Navigating Uncertainty: Ruffer's Master of Disaster Explains his Roadmap

Fund managers reveal their top picks and strategies for 2025 and beyond

Last week, I attended two conferences in London:

Unbundling Uncovered – a get-together of buyside and sellside firms to discuss the latest developments in Mifid II and the provision of research.

The Moneyweek Investing Summit – a series of presentations and panels from leading investors and commentators.

Before that, a couple of news items. I am off tomorrow to New York to deliver my Forensic Analysis Course to a group of investors on Wednesday November 13. On Thursday I am delivering the same course to the New York office of a London client and afterwards, early evening, I will be hosting drinks midtown (premium subscribers who would like to meet up please feel free to email me, sorry the free email list is too long to extend the invite).

The following week is a big week too. Wednesday November 20 I shall be at the Sohn conference. There is a terrific line-up of speakers and you are not too late to get a ticket.

That evening is the Sunday Times Business Christmas party, my favourite business event of the year, with guests ranging from the Chancellor of the Exchequer to (it seems) every FTSE 100 CEO, and all the UK’s movers and shakers, plus a few hangers-on like me.

The following morning, I fly to Edinburgh for a really special event. I have wanted to get Anthony Bolton on the podcast for ages. He has kindly agreed to a LIVE interview at the Library of Mistakes in Edinburgh.

Some truly great investors have been kind enough to come on as guests on my podcast, but I think most of them would acknowledge that Anthony Bolton is quite special. Peter Lynch no less described him as one of the best investors on earth.

Bolton's Special Situations Fund delivered 19.5% pa for nearly 28 years vs a benchmark of 13.5%. This in a mutual fund with daily liquidity.

Bolton is unassuming and generous with his help and advice. I cannot wait for this interview, although with it being live, I better not screw up.

If you would like to come, drinks start at 6pm on November 21st in Edinburgh, and the tickets sold out quickly but I have reserved a few for my subscribers. There is a simple competition to enter here.

As ever, you get priority if you are a premium subscriber – more tickets and a smaller universe, so 100x better odds. Your link is below, behind the paywall.

Unbundling Uncovered

This section is mainly for professional investors – others please jump to MoneyWeek Summit below.

This is quite a special conference as it’s about the mechanics of how investors on the buyside pay research providers. In 2018, new EU rules required the unbundling of research from commission payments and there has been turmoil more or less since – this is a great forum for understanding what is happening in this corner of the market.

Why is this important? Well, my clients often include training in their research budgets. It’s useful to understand the trends here as it informs my perspective of the industry. I don’t normally write about it, but there were some really interesting snippets which I wanted to share.

AI

There was not that much talk about AI, perhaps surprisingly, as there are a lot of data vendors at the conference, but a few interesting points were made:

The use cases for AI are still in a nascent phase, but both the buyside and the sellside are engaged in an all-out effort to capture data. They don’t necessarily know what data they will need to train models in the future, so they are capturing as much as they can now.

One presenter made an interesting point regarding the most obvious use case of AI - to improve workflows. He pointed out that today one group (the sell side) spends a lot of time assembling data in Excel and emailing it to the buyside who then in turn spend a lot of time extracting that data and putting it in Excel. AI should be able to streamline this dramatically.

The sell side are using it to target clients – their system will suggest to analysts that they call particular clients who have been reading lots of their research. Analysts are also being prompted to plug in snippets of past research into notes.

The buy side are seeking different ways of capturing data including more use of APIs so that they can plug the information into their internal AI systems.

The corollary is that more of the research budget is being allocated to AI developments with a likely squeeze on sellside research dollars. The growing use of alternative data, expert networks and multiple software applications is a further pressure on the revenue pool available to research providers.

US vs Europe

A consequence of Mifid II is that European investors are effectively disadvantaged vs the American counterparts. To the extent that European managers are paying for research out of their P&L – most of the big managers and retail funds, but not the hedge funds - and the Americans are still paying for research out of trading commission, the US managers have an important advantage.

Research is more expensive in the US, as is corporate access. (A New York competitor outsources the legwork to India, yet charges 60% more for a Forensic Accounting Review than we do!) Hence, independent research is prospering, unlike over here. There, a number of highly regarded analysts have left the big firms and set up on their own as sector specialist research boutiques, particularly since 2018. Most important these firms can prosper simply serving the US hedge fund space, which alone can support the research effort. This is in sharp contrast to the European situation where many of the independent firms are struggling.

This US-Europe gap is really playing out in corporate access:

Corporate Access

This is becoming increasingly important. In Europe, brokers charge for corporate access on a cost plus model. Go to lunch with the Nestle CEO and the broker charges you for the cost of the lunch plus a charge for overhead.

The number of broker conferences and the value ascribed to them is exploding. One European broker has seen the number of conferences increase 30% while the number of meeting requests from investors has gone up by 70%. One manager explained that over 50% of their research budget was allocated to corporate access.

A US asset manager can pay say $2,000 for that meeting with the CEO of a major company and the European manager may only be able to pay $200 (because of the cost+ regulation). Brokers in Europe are therefore prioritising American managers and hedge funds when it comes to meeting companies. As the companies generally dislike meeting hedge funds, particularly pod shops, the US long-onlys are in an advantageous position. I have encountered this sloping playing field in favour of US finance increasingly in recent months.

One manager said they were keeping their traders in the US to keep themselves out of the scope of Mifid II legislation. Their traders are having to get up at 3am and they would like to recruit traders in London but they want to avoid the regulatory impact.

Other

One-third of total assets in German equity funds are now ETFs so costs are under pressure here too.

Research budgets have declined since Mifid II was introduced in 2018 – passive has increased and the bigger firms have grown their internal research teams to the detriment of external research spend.

Research prices have bottomed and are going up. One sell side presenter argued that even a piece of research that is wrong can still add value to the client’s process. This sounds daft, but I agree. I never cared that much about the analyst’s recommendations.

MoneyWeek Summit

This is an interesting conference, with a series of panels and keynote speakers. The agenda was:

The global geopolitical outlook: Alex Chartres of Ruffer who also presented last year.

The outlook for the UK stock market: can the recovery last? Andrew Van Sickle moderated a panel with Laura Foll (Janus Henderson), Merryn Somerset Webb (Bloomberg), John Stepek (Bloomberg) and Gervais Williams of Premier Miton.

The energy transition: Barry Norris of Argonaut Capital, whom I interviewed on my sustainable energy podcast a few months ago and whom I met at this conference last year.

Opportunities in Emerging Markets: Cris Heaton of MoneyWeek moderated a discussion with EM fund managers Adnan El-Araby (Barings), Linda Lin (Baillie Gifford), Gabriel Sacks (abrdn) and Chris Tennant (Fidelity).

Investment trust bargains and where to find them: Max King, MoneyWeek columnist.

The world’s top growth markets: Kalpana Fitzpatrick moderated a panel with Tom Bailey (HANetf, specialist ETF provider), Gareth Powell (Polar Healthcare), Helen Steers (Pantheon International, private equity closed end fund) and Paul Niven (Columbia Threadneedle asset allocation).

The final two panels were on gold and wine, but I didn’t attend as I am heavily invested in gold and my wine cellar is already a sufficiently large investment in my portfolio. (I have in recent years been selling down some of my 2005 Bordeaux and Burgundy in particular, as prices have gone up so much).

Global Geopolitics

Alex Chartres of Ruffer presented last year, inspiring my title then “Doom, Gloom and no Boom”, and one wag has christened him the Master of Disaster. But he hasn’t changed tune, and it’s useful to think about risk, so here are my principal takeaways.

Source: Ruffer LLP

Geopolitical risk abounds. They are concerned that China will blockade Taiwan which has limited energy reserves – 146 days of oil, 11 days of natural gas and 39 days of coal. On October 15, the Chinese had 153 aircraft in the sky around Taiwan and 111 crossed into Taiwan airspace, along with 26 ships. These daily manoeuvres look like the dry run for a blockade.

The situation in Ukraine is clear, while Trump may greenlight Israeli action against Iranian nuclear capacity.

Source: Ruffer LLP

Wars are expensive – Chartres highlighted that it costs $500m to refill the missile cells on a US destroyer. More drones are in use and they are cheaper, but defence spending will continue to increase.

Financial repression was in operation during the cold war and will be the tool the authorities choose now. Many countries want to circumvent the dollar and Ruffer like gold which is being driven by central bank buying, in spite of ETF outflows:

Source: Ruffer LLP

As last year, they are gloomy on China and the property bust – residential sales and starts are below pre-GFC levels. This is massively deflationary, although cheap money can finance a huge stimulus. They think the Chinese authorities will do more, especially if Trump starts a trade war. They don’t like the demographics, in China and elsewhere.

Source: Ruffer LLP

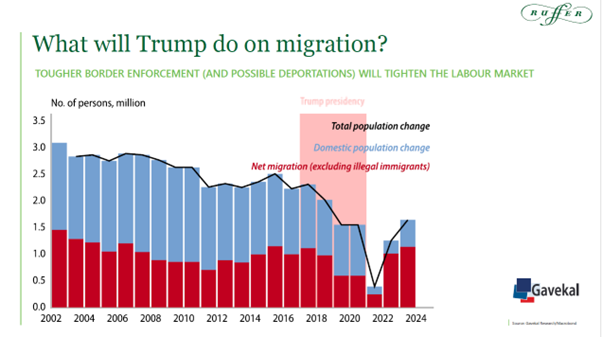

Trump’s inheritance is attractive and we could see a reflationary boom, but if he deports illegal immigrants and tightens border controls, will the US have enough workers to reindustrialise? And that likely requires a weaker dollar.

Source: Ruffer LLP from Gavekal data

He mentioned AI a few times, with a chart of spectacular growth in data centre spending (there were 91 charts – I cannot reproduce too many or this email will bounce). Estimates of productivity growth of >10% in call centres to >50% in coding were presented, but a recent academic study questioned whether LLMs really worked, with accuracy drops of 18-66% when the model is asked to deal with data which has been altered from the training models.

There are 3m truckers in the US plus many more cab drivers and those jobs are at risk on a 5-10 year view, if not on a 3 year view. And of course AI is fuelling power demand, with 60GW of capacity forecast as required for data centres by 2030 from c.25GW today – that’s adding half the UK capacity in 6 years. Hence they believe in the nuclear renaissance.

Source: Ruffer LLP

They are concerned about the deficit when the economy is booming and the Congressional Budget Office is forecasting that debt will mushroom by a further 80% of GDP and that interest costs will be one-third of the budget by 2050. That’s clearly unsustainable and there is greater fiscal risk - they see financial repression as inevitable.

He talked about the UK but I have depressed you enough already. The UK’s high cost of energy was a theme in the conference and Chartres highlighted the UK’s lack of investment, with the following slide, illustrating that a carrier pigeon is sometimes the fastest way to transmit data here, notable:

Source: Ruffer LLP

They don’t like the bigger role of the state and higher taxes in the UK, but they cited Germany as being in a worse situation. VW’s proposed closure of 3 plants, the first in 87 years, illustrates that the German growth model is dying.

Source: Ruffer LLP

The US stock market is expensive and investors are very long.

Source: Ruffer LLP

And bonds won’t help, as they tend to be positively correlated to equities in inflationary periods, with a negative corelation at CPI <2.5% and a positive correlation above that.

Source: Ruffer LLP

Inflation is not an issue for markets today which creates an opportunity as inflation can come in waves, with a second peak 4-5 years after the first peak.

Chartres concluded with Ruffer’s recommendations which I have summarised below for premium subscribers. This was an excellent presentation and although pretty gloomy and focused on the risk, there are certainly good opportunities, and I was interested that my portfolio shares some of their positions.

UK Panel

This was a pretty gloomy panel in some respects with talk of the UK stockmarket slowly dying; market hopes of a Tony Blair-esque “things can only get better” regime being dashed; and the Employer National Insurance hike being the worst possible solution to Government finances.

But the UK is cheap and has been outperforming - Gervais Williams reckoned that it had outpaced the Nasdaq over the last 3 years, without the Mag 7, which surprised me. He also pointed out that small caps were seriously cheap and were about the only thing which made you money in the 1970s, with the UK doing better than most other markets.

I have reported here before that Gervais thinks the UK will be the best performing market in the next 20 years. He is talking his book of course, but I think he genuinely believes this and it’s clearly possible given starting valuations, although the economy is an issue. The UK also has some protection against Trump tariffs as it’s 80% a services economy.

Even a reduction in selling pressure will help the UK market and some marginal buying could cause it to accelerate. Sentiment is improving too, as the BAML Global Fund Manager Survey has seen the UK move off the bottom and into a more attractive ranking.

Gervais Wiliams also highlighted the attraction of dividends – if markets were to move sideways over an extended period, at least you can clip decent income in the UK, and a dividend can never be negative.

He also highlighted that the world was highly uncertain and many private equity backed companies are over levered for such an environment.

The Energy Transition

Barry Norris of Argonaut Capital gave a keynote speech highlighting his view that we have enough windpower in the UK and it’s daft to build more. I have reported on this extensively both on the podcast and in my sustainable finance Substack, both titled Beyond the Balance Sheet, so I won’t go into any detail here.

Emerging Markets Panel

This was a good panel with some accomplished fund managers presenting, although the emphasis was on countries rather than stocks. I have included a couple of names for my more adventurous readers at the end, in the section for premium subscribers. Main takeaways were:

Growth is being prioritised in China and there are lots of tech stocks on offer at big discounts to US tech.

Exciting opportunities in small cap in Asia, with 700m people and vibrant economies. Indonesia and Vietnam were the manager’s picks.

LatAM is politically volatile but has fantastic natural resources exposure, with Brazil and Mexico highlighted. They have fiscal and political issues respectively, but the markets are seen as attractive.

US tariffs are an issue but China has focused on other export markets and now has 15% of global trade, up from 12% when tariffs were first introduced by Trump in 2018. And southeast Asia could be a relative beneficiary of tariffs, as Chinese firms relocate production and supply chains to Malaysia, India and Vietnam.

BYD, the electric vehicle manufacturer, is building facilities in Brazil, Hungary and Turkey. Localisation of production is critical and one manager highlighted the power tools industry where US company Black and Decker still imports all its equipment from China, while a competitor has started to localise production. I think this will quickly become an important theme which requires significant research.

Even with tariffs, the US cannot produce everything domestically at competitive prices, so there will be winners as well as losers.

EM countries look models of fiscal rectitude compared to the developed world and their government bonds have outperformed treasuries significantly. That could continue.

Is India the most overvalued market or the one with the greatest opportunity? It could be both!

The World’s Top Growth Markets Panel

Some sectors have structural growth opportunities.

Tech is not in a bubble, with valuations more reasonable than in the dot.com era, while the big tech stocks have no choice but to invest in AI because of the risk of not doing so. The downstream areas of power demand and cooling systems may prove better investment plays.

Healthcare could be one of the largest markets for AI, with applications in imaging, for example and attractive valuations still, outside GLP-1 plays. Even there, however, there is potential for further applications.

Defence has rerated and is at a valuation premium to the market, but that is justified by earnings prospects, a backdrop of geopolitical tension and the return of Trump.

Conclusion

This was an interesting conference and premium subscribers can read on for the Ruffer recommendations and 3 interesting stock ideas.