Playbook for 2025: 4Rs, 3Ts & Surprising Shifts Experts Are Betting on

And why the former head of MI6 is worried about big tech. And a short idea!

I estimate that some 25% of you have joined in the past year (I don’t track it as closely as perhaps I should), so you may well have missed my write-up of the 2023 Edelman Summit.

This is a limited invitation conference where Edelman staff interview representatives from Edelman clients. There were five panels on macro, equities, credit, ESG, and private equity. The sessions are always thoughtful and thought-provoking with serious speakers.

This year’s edition kicked off with a fireside chat with Sir John Sawers, former Chief of the Secret Intelligence or MI6. This was a fascinating discussion with one of the world’s top geo-political experts and I think his views have major implications for big tech – more on that later.

Macro

The first panel was macro with Aaron Anderson, SVP of Research from Fisher Investments, an equity house, Alex Lasagna, Deputy CEO of Algebris, a financials specialist that covers both equities and credit, Gurpreet Garewal, Macro Strategist & Co-Head of Public Markets Investing Insights of Goldman Sachs Asset Management and Niall O'Sullivan, Global Solutions CIO of Mercer Investments.

Goldman’s 2025 outlook majored on more growth divergence between the US and EU and ongoing challenges in China. Obviously, Trump means more uncertainty (I won’t say that again, you can just assume everyone will say that for the next 4 years). Garewal neatly summarised the US policy shifts as the 4 “Rs” - Rising tariffs, Reduction in taxation, Relaxation of regulation, and Restrictions on immigration. I think I prefer TIRT (RITT, TRIT?). They see tariffs as a one-off tax which will impact US domestic consumption, but will have a greater impact on Europe and China.

Main takeaway from Algebris was that Europe is hated but Mediterranean countries look OK and it’s all in the price. They think 2025 will simply be about fiscal moves and they expect a lot of volatility in rates markets. They think the situation is very different from 2016 when Trump was last elected with valuations and government debt both higher today and they think there is a bubble, but don’t know when it will burst.

Fisher find it hard to see major concerns and interestingly they perceive political uncertainty as likely to diminish. They believe Trump will do less than people expect – “Presidents aren’t Kings”. (The presenter was American and like the federal judge who coined the term, may not have realised that Henry VIII died in 1547 and King Charles has control over the temperature of the Buckingham Palace swimming pool and not much else.) They see the stockmarket reaction to Trump as sustainable and think the weakness in healthcare is temporary.

Mercer pointed out that clients are asking why have anything outside US equities which have beaten other public markets and private equity. They think people will question private equity and also ask if too much money is going into private credit. They see US equities valuations as stretched but point out that at this level in the past, equities have beaten bonds by 70% in the following 3 years.

On likes and dislikes for 2025, Algebris like the whole capital stack at banks, with 9-12% dividend yields and better spreads in credit, especially AT1s. Mercer are underweight high yield because they think spreads are too tight (they are). Mercer are overweight frontier market debt - I have no idea how big the asset class is, or even which countries are included, but I think that a fund investing in frontier market sovereign debt sounds really risky – I looked at one whose largest allocations were to Angola, Cote d’Ivoire, Senegal, Nigeria, and Paraguay.

It also invests in El Salvador (6th largest holding) which ironically I think might be the best bet. President Nayib Bukele has been buying bitcoin for the country (1 per day) and last I looked, they had c.6000 bitcoin which is worth c. $600m or 2% of GDP. Moody’s have upgraded the sovereign debt by two notches while the interest rate has fallen from mid-30s to single digit.

The fund is up 50% in the last 2 years and has managed to regain its level of 3 years ago. Its risk level is 4/7 which is clearly an underestimate. I am not sure that these baskets of risky debt are any less risky than the individual components because when one country goes down, the whole asset class is hit and all the funds in the asset class are likely to take a similar action in response. And the last 10 days in Syria and South Korea have shown how difficult forecasting geopolitics is.

Imagine the mails I am going to get from frontier debt people. And no Christmas card from Mercer.

Fisher like equities and they see high valuations but good economic outlooks and strong corporate profitability. GSAM like commercial mortgage backed securities (CMBS) which are over-hated and they are shorting Japanese government bonds – the only country they think will raise rates.

I don’t know why people are so convinced that US interest rates can only go down. If there are tariffs, tumultuous deportations and tax cuts (see what I just did – the 3Ts), then we might be in a different environment. I always think it’s important to question the consensus and ensure that the portfolio is protected if something different happens – remember all the 2023 outlooks two years ago? Completely wrong.

Fixed Income

Edelman surveyed 300 asset managers, 50% at firms with >$50bn in AUM and the biggest worry in fixed income was that market were underestimating a rise in defaults. This panel had Lloyd Harris, Head of Fixed Income at Premier Miton Investors; April LaRusse, Head of Investment Specialists at Insight Investment; Robert Dishner, Senior Portfolio Manager at Neuberger Berman and Dan Kemp, Chief Research and Investment Officer at Morningstar.

Insight explained that the reason for the low level of defaults might be partly that companies have learned something and been more conservative post Covid and partly that high yield have had money thrown at them by private credit, so they don’t need to default.

An associated reason may be the rising incidence of PIK notes, as shown in this chart:

Rising Proportion of PIK Notes

Source: Fitch

Neuberger Bergman pointed out that companies have been more pro-active in managing their balance sheet liabilities, while Premier Miton see the volume of capital chasing returns as the core reason. They call it “dysfunctional capital” which I like. MorningStar pointed out that markets have over-estimated defaults in the past.

Premier Miton like bank credit, “the best looking horse in the knacker’s yard” and similar to Algebris like AT1s, especially short dated AT1 bonds. Even if defaults pick up, banks are protected. They like EU bank debt, especially in the PIIGS (Portugal, Ireland, Italy, Greece and Spain) and the UK. Insight think rates are going to be cut more than consensus believes and like the banks as they have been derisked – the risky lending has moved to private markets.

Morningstar are using sovereign bonds as a diversifier in 2025. Premier Miton don’t like duration and think short dated fixed income is safest. Insight don’t like sovereign bonds generally, as debt servicing costs are high everywhere, and they believe that suggests rates will come down.

Neuberger Berman are more constructive on high yield and are looking at floating rates and private market credit. High yield doesn’t offer enough spread over investment grade to make the extra risk worthwhile, according to Premier Miton and Insight, as well as Mercer earlier (and this month’s podcast guest). Morningstar thinks that high yield is simply being supported by positive investor sentiment and if equities turn, high yield will too.

The panel had mixed views on the levels of Government debt, with one concerned at the trajectory out to 2050, another thinking that if things get disorderly, people will buy treasuries and a third pointing out that Trump wants a smaller state so that could solve the problem.

I think they are missing the risk that there might not be enough demand for US treasuries and if the Japanese repatriate their holdings, much higher yields will be required. This is an overlooked risk in markets in my view.

Equities

This was a heavyweight panel with Mathew Beesley, CEO of quoted asset manager Jupiter, Helen Jewell CIO EMEA, BlackRock Fundamental Equities and Lucas Klein, Head of EMEA and Asia Pacific Equities, Janus Henderson.

Asked if big tech will continue to dominate portfolios, Jewell doubts we are at a turning point. They won’t do as well in 2025 as in 2024, but eps is robust in the space and that’s what will drive the stocks. She sees some broadening out of performance in the US and some great European companies at really compelling valuations.

Lucas Klein pointed out that the equal weighted S&P outperformed the index in Q3, 2024 and they are looking for low single digit returns in the next 10 years and for small cap to beat large cap.

Beesley pointed out that turning points are hard to predict and that money is still flowing into US equities, but the market is broadening out with the NYSE advance decline ratio picking up.

S&P500 Advance Decline Ratio

Source:MarketInOut

Asked about the decision of some big tech to pay dividends, the panel didn’t think this made much difference – people aren’t in tech for yield which is too low to warrant that as a basis for ownership.

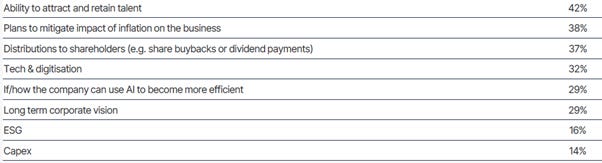

Edelman asked their survey respondents where they felt there are the biggest gaps in valuable information from companies' management teams and here are the results:

Information Gaps

Source: Edelman Smithfield

In response, Beesley, the CEO of a quoted company, argued:

“there is a lot of information out there but most investors are just too lazy to ingest it.”

Jewell disagreed with the survey as she feels that the ability to attract talent wasn’t that investment sensitive. She thinks inflation mitigation is much more significant as inflation may be here to stay and has a direct investment impact. Interestingly Klein agreed with the survey’s #1 and argued that culture is really important but that there is a big information gap and they are hungry for more info.

Klein went on to say they want a lot more information on how AI can make a company more efficient and how companies are using it, so of course I asked the panel how they were using AI in their own businesses.

Blackrock are seeking to benefit from their scale so are centralising their AI efforts and applying the results locally. They are using it to ingest information more quickly – a portfolio manager can now easily access all the news affecting his company - and to assess if there might be a difference in what the transcripts say and what is in their analyst’s model – I thought that was interesting as obviously speeding up responses to results is something machines can easily perform.

Jupiter don’t see any evidence of any competitive advantage among asset managers and are not convinced that anyone has a big lead. I wonder - when they see that competitive advantage, it’s obviously too late. Janus Henderson have a disruptive tech team and their budget is increasing each year with benefits both to the investment process and to client facing groups, particularly in automating low value added activity.

ESG

Another heavyweight panel with Jeremy Taylor, CEO of Lazard Asset Management Ltd, Leon Kamhi, Head of Responsibility and EOS, Federated Hermes, Andy Clark, CEO of EdenTree and Richard Lum, CIO – Infrastructure, Victory Hill.

The panel agreed that we have moved on in sustainability from v1.0 to v2.0 which is not just a slew of passive products with ESG in the title but is more focused on engagement and generating returns from positive exposure to sustainability drivers. And they highlighted the sheer scale of the investment required for the energy transition.

Taylor made the interesting point that asset managers should not measure DM and EM in the same way – they should be spending much more of their carbon budget in emerging markets where the environmental challenge is lower down the priority list.

Although clients put climate change at the top and labour rights in second place, Federated Hermes believe that governance is at the heart of sustainability – if boards are operating properly, that’s the bulk of the work, although governance has become too much of a box-ticking affair. Managers generally are de-emphasising ESG, as are corporates, but the consensus on the panel was that sustainability done right is about investing for better returns as well as making a positive impact. There was general resistance to the idea of regulation.

Private Markets

Kutty Dutta, Head of Secondaries & Co-Investments at HSBC was joined by Hani El Khoury of Coller Capital, Nicola Falcinelli, Deputy Head of European Private Credit at Carlyle and Matthew Theodorakis, a partner at Ares Management. Not a private equity investor in sight, and a 50:50 split between secondaries and private credit – I don’t know if that was deliberate.

Asked about the outlook for exits via M&A or IPO in 2025, one panellist talked about the impact of Covid and the hangover after, but that was nearly 5 years ago. They said that you don’t want to go to IPO unless there is interest, as if you cannot get your price, there can be a 3 year delay. But companies are more stable now and the outlook is for more activity in 2025.

Clients tell me banks are telling them that there is a big pipeline of IPOs so let’s see how many P-E firms can get their stable away at a premium to the marks. I was shocked by press reports on the carrying values some managers had for Northvolt – I would love to write about this but info is hard to come by. LPs who would like to share data can feel free to email me. Please.

One of the private credit operators was talking about supporting private equity buyers with innovation, that the market is becoming more sophisticated and that credit is being offered without change of control provisions which facilitates company sales as the debt is all there. I can see why that’s good for the private equity borrower, I am less sure how that helps the provider of the credit.

Mr Dutta talked of converging themes: the attractions of a public quote are diminishing; the old model of a 10 year fund is shifting with some going to perpetual vehicles; p-e owning good companies they don’t want to sell and the growth of continuation vehicles; and the sources of capital changing in that the endowments and pension funds are still there but are being joined by less patient capital like wealth management - this channel is quite well developed in the US but is increasing in Europe. On the quality theme, HSBC talked of a feeding frenzy for the best assets in sectors like healthcare and software.

I can see how those trends would boost the secondaries market, especially if private equity wanted to own quality companies for longer but were taking capital from funders with shorter timescales. But I do scratch my head and ask if we don’t have a perfectly good mechanism for that – public markets. Private markets have much higher fees – good for the managers, less so for the asset owners.

I said last year that if economies fade and markets correct, there will be significant fallout among private equity. Even if we get a relatively benign outcome, lots of overstretched private companies will get into difficulty. The abundance of private credit and the growth of PIK as a percentage of the total has kicked the can down the road - the private equity players are good at that game. There is even more riding on continued strong equity markets going into 2025.

As always, it was an interesting conference with quick 45 minute snapshots of sentiment across different sectors. The most interesting part was Andy Wilde’s fireside chat with Sir John Sawyers and paying subscribers can read on to find out why he is worried about the big tech stocks and for an outstanding short idea from a former TCI partner.

Short of ideas for a Christmas present for that friend who has everything? Gift a subscription to my newsletter and get 20% off until Christmas Day.