A “Hidden Value” Idea With 149% Potential Upside

This pitch for a beaten up spin-off candidate caught my eye. Here’s what I did next.

This newsletter was not intended to be a stock-picking newsletter. First, I have been a sell-side analyst and I had no desire to repeat that, whether through a new research boutique, or by publishing a stock tips letter, and I feel that $150 (now $160) is too low a price point for that. Perhaps I should do, as I believe my friend Whitney Tilson is making several million dollars a year out of his newsletter business.

Instead, my plan was to add value to my readers by helping you improve your investing skills, providing commentary on markets and specific situations which might help people make money. At the Value Investor Conference in London in May, there were so many good ideas that I felt obliged to share some of them, adding in my tuppence worth to the presenter’s analysis. This is the third of these posts and the stock is Scotts Miracle-Gro. It was a new stock to me, so I shall describe some of the steps I conduct when looking at a new company.

It was recommended by my friend Jonathan Boyar, of Boyar Asset Management, a firm founded by his father. They are a solid stock-picking firm and also run a research service – I don’t subscribe, but I probably ought to. Jonathan has a good track record with me and I always like to look at his recommendations because he is excellent at identifying hidden value: for example, the air rights above Madison Square Garden, or the media content in Discovery.

Scotts’ generic description, which I have basically taken from Sentieo is:

The Scotts Miracle-Gro Company (ticker SMG) is a manufacturer, marketer, and seller of branded consumer lawn and garden products, as well as indoor and hydroponic growing products. The company operates through three segments:

The consumer segment (65% of sales) consists of the company's consumer lawn and garden business located in the geographic United States which owns a number of well-regarded brands, including Scotts and Turf Builder lawn and grass seed products; Miracle-Gro soil, plant food and insecticide, and more

The Hawthorne segment (29% of sales) consists of the Company's indoor and hydroponic gardening business.

The Other segment (6% of sales) consists of the Company's consumer lawn and garden business in geographies other than the United States and the Company's product sales to commercial nurseries, greenhouses, and other professional customers.

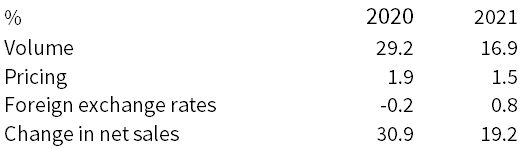

Hawthorne provides services to the cannabis industry which makes it a potential candidate for a spinoff at some point, according to Boyar. As is clear from the next table, volumes spiked in the pandemic as people were at home and spent more on their gardens (sound familiar?). Historically this has been a low growth business with a 0-2% top line increase and management is now targeting 2-4% according to the transcript of the most recent broker presentation (added below for paying subscribers).

Revenue Change Analysis

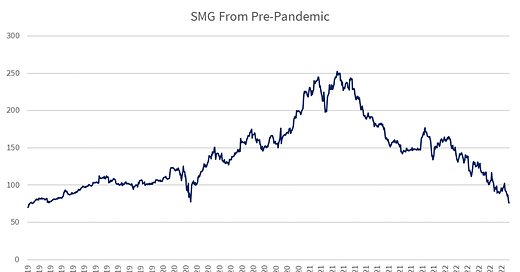

The reason the stock attracted Boyar’s interest is that the shares had fallen significantly. Since his presentation, there has been a profit warning and they have fallen further:

SMG Recent Share Price

Source: Behind the Balance Sheet from Sentieo Data

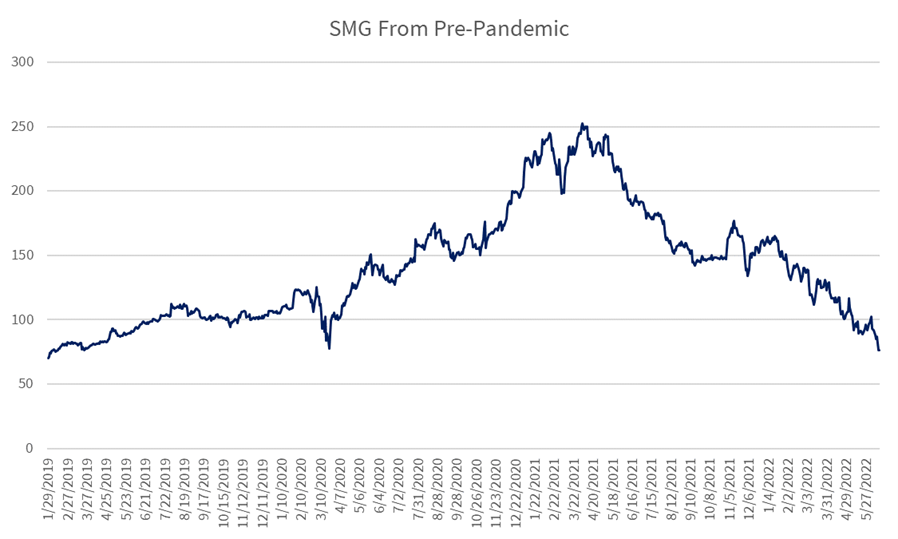

To put this performance in context, the shares started to accelerate in 2019, as can be seen more clearly from this longer term chart.

SMG Share Price Longer Term

Source: Behind the Balance Sheet from Sentieo Data

Both charts offer one simple conclusion – the stock went up a lot and then gave it back. Boyar feels that the change in the pandemic – people spending more time at home and in their garden - will be enduring. Meantime the stock has given back most of the gains.

At this point, if I were still a hedge fund investor, I would have stopped looking at the stock, as it seems unlikely to offer the type of special situation appreciation that I was seeking. I wouldn’t disagree with Jonathan that people were going to spend a bit more time in, and more money on, their gardens, but is that sufficient to move the needle? The retracement of forecasts suggests it may not be:

SMG Earnings Estimates

Source: Sentieo

The charts show the significant retracement in both 2022 and 2023 estimates. Some of the damage in 2022 is attributable to the weather which is almost always a one year impact. The 2022 eps estimates have gone from 6.60 in mid-‘20 to 9.60 in mid-’21 and are now back where they started. The estimates for 2023 have gone from 10.00 to 6.00, a punchy 40% drop which explains why the share price has more than halved. Before looking at the valuation, let me run through Jonathan’s thesis.

The company saw good growth in the pandemic and it estimates that over 20m new customers entered the category during the pandemic and their surveys suggest that 86% intend to stay with over half intending to spend more. Many bult raised flower beds in their backyards and will continue to use these.

Jonathan explains the then 59% fall in the stock price as a combination of concerns about

Increased capital investment

Gross margin pressure

Capital allocation uncertainty

Poor performance of Hawthorne due to cannabis oversupply issues

Difficult comparisons

Poor weather has resulted in a slow start to the 2022 gardening season

Jonathan is bullish on capital allocation with the CEO and family owning 26% of the company and having a good record in paying special dividends and buying back shares – there is also a generous quarterly yield. He also sees significant upside in the cannabis market where they have the number 1 brand in their category. Jonathan presented this valuation slide.

Boyar Valuation of Scotts

Source: Boyar Research

The shares are now lower and hence his upside greater. As I write this with the stock at $77, the upside to his target is 149%! That looks a little ambitious. I disagree with some of the elements in the chart, so let’s go through that and then look at some conventional multiples.

First point to note is that he is using 2024 estimates as the basis for his valuation. There is nothing wrong with that, but to get to an intrinsic value estimate today, I would prefer to include a discount to reflect the time value of money. We are in mid-2022, so I would generally use a 2023 estimate unless there was a specific reason for using 2024.

He is using a multiple of 8x for corporate expense. I prefer to use the same multiple as for the individual businesses in aggregate. In the table, I have backed out the average EBITDA as being 14.2x which brings the valuation down by just over $1bn and I believe this is the more appropriate multiple to use. I imagine that they use the same multiple for corporate expense across all groups and that the multiple is lower as they feel there is more scope for cost-cutting, especially if there is a potential acquisition, which would be a fair treatment.

Adjusting Boyar Valuation

Source: Behind the Balance Sheet

The company has 55.4m shares in issue and the Boyar number is slightly higher which presumably accounts for potential dilution from share options etc which is the correct approach if you are

1) using 2024 forecasts and

2) looking at potential takeout multiples.

I would generally construct the valuation using nearer term metrics and then perhaps construct an upside scenario using the later forecasts and acquisition multiples and factor this in as an acquisition scenario – that might be my bull case. Sometimes if the bull case rests for example on a change in profitability driven by an external factor, that can be even higher – the profit change AND an acquisition is more of a blue sky scenario and I tend to avoid relying on those.

Just to put the Boyar valuation into context, here is the chart of the EV/EBITDA multiple over time.

SMG Forward EV/EBITDA

Source: Behind the Balance Sheet from Sentieo Data

Its 5 year average is around 13x (13.4x or 12.9x ex the Covid-related jump in H1 2020). If you put the Boyar 2024 estimates on 13x, that reduces their target to $9.3bn and still gives a target of $155/share, or twice the current share price. Sentieo has a consensus 2023 EBITDA of $670m. On 13 times, that gives

an EV of $8.7bn

less debt of just over $2bn at last year end

would be a target price of $120 or still over 50% upside.

Sentieo has a big increase in the net debt which is inconsistent with the Boyar data above which appears to factor in the historical level. There is a seasonal outflow which suggests that it would be more appropriate to take an average net debt in the calculation. Paying subscribers can download the model to assess further Jonathan’s valuation criteria in the light of the historical valuation ranges, access the broker conference presentation transcript, and read my overall conclusions.