didn’t start well. We flew in to Vegas with JetBlue, the only airline I have travelled on since 9/11 where the pilot and co-pilot emerged from the cockpit to chat with the cabin crew. We took the automated rail to the baggage claim, only to find we were in the wrong terminal, something which has never happened to me in hundreds of flights.

We eventually arrived at the Venetian. The room (OK, suite) was as big as a London apartment, and the hotel(s) and casinos were immense. To give you a sense of scale – over 4,000 rooms; indoor and outdoor gondola rides ($156 for a family of 4 for a 15 minute ride); 60 restaurants; a queue to check in of at least 50 people; and I could go on.

Check in queue at Venetian was this big all day and all night. Photo courtesy Mrs C

We had breakfast at one of the restaurants, and I asked the server about its size. It’s open 24 hours, naturally. It has 523 covers, 300 staff, 11 cooks, and it’s always busy. Oh and it has no windows, like everywhere else in the Venetian. Weirdly, you can smoke in the casino. I didn’t realise that and it was surprising how many smokers there were.

A gambler smoking a cigar

Why am I telling you this?

Well, I have a little bit of history with the industry and I am familiar with Las Vegas Sands, owner of the Venetian, and with Wynn. I even saw Steve Wynn present to a conference, a rare event. These are stocks which have exposure to both Vegas and Macau, so they are quite complex. But what I saw in Vegas was very clear.

The place was buzzing, full of middle America having a good time. And it wasn’t cheap. It has been five years since I was in the US, my longest absence in 25 years, and I was shocked at how much things cost. Obviously, $1.20 is a highly unfavourable exchange rate. But even the dollar prices seemed steep.

Our one scoop ice-creams were $9.07 each (including a $1 tip) because they charged $1.58 extra for the cone – I mean, seriously. That was £7.53 in real money, or 3x what I paid for a cone the previous weekend in Edinburgh.

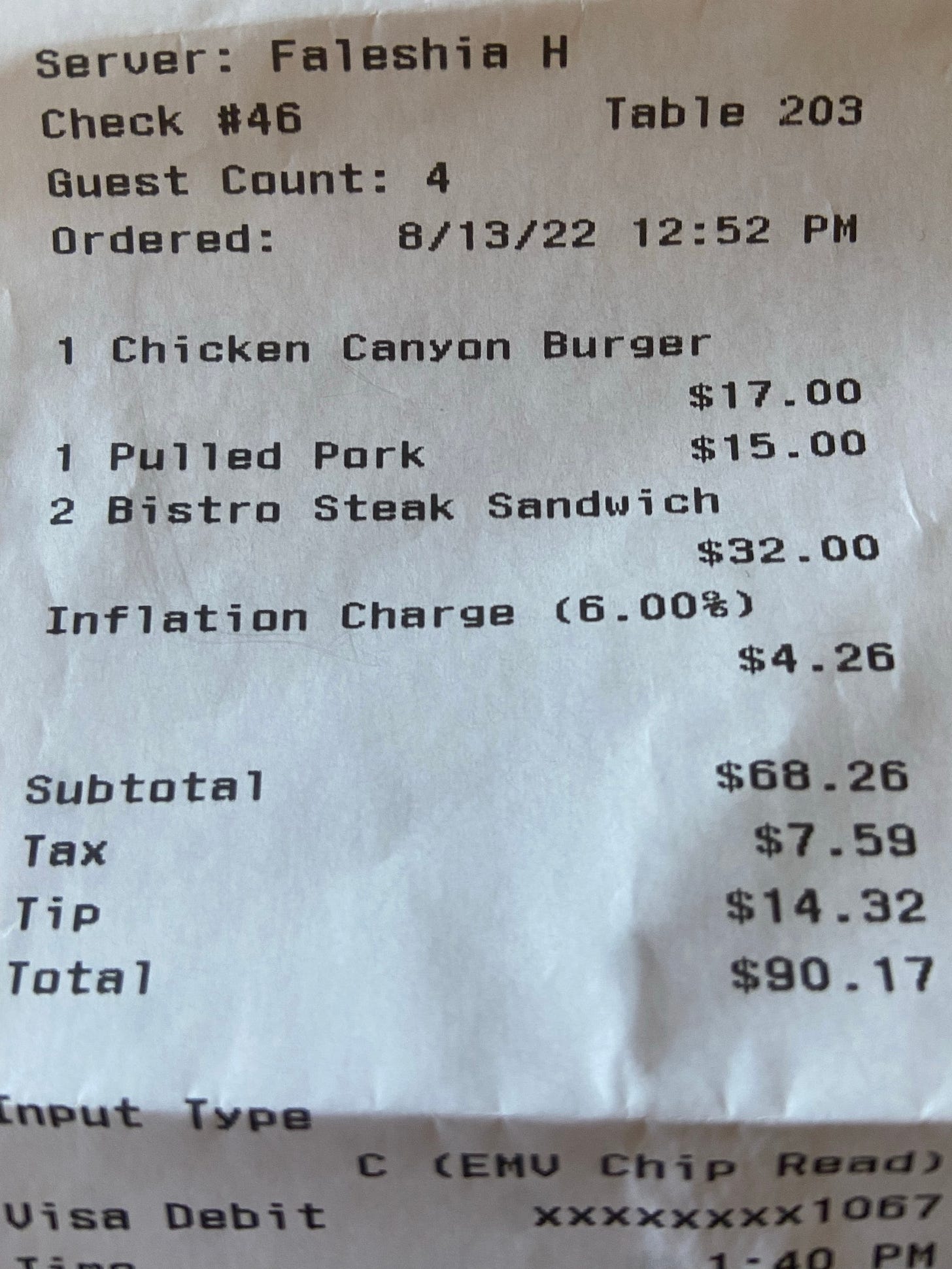

At one bar, my bill was higher than I expected and it turned out that they added a 6% inflation surcharge:

So, inflation is an issue, but you knew that. I thought it would be interesting to see how much of these risks were factored into Vegas share prices. Wynn and Las Vegas Sands are interesting, albeit imperfect, case studies as I shall explain. To keep this article at a readable length, I’ll focus on Wynn.

A Quick Look At Wynn’s Stock

A good place to start is the share price – how much has it fallen since Covid?

Source: Behind the Balance Sheet from Sentieo data

This chart says a couple of things to me.

First of all, Wynn is perceived as growth stock but in reality it has been pretty cyclical, or at least volatile. As a special situations investor, this is the kind of stock I find interesting.

Post 2016, Wynn peaked at just over $200 at the start of October 2018. I took a mental note of this, because I would bet that Las Vegas Sands shows a similar pattern. This is probably related to China, when there were clampdowns on the high rollers being escorted to Macau. I don’t know these stocks that well, but I recall this was an issue. Wynn shares were around $150 in mid-January, prior to the Covid market bottom in March 2020.

When assessing whether this idea is worth pursuing, my first step would be to look at the EV then vs now; is there a significant enough upside to make it worth looking at as a long? If not, are the profits in Vegas likely to fall enough to make it a short?

I try, not always successfully, to approach the stock with an open mind. That’s hard to achieve in practice because I always arrive with a pre-conceived notion. In this case, I felt that Vegas profitability is likely to fall.

The problem here is that these companies are actually more dependent on Macau than Vegas – Wynn’s 2018 Macau revenues were $5.1bn vs $1.7bn for Vegas – a ratio of 3:1. So it’s quite possible that there is more upside from a return to more normal conditions in Macau, than there is downside from margin pressures at Las Vegas.

Wynn appears to have issued around 8m shares, or 7% of its equity, during Covid and its debt was up c.$1.5bn. If I use the pre-covid share price of $150, the 107.4m shares in issue and the $8.1bn net debt plus minorities, I get an EV of $24.4bn. Today’s debt and minorities total c. $10bn, so the implied market cap is $14.4bn on 113.7m shares in issue. This gives a potential price of c.$124 if trading returns to normal, which would be a double from here.

What would be the price today, based on a $150 price pre-Covid?

Source: Behind the Balance Sheet calculations, Sentieo data

These numbers are all from Sentieo’s valuation overview, without adjustment and the table shows the calculations working back from a flat EV to what the implied share price would be on today’s debt and higher shares in issue.

This initial hypothesis has taken me 15-20 minutes. It’s very rough, but it’s not a bad way of approaching this problem – and it looks more likely to be a long than a short. The issue here is that it’s quite a complicated situation as the moving parts are going in different directions:

Potential for inflation and lower consumer spending to hit squeeze Las Vegas margins.

Potential for a recovery in Macau if the zero Covid policy is lifted.

In addition to that, the China part comes with some serious questions:

Will Xi lift the zero Covid policy after the October party meetings if he gets another term? Or will he want to keep the policy in place?

If China is entering an era of much slower growth with property prices falling, how does that impact the recovery?

These are quite complicated issues and not ones I have an instant answer to. Another way of assessing risk-reward is to look at the valuation in the context of current profitability. Consensus has EBITDA rising from $756m in 2022 to $1545m in 2023, quite a jump, on revenues going from $3.9bn to $5.5bn. Revenues were $6.6-6.7bn in 2018/19 and EBITDA was $1.8-2.0bn. Consensus is assuming a return to peak margins in 2023/24, which looks ambitious.

A look at the revenue estimates may help to put this into context:

Source: Behind the Balance Sheet from Sentieo data

Revenue forecasts collapsed during Covid, naturaslly, but have still been trending down this year.

Source: Behind the Balance Sheet from Sentieo data

Revenues for 2023 were predicted to be $10bn in 2019 and consensus is now at 60% of that level. But if anything, given its zero-Covid policy, there still looks to be risk in 2023 forecasts, if China takes longer to return to normal.

Paying subscribers can read on for the strategy I would consider using to take advantage of this situation.