Background

Bill Ackman recently raised $1.05bn from the sale of 10% of his management company, Pershing Square Capital Management L.P., valuing the business at $10.5bn, or an astonishing 64% of its $16bn AUM. To be fair, the bulk ($15bn) of these assets is in a permanent capital vehicle, Pershing Square Holdings (a closed end fund or investment trust listed in Amsterdam and London).

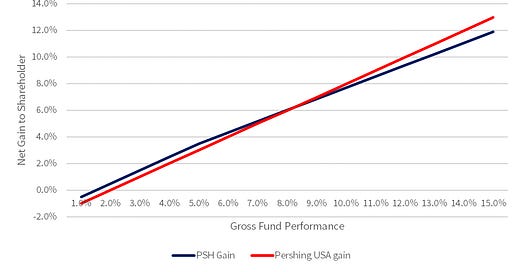

I wasn’t surprised, as Ackman had done a marketing meeting in Omaha ahead of the Berkshire AGM (see my first post on my visit), presumably to generate interest in the upcoming float of Pershing USA, a US listed permanent capital vehicle similar to the European fund. My understanding is that in the US, incentive fees are not allowed on such funds marketed to retail investors. Its management fee will be 2%, or 2-3 times what a “normal” long-only manager can charge, and will be waived in the first year.

The potential pre-IPO of the hedge fund was trailed in the press; I assume this is taking advantage of the upcoming float of the US vehicle, whose target AUM has been raised from $10bn to $25bn. Bill must be busy (he also has a SPAC type vehicle, sits on the boards of some of the portfolio companies and seems to spend a lot of time on Twitter).

I was puzzled as to why serious investors think Bill’s asset management company is worth over $10bn and their apparent confidence that investors would flock to invest $25bn in his new fund. There is no question that Bill is not just a smart investor but also a marketing genius, and when I did the “analysis” (honestly there is a lot of guesswork involved), the results surprised me and I wanted to share the thinking with you and tap into my readers’ collective wisdom. I would love to hear your feedback.

My sponsor AlphaSense have an exclusive webinar with my pal, hedge fund manager and thought leader Harris "Kuppy" Kupperman, Founder & CIO of Praetorian Capital, to explore the increasingly important world of uranium markets.

I have interviewed Kuppy in the past and he is a real special situations expert and seriously knowledgeable about this area. This is a paid ad, but I will be listening in.

📅 Tuesday, June 18th ⌚️1 PM ET | 10 AM PT | 6 PM BST

Is Bill Really a $10bn Man?

Let’s start with that hedge fund valuation. In my view, it’s predicated on

1 Bill raising $25bn for Pershing USA to generate an initial fee income after its first (free) year of $500m pa and rising with growth in AUM.

2 Fees from the existing European vehicle, Pershing Square Holdings. This has a 1.5% management fee and a complicated variable 16% management fee whose fees are reduced depending on how much other capital is managed by the asset manager

3 Bill growing the AUM.

1 The $25bn Raise

The target was apparently originally $10bn. Raising it to $25bn means that he can sell 10% of the asset manager for $1bn, but it’s more complicated than this. The more he raises, the more he risks diluting his performance and income. I am not referring to the $100m offset in the European fund’s performance fee, but the gains from the macro bets - by their nature they tend to be one-off, and therefore likely to be size- constrained.

His $27m Covid bet, a near 100-1 shot, was likely limited by the liquidity in the asset pool, rather than by his pocket book, as it was probably only 15-20bps of his AUM. I don’t know the details of course, but such opportunities are very rare and liquidity often is limited.

2 European fees

I estimate that Bill has pocketed a cool $2.7bn in fees in the last 10 years from the European closed-end fund. Well Bill, his various personal and charitable vehicles and his partners and colleagues have taken this home. And yes he has some expenses to pay, but not many, more on this later.

Pershing Square Holdings Fee History

Source: BTBS from Pershing Square Holdings Accounts

The European performance fee will be curtailed by an offset arrangement and this is a potential $100m pa loss of income, small in the context of adding $500m in management fees (which are also more highly valued), and obviously only payable if performance is delivered. The performance will also be impaired by having an asset base which is 2.5x the size, but at least the history is good.

3 Asset growth

This is clearly a function both of performance and of markets because a large part of the fee income growth will be beta driven. Markets are unlikely to repeat their performance since the GFC. But Bill has an excellent long term record, although he had a bad period in the mid-2010s.

Ackman’s Returns

Source: Pershing USA Prospectus

Ackman may accept that he can invest in a more limited range of opportunities but feel that for most of the stocks he buys, he can do so at a size of 2.5x his current positions. That seems challenging to me. If you are investing in out of favour stocks in size, there comes a point at which sellers dry up; and then, the more you buy, the more you move the stock against you.

He runs a very concentrated portfolio, usually 8-10 stocks, and his average unit size now is over $1.5bn (he can have a much larger position in one stock). Raising that to c.$4.5bn is in my view incredibly challenging (and would be impossible outside a permanent capital vehicle). He will need some $10bn positions and these requirements will increase if the fund grows.

This is even more of an issue when you want to get out. In US stocks, holdings have to be reported quarterly, so your exit strategy will become visible. Perhaps Bill is going to adopt a longer holding period, but again that is a potential negative for returns.

Valuation

The reason that seasoned investors have paid up for Bill’s hedge fund is surely the Pershing USA float. If it achieves the targeted $25bn, it would bring in $500m pa in fees in addition to the $150m-ish pa management fees from the European vehicle and the performance fees that can accrue going forward (although I expect a large part of those will go to the investment team).

Leaving aside the performance fees, even if Bill doesn’t beat the market, if the market goes up at say 8%, the management fees by 2035 would be some $1.4bn. If Bill can do 15% p.a., the fees in 2035 would hit $2.6bn. There isn’t much in the way of costs in the business (see below) and after tax, I estimate that the valuation is c.10x 2035 earnings, assuming the funds’ performance matches the long term market average.

Note that this is a theoretical exercise – by 2035, the funds would be managing over $150bn and they would have to have $15bn in each stock. This seems an unlikely outcome. And Bill would be 68 and not running for president; or maybe he would hand over the keys to his CIO.

The investor group will have considered two key factors:

Is 10x 2035 earnings cheap?

Can Bill do better than the market or can he raise (and manage) more than $25bn?

First, let’s look at who the investors are. Reuters reported that investment firm ICONIQ, specialty insurer Arch Capital Group, investment bank BTG Pactual, Israeli insurer Menora Mivtachim, investment manager Consulta and an international group of family offices took part in the funding.

Iconiq’s website describes itself this, “With over $80B assets under management, we seek to build resilient investment portfolios, partner with inspired entrepreneurs transforming industries, manage our clients’ lives and legacies, and create uncommon opportunities across sectors and society.” I have heard of Arch Capital but I know nothing about its investments. BTG Pactual was a highly successful Brazilian investment story but fell from grace a few years ago. Menora Mivtachim is a top 5 Israeli insurer quoted locally. Consulta, according to Bloomberg, “provides investment management services to private investment funds. The Company makes concentrated, long-term investments in businesses run by owner-oriented management teams”.

It's a rather unusual group of investors but they clearly have plenty of money. I am unsure how they expect to make more money out of this deal. The international group of family offices did not include one billionaire fan of Bill’s – he told me he was offered the deal but passed on valuation grounds. He is smart (well, he’s a billionaire!).

First point to make is that this is a risky business. Neither prospectus mentions key man insurance for Bill, and as I alluded to earlier, he is now the $10bn man. His CIO, Ryan Israel is clearly smart, sports an impressive haircut and according to Forbes is now a billionaire; Israel is 38 years old and has worked for Bill since 2009, after a stint as a TMT analyst at Goldman.

On conventional percentages of AUM, adjusting for the higher fees, the deal looks expensive, even assuming that Bill can raise $25bn. And I think I could find quite a few quoted growth businesses which are on a P/E of 10x in 2035 and don’t require any heroic assumptions.

The group is investing pre-IPO in a company which hasn’t yet raised that $25bn. In my view, the valuation should have a discount to reflect the risk that the hedge fund might never achieve an IPO and that Pershing USA might not achieve its $25bn aspiration. Or that Bill decided he would rather do his SPAC or buy Twitter or something – no of course, I don’t actually think he will buy Twitter (although he is a co-investor with Elon in the deal which will be regarded as the peak of the post-Covid tech bubble), but he does seem to be pretty busy.

Will Bill raise the $25bn? He is incredibly high profile and an amazing marketer. He and others seem to think that his support for President Trump is relevant to his chances of success in the election – even Trump, the arch marketeer, seems to think so because they met recently. And he has a massive following on Twitter which apparently is monetisable:

I wouldn’t bet much against it – look at the meme stocks phenomenon, but serious investors are unlikely to get involved, as I explain later.

Other Issues

Conflicts of Interest

There are multiple complications here. Bill will eventually have 3 quoted vehicles, the asset management company, a US fund and a European fund. Luckily, Bill is a long term investor with a limited number of stocks – otherwise, how would he have time to manage the expectations of three different investor groups?

But there is clear potential for conflicts of interest. Presumably the two funds will have to be treated pari passu, which is why current investors in the European fund are being sweetened with a reduced performance fee. If Bill manages to repeat his 100-1 shot with another $27m as he did so brilliantly in Covid, the European investors will only receive c.35% of the benefit. And as he cannot charge performance fees on the US portion, the management company will be foregoing 16% of 65%, or c.10% of any gain.

There will be occasions when the interests of the different shareholders are conflicting. Most obviously, holders of the funds will want the funds to do buybacks when they trade at a discount to NAV. Holders of the asset manager want to maximise AUM. Insiders will likely have more resting on the valuation of the asset manager than the funds.

We have seen with Elon Musk that shareholders of his various enterprises must accept that Elon comes first. To be fair, at least, Bill Ackman sounds rational and appears trustworthy. He and partners and related vehicles own stock in Pershing Square Holdings in Europe worth $3.3bn; they will presumably also own some stock in Pershing USA; but their ownership of the asset manager is likely to be more valuable, c.$9bn today, less whatever they sell in an IPO.

One conclusion I would draw from this is that buybacks at the European vehicle will be limited for a while. At least until the asset manager is IPO’ed.

Costs

I mentioned above that the costs are limited. Here is the Pershing USA N-2 prospectus on expenses borne directly by the fund, other than the cost of audits, settlement, custodial fees and similar unavoidable costs:

Expenses borne by the Fund include:

“Fees and expenses associated with investment research and due diligence including fees and expenses relating to newswire, quotation equipment and services, market data services, third-party providers of research, publications, periodicals, subscriptions and database services, data processing and computer software expenses, due diligence, providers of specialized data and/or analysis related to companies, sectors or asset classes in which the Fund has made or intends to make an investment”

So the fund will be paying for Bill’s Bloomberg through to expert network charges.

“Professional fees and expenses (including fees and expenses of investment bankers, appraisers, public and government relations firms and other consultants and experts”.

I am puzzled as to why a PR firm should be paid by the fund. Perhaps if it was doing a survey on shareholder attitudes, as I cannot imagine Bill needing advice on how to close the discount to NAV. But again there is the potential for a conflict of interest as it’s in the asset management company’s interest that it has positive PR and the management company should surely fund that, rather than the funds. I suppose Bill might anticipate a potential return to activism.

“Fees and expenses (including travel and lodging expenses) associated with corporate engagement campaigns (both long and short) such as fees and expenses related to event hosting and production, public presentations, creating and maintaining informational websites and engaging in online campaigns including via social media, public relations, public affairs and government relations, forensic and other analyses and investigations, proxy contests, solicitations and tender offers, and compensation, indemnification and other fees and expenses of any nominees proposed by the Adviser as directors or executives of portfolio companies”.

So, if Bill engaged me to do a forensic analysis of a target’s accounting, the fund would pay for that. No, Pershing Square is not one of my clients. At least, not yet.

Therefore, the costs to be borne by the management company are mainly the office near Central Park, staff salaries and bonuses. We don’t know these amounts which inevitably will be significant – the investment team as of February numbered 7 analysts including the CIO plus 2 assistants. Legal and compliance had 8 people, IR 3, Trading 2, Finance 7, Tech 4 and 5 other staff which I make as 38 in total. Staff numbers may rise if he launches other funds, as has been reported.

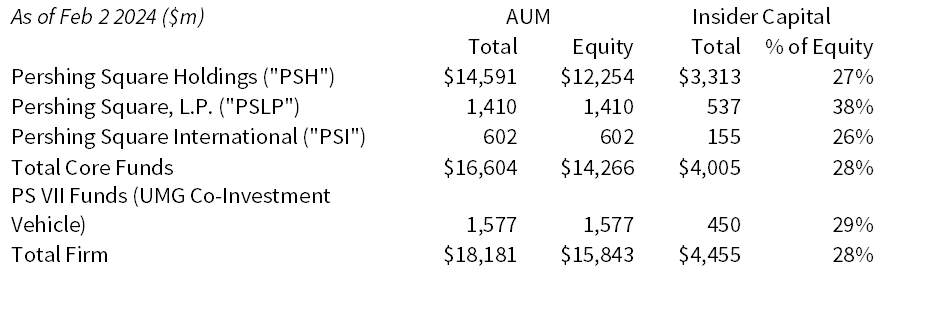

Another major factor in the profit equation is whether Bill and colleagues pay fees. Attitudes vary here. Chris Hohn pays fees to invest in his own fund as do all the staff. In my experience, this is rather unusual and normally employees get a free ride. Insiders own 27% of the European Fund:

Insider Ownership of Pershing Square Holdings

Source: Company

But even this is complicated. Bill should probably pay fees on his investments in his own funds, because the multiple applied to the income in the asset management company is likely worth more to him than the fees. But you have to value $20m of cash outflow on each $1bn invested in Pershing USA vs the notional gain in value on a capital asset. It’s amazing that there is time left to do research on stocks – working out his personal position is difficult enough.

I assume that the management company will be highly profitable with sub-$50m of costs before investment team bonuses and on a $650m+ pro forma revenue run rate, should clear $600m pretax and close to $500m of earnings. Will the investment team take over $100m? I doubt it.

I assume Bill doesn’t draw a salary or bonus, but that’s simply a guess on my part. If he does, then all these calculations go out of the window. And how does he maintain his lifestyle, with I assume multiple homes, a private jet etc. He may take a salary and share of the performance fee - nothing would surprise me.

Premium subscribers can read on for what I think will happen and some actionable stock advice and how I intend to take advantage.

I shall return to this topic later in the year. I have been observing Bill Ackman and his funds since the European IPO. And I advised a number of my clients and contacts who were his investors to sell the fund in 2015/16.

I wanted to highlight my friend Callum Thomas has a new chart Perspectives Pack out. Plenty of useful charts in here.