The Future of Quality Investing

"The outperformance of this long-short strategy is surprisingly high"

Background

Two weeks ago in this newsletter, I began a series on quality investing, which has been at the fore in the past decade. In our previous article, we looked at a report by Amundi Asset Management, Revisiting Quality Investing, which showed that:

quality was persistent;

it outperforms in the long term; and

(equally important) an absence of quality underperforms.

Amundi demonstrated that high quality stocks significantly outperformed lower quality stocks with an 8%-a year performance gap between the highest and lowest quintiles. They used four different variables to define quality, as shown below. Each of these behaves differently, and a combination of all four delivered the best results.

Amundi’s Quality Factors

Source: Amundi Asset Management

One reason why quality outperforms is that it does well in times of turbulence and particularly in the event of turmoil in markets. But it often underperforms in bull markets, especially in the early stages of recovery from a bear market – all this we know and it makes sense. But given that we live in bull markets for most of the time, the benefit from quality in adverse markets must be larger than the drag in bull markets.

Excess Return by Factor – Global Universe

Source: Amundi Asset Management

Unfortunately, the period of the Amundi study, 2003-2020, does not include a traditional bear market, although it does include two crises, the global financial crisis (GFC) and the pandemic. The 2003-2007 period was a fairly traditional bull market, with the quality factors overall underperforming, and the most powerful factor returns, faring worst. The latter part of the period saw returns in positive territory, albeit at a lower annual rate than when it was underperforming; but by virtue of a longer period, it comes out positive overall.

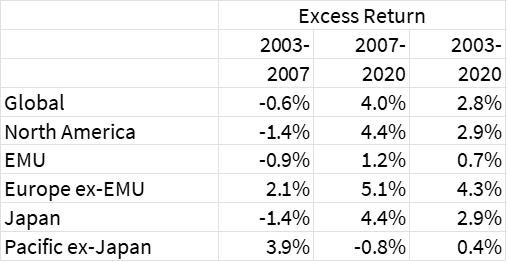

Returns for Combined Factors – by Geography

Source: Amundi Asset Management

The US shows above average scores in both directions as does the EMU, suggesting this is not a tech stock phenomenon. There are significant regional differences in the performance of quality overall (ie, using a combination of the four factors), which suggests there may be something specific about certain regions or that the quality factor is not as consistent as might be hoped. This is also true for the profitability factor which is returns -based, as can be seen in the next table.

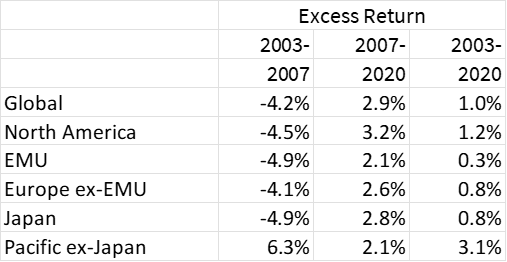

Returns for Profitability Factor – by Geography

Source: Amundi Asset Management

The pattern here is more consistent with only the Pacific ex-Japan region showing a different trend in 2003-2007, and this could be a specific driver – for example, growth derived from China after its accession to the World Trade Organisation (WTO) in 2001. The other regions show a consistent pattern.

The Amundi study was not as detailed on the time periods as I had hoped when I was writing the last articleIn the meantime, I therefore looked at a number of other studies on quality.

Goldmans Sachs Asset Management suggests that high quality outperforms in drawdowns by 2.9% in the US and by 1.3% internationally, and that it has outperformed 80% of the time in the last decade – the chart shows underperformance only in 2013 and 2016.

High Quality Stocks Have Outperformed in the Last Decade

Source: Goldman Sachs Asset Management

In the same article, it suggests that quality is not as persistent as I concluded last time, with only 54% of companies described as high quality five years previously retaining that description – unfortunately, there is limited explanation in the article.

The Schroders QEP team [1] defines quality as having three characteristics:

Profitability, as defined by return on equity, cash generation and margins

Stability, principally of sales, earnings and cash flows

Financial strength, modest leverage and ability to service debt

Quality companies deliver a consistent operational performance for the following two years and continue to deliver good news as shown in the chart.

Quality Companies Deliver

Source: Schroders, MSCI 1988-June 2014

Their definition gives a significant long-short performance differential for high vs low quality companies.

Returns by Quality Cohort

Source: Schroders, MSCI 1988-June 2014

Like Amundi, Schroders shows a better performance for the combination of quality measures than for the individual components – profitability, stability and financial strength. They actually monitor more than 60 individual inputs before making a final assessment of the underlying quality of a company.

An MSCI paper discusses the quality factor as defined by its Quality Index, which employs three fundamental variables to capture quality:

Return on equity

Debt to equity

Earnings variability

They show that the quality factor is defensive, historically having outperformed during declining market conditions, as illustrated in the chart. Note the significant underperformance in sharp upticks, which might simply be the worst performers having a bounce in bear market rallies.

Quality Performs in Downturns, Lags in Sharp Rallies

Source: MSCI

They also show this chart where quality was the worst factor coming out of an economic downturn, having outperformed on the way down, again consistent with expectations. The conclusions are consistent with the thesis that quality outperforms in a bear market and then gets left behind, but does well overall.

Performance of Quality vs Other Factors by Year

Source: MSCI

Conclusions

The conclusion from all these studies is that quality is worth pursuing – some conclude that quality underperforms in bull markets, but more than make up for it in bear markets, some conclude that more recently quality outperforms most years.

I wonder if it will be that simple in this cycle. The crucial questions are

1. The degree to which quality persists –my last article suggested that it was quite persistent, but Goldmans are less positive.

2. The definition of quality – many of these studies (and I have omitted an AQR study which is incredibly detailed) rely on very sophisticated quantitative screening which is beyond the reach of the ordinary investor. I wonder how these filters will perform in the rather different economic and stockmarket environment I foresee in the next decade.

3. In one or two of these studies, quality worked better in the US than elsewhere. This is an important concern. The likes of Apple and Microsoft are large and have been massive outperformers and could conceivably skew results. I don’t know this, but it could be a risk.

Paying subscribers can read on to see the strategy I think is most likely to work in the next decade.