Mid-Year Book Roundup: Essential Reads for Investment Professionals

Exploring the Key Themes and Takeaways from My Recent Reading

Here are some of the books which I have read in the first half of this year. Some are essential reads, some probably not. I am trying to read more books and I started 2024 well, on a business trip to the Middle East - I read a few books ( I also listened to several podcasts and watched some surprisingly good games of local soccer on the TV), but my subsequent reading has been quite podcast focused. When I interview an author, I always like to read their books first, and I have done several this year.

The books are in no particular order and I decided to delete the scores out of 10! Before I do so, though, I should briefly mention Bill Ackman’s flopped IPO which I have been writing about last week and a few weeks ago.

I pointed out last week that the arithmetic was against him repeating past performance if he had an additional $25bn AUM, because he has only 10-12 positions and the universe wouldn’t be large enough. Perhaps retail investors and wealth managers worked this out (or read my piece!).

But surely Bill must have come up with that $25bn number from somewhere? After all, he used it to raise $1bn from a fan club of mega wealthy investors. UBS Wealth Management hosted Bill and his CIO in Omaha. The event was sold out at a couple of days’ notice. I had expected UBS alone to have promised to invest >$1bn on behalf of their clients.

The flop is a real embarrassment for Ackman and investors in his asset management firm will be disappointed, to say the least. It will be interesting to see Bill’s next move, as his ego will have taken a dent, if not his wallet which is still his share of the $1.05bn bigger. He is promising a new structure which he has already devised; I cannot help having a grudging admiration for the salesmanship. On to the books…

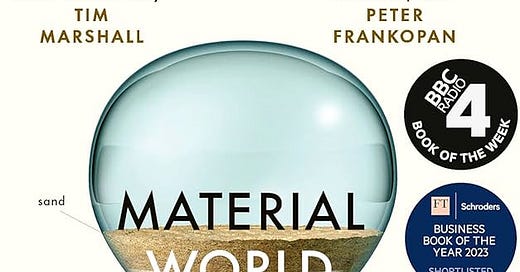

Material World: A Substantial Story of Our Past and Future

Ed Conway

A look at 6 substances which define our world today. Without them, our lives would be very different, yet we take them for granted. Conway looks at the history of their use, why they are important and how they are produced. He has travelled from Chile to Australia to better understand their origins, paints a rich picture of why we are so dependent on them and discusses their likely future. I loved how he explained scale and his emphasis on geography. I had no idea that the chip in my phone had circumnavigated the world more than once. Lots of factoids to impress your colleagues.

Stirling Moss: The Authorised Biography

Robert Edwards

I am a huge fan of Moss and I expected great things from this book. I was disappointed. Too often, books like these end up as simply a catalogue of the races. This had a little more but given the author spent considerable time with Stirling, I think he could have done a better job. There were references to Stirling's character and a few anecdotes but I had hoped for a greater insight into what drove the man. Amusingly, the author is an advisor to a hedge fund.

I met Moss once - Simon Kidston was translating for him at the Mille MIglia as he answered questions from a class of school kids. The only time I have every asked for someone’s autograph - I still have it. My Mille Miglia press pass signed by Stirling is in a frame on my bookshelf. You can just about see his signature above my name in the bottom panel.

100 Baggers: Stocks that Return 100-to-1 and How to Find Them

Chris Mayer

A simple and enjoyable study of stocks which had returned 100x. Naturally, these need very long holding periods and an extended runway for growth - they also require extraordinary patience from the shareholder. The common themes discussed are fruitful areas for exploration for the next 100-bagger; and of course, you only need one of these for your portfolio to produce an exceptional result - and it need not even hit that magic number. I recommend this and I only wish Chris would update it.

For more on this, listen to my podcast with Chris.

How do you Know? A Guide to Clear Thinking about Wall Street, Investing and Life

Chris Mayer

After re-reading 100 Baggers and when doing my prep, I realised Chris had also written this book on General Semantics. This is a worthwhile read for any investor as it's full of common sense wisdom. ""We don’t really know what makes a company great. We don’t really know most of the things we think we do. Therefore, to clarify your thinking, you must learn to distrust (and question) cause-and-effect analysis"" is a typical quote. This book is certainly an aid to clearer thinking. See also Ergodicity which is similar in some ways.

Extra Time: 10 Lessons for Living Longer Better

Camilla Cavendish

I enjoy Cavendish's column in the FT which is always full of common sense. In this book, she tackles the seemingly impossible problems of what to do about the growing number of old people in society and the increasing incidence of dementia, and looks at how we can exploit new scientific understanding to resolve them.

Cavendish traverses the world, speaking to a wide range of interested and interesting people, from scientists to social workers, and studies unconventional solutions to create better environments for old people. She highlights that as we live longer lives, it's crazy not to exploit the skills of those who have passed retirement age but whose experience and wisdom are valuable to society. This is a great book which offers real and practical solutions and should be compulsory reading for politicians.

Responsible Investment

Will Martindale

This book was written to promote the author's consultancy. It's a personal account of issues relating to responsible investment, more ESG than climate change and I didn’t learn that much. I didn’t finish it, so I am probably being uncharitable. I would recommend you read Bill Gates' book instead, as the story of what has happened so far in SRI/ESG (as covered by Martindale) is less important than the future action required which Gates summarises brilliantly.

The Unaccountability Machine: Why Big Systems Make Terrible Decisions - and How The World Lost its Mind

Dan Davies

I bumped into Dan recently and was reminded at how smart he is. This is his second book. I also really enjoyed his first book, Lying for Money, which explored financial crime and drew inferences for our world today. His new book is equally enjoyable and as thoroughly researched but is on a subject that I didn’t even know was a subject.

Dan examines why markets, institutions and even governments systematically generate outcomes that everyone involved claims not to want. He sees organisations as a form of artificial intelligence which create undesirable outcomes and then to avoid having to take action after the inevitable complaints, build an “accountability sink” to absorb unwanted negative emotion.

It’s far too difficult for me to explain, but if you run a large organisation, this is compulsory reading. For everyone else, it’s simply an enjoyable romp through a series of anecdotes about “the system”. Except there isn’t one. Just buy the book, you won’t be disappointed.

Public Success, Private Grief

Peter Cowley

An account of Cowley's life, his experience as a businessman and angel investor and the harrowing story of his personal life. I didn’t enjoy the book, reading an early and still to be edited draft, mainly because the multiple tragedies he experienced were painful to read about. How he lived through all this and remains cheerful is beyond me. Better to listen to my podcast.

The Invested Investor

Peter Cowley

I skimmed this as prep for my podcast interview with the author and I wasn’t much taken with it. If you know nothing about angel investing and want a guide, this might be useful.

The Essays of Warren Buffett 8th Edition

Lawrence Cunningham

This wasn’t my first reading of Cunningham's collection of Buffett’s wisdom. He updates the book every few years to incorporate the great man's latest writings and thoughts. The first time I read the book I thought it was superb and a better way of accessing Mr Buffett's thought process than reading the letters consecutively (which I have also done).

I read the book as preparation for my podcast interview with Larry and I was surprised at just how much I enjoyed it. I called Buffett's writing “poetry for finance geeks” in my conversation with Larry and he agreed wholeheartedly. This is compulsory reading for any investor, young or old. I was surprised to hear from a client who is the principal of a $2bn hedge fund that he was reading the latest edition at the same time. Yong or old, experienced or amateur, you must read this book if you want to become a better investor.

Same as Ever

Morgan Housel

A selection of Morgan's blogs and additional writing on the theme of what doesn't change. Likely inspired by Jeff Bezos' insight that there are some things which won't be disintermediated - customers will always like good service, fair prices etc. This is a nice selection of stories, short and sweet with some useful lessons, although I cannot say I learned much new of any significance.

Ergodicity

Luca Dellanna

Slightly along the lines of Taleb, but easier to read and digest. This is a short and sweet book which was kindly gifted to me by Guy Spier. Ergodicity is a fancy name and I am not sure that I can simply explain it, best read the book. But there are some useful learnings, beautifully illustrated with clever examples. In life, aim for the long term; remember winners must first survive; and often survival is the most important objective. Useful for investors.

Clear Thinking

Shane Parrish

Shane Parrish is a genius. His weekly email is a joy, as is his podcast, and this book distils his thinking brilliantly. More than a series of decision-making tools, this is a guide as to how to live a meaningful and fulfilled life, with less stress and better relationships - it's like a compass, although the over-riding message is that you need to know where you are going if you want to get there.

Premium subscribers can read on for some more books and a sneak preview of an upcoming podcast with an author.

Amazon affiliate links proceeds go to my podcast’s charity, Duchenne UK.