One Year on Substack

It’s approaching the first anniversary of this Substack and I wanted to thank all my subscribers. This is the 70th edition of the free letter and paying subscribers have received a few more.

There will be a few changes going forward, so let me explain what to expect.

Until now, most of the posts have been free with an extra snippet for paying subscribers who also receive the odd exclusive post. I would like to see a few more paying subscribers so I shall be reducing the free content and increasing the value for the paying subs.

You should also expect to see some ads. I shall try to limit the annoyance factor and to keep those relevant, but it’s quite a bit of work to produce 1500 words a week and it would be nice to be paid a bit extra. If your business (or a friend’s) would like to target a bunch of high net worth readers with an interest in investing, please get in touch.

I know many of you would like me to do more stock recommendations. I don’t have enough subscribers to warrant spending time researching stock ideas and making this a stock newsletter. More important, I don’t want to do so – I would worry when recommendations went wrong and I might as well run a fund if I want stress (I don’t).

I hope to increase the number of institutional subscriptions – I would encourage those of you who have a corporate email address and widely share the paid content with your team mates to inquire about our very reasonable institutional rates which include some consulting time with me.

To encourage existing subscribers to continue at their reduced rates, I have increased the price to $20/month. Buy one less latte a week. (That was Mario Gabelli’s advice to young savers).

You will shortly be asked to complete a survey so that we can find out more about you – the demographics are important for advertisers so I would encourage all the senior/rich/important readers to complete that please – it will really help.

I would like to help all those students with non gmail addresses from over 100 universities. A career in analysis has been great for me and could be for you too – let me know how I can help you.

I am here to help you improve the performance of your portfolios. Let me know how I can do that more effectively. I hope you are enjoying the content and would love to hear from readers as to what you would like more of. I have dropped the monthly roundup – should we reinstate that? Let me know.

Subscriber Growth

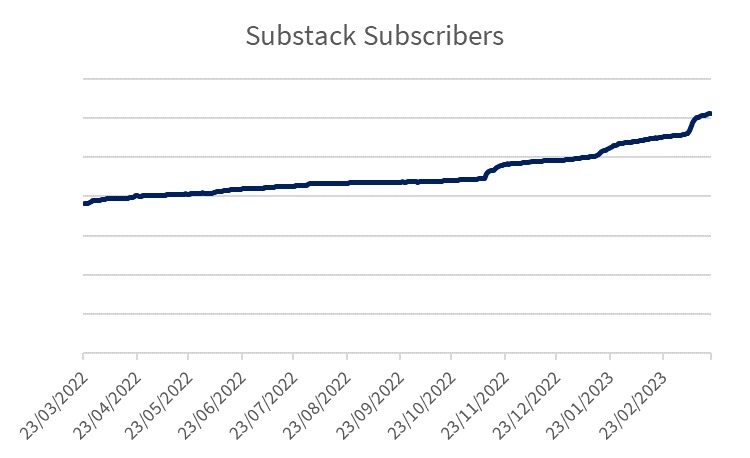

Thanks to everyone who has opened these emails in the last 12 months. I was a little nervous as to whether I could produce content of a reasonable quality at this volume and the 45% average open rates and subscriber growth suggests that I am doing ok. I am number 40 in Finance Substack so plenty of room for improvement, no complacency here.

To anyone considering starting a Substack, I would encourage you to go for it. The benefits are:

most important, I have had fun writing these columns;

even my wife (the harshest judge on the planet) reckons my writing has improved;

it has given me an excuse to explore areas which I would not otherwise

I can get some tangible benefit out of otherwise routine activities – attending a conference, reading a book, reviewing an academic paper etc. Writing an article forces you to focus and think about what you are learning and you therefore learn more.

reader interaction – I haven’t done as much of this as I would like to so will plan more in the coming months. But I have had a couple of nice lunches, coffees and similar meetings with people from London and overseas. I really enjoy getting feedback so please feel free to respond. I answer every mail.

after I wrote this, I heard back from a subscriber who had cancelled. Rob was a highly successful businessman, was enjoying the content and cancelled because he is “suffering from a terminal disease and the clock is ticking”. That made me think! I took the scenic route to work this morning and took time to appreciate the cherry blossom.

My walk to work

So thanks, whether you are a new or longtime reader, whether you have liked every single article (thanks Tim) or liked an occasional one, whether you just open occasionally when the strapline is good enough or if you open every one and send to all your friends - the record: one person sent an article to 438 friends and colleagues. I appreciate everyone taking time to read my output (I hesitate to call it work).

And if you have enjoyed it, please

- Tell your friends

- Upgrade to a paid subscription

- Upgrade to an institutional subscription

- Listen to the podcast

- Check out our online courses

And don’t forget that the Investing Resources section of the website has a library, free videos, the top 20 podcasts, top 20 newsletters and much more. We even have a YouTube channel.

Thanks for being a part of the community.

And on to the main event………

Return on Capital

Bill Ackman is pretty smart – he made an over 100% return on his $2bn investment in Air Products, and largely credited his appointee, CEO Seifi Ghasemi. At the time of that investment, I was helping a couple of investors assess their holding in his Pershing Square funds which included meeting Bill a couple of times and interviewing some of his analysts.

The analyst responsible for Air Products told me about his incredibly detailed process for assessing new CEO candidates and praised Ghasemi for his improvement in ROIC in his previous role. I was puzzled and asked the analyst why he had not evaluated the executive’s performance on ROCE instead or as well, and I was told “it’s earnings that count”. He made it clear he meant to add “dummy” to the end of that sentence but was being polite.

I am continually mystified by the fashions that operate in equity markets with large numbers of professional players happy to bullsh*t about the latest ratio etc without having the faintest idea about what’s actually going on under the hood of the company they are discussing. I think the professionals are worse than the amateurs.

My idea with this Substack was to explore and explode some of these myths. We have covered the cash flow statement in some detail and this week and next I am covering the Return on Invested Capital metric which is at the centre of any quality investor’s process. But how many actually understand the metric in detail? You will after reading these articles.

ROIC is a measure of returns after tax on total capital employed including any goodwill generated on acquisitions. The goodwill element is important because companies often overpay for deals which depresses the subsequent returns. Analysts want to look at ROIC because it allows them to understand how effective capital allocation has been for a business, including both acquisitions and organic investments. And it’s this overall picture which affects shareholders.

There is nothing wrong with the use of the metric – it’s an effective guide to the historical picture. But when you are considering an investment, you should be interested in future returns. And those returns are driven by

the historical record of returns

the ability to deploy capital and

the return on incremental capital employed

Historical record of returns

Obviously, we need to consider changes in the fundamentals which may affect the operating performance and this is the most critical factor when considering the outlook. This capital has been deployed and cannot easily be moved elsewhere. This is where greatest attention is required.

The Ability to Deploy Capital

Companies’ abilities to invest capital differ. In some industries, it may be better to return capital to shareholders, while in others there is ample opportunity for further investment. Understanding this is core to the valuation of the business – the market will pay a lot more for a business which can continue to invest at high returns than one which has historically had high returns but is running out of road. Investors do pay a lot of attention to metrics like total addressable market and often talk about the runway for growth. It’s also obviously important to understand the quality of that growth or the incremental return.

Return on Incremental Capital Employed

This element of the future return can look very different from the past returns on sunk capital for a number of reasons:

Changes in the return profile – these may also affect the existing base. Often this is caused by a change in the competitive profile of the industry, eg the emergence of a new competitor.

The type of return profile – incremental returns may be significantly higher or lower than the return on the existing capital base, depending on the type of industry.

The level of past acquisition spend – how important acquisitions have been.

Change in the return profile: A change in the competitive landscape which dilutes returns is pretty obvious so I won’t dwell on that here but it may be worth covering separately in a future article.

The type of return profile is more subtle. Let’s say you have a supermarket network. You already have a distribution system, with warehouses and trucks, and you already have a large network of stores. The return on the incremental store should look quite different from the overall return because the capital employed includes:

Advance to landlord – which might be much lower in today’s market than on the existing shops.

Fit out costs – may be a bit higher today because of inflation and lack of available trades.

Negative working capital because much of the initial stock will be sold well before the supplier is paid.

It’s essential when studying a system of this nature to understand the incremental returns, because that will ultimately determine the shape of the forward returns and because it is a major factor in the strength of the competitive position etc.

The level of past acquisition spend is also important because companies often overpay for acquisitions which don’t deliver the promised synergy benefits. The spreadsheet extract below shows the cash spend over a five year period for a European industrial company:

5 Year Cash Flow Summary Indexed on Net Income

You can see that the ROIC for this company is much more contingent on the acquisition spend than on capital expenditure. Its future return profile may look quite different if its acquisitive activity changes, which indeed was the case for this stock.

That’s a few of the factors I try to assess when looking at ROIC. Paying subscribers can read on for the two main limitations and next week I shall explain why I use an alternative metric.