How Lateral Thinkers Can Make Billions

From Pumpkin Lattes to Primates: What Investors Can Learn from Marketers

I went to Nudgestock, Rory Sutherland’s annual behavioural science and marketing conference for the first time last week—and I left wondering why I hadn’t gone before. I’d seen some of the presentations online over the years, but attending live was quite special.

This wasn’t an investing conference, but it just might revolutionise how you think about investing. Because Nudgestock is about how people make decisions which is the heart of markets.

The published theme this year was power, but for me there were two key takeaways:

In the pursuit of shareholder value, companies can stifle original thinking and creativity and therefore inadvertently suppress growth; for Sutherland and other speakers, it’s marketing vs beancounters.

I was also struck by the power of storytelling. Rory Sutherland is one of the most original thinkers I have encountered and a great presenter – no surprise that he is a master storyteller. So too is Maz Farrelly, a former executive producer of top reality TV shows, now a strategy consultant.

Let’s explore these first, with Sutherland in pole position on both, but first a word from my sponsor and because this week’s article is 5000 words, I have added a Table of Contents, for those of you with less time on a US holiday weekend.

Before we get into those, a quick reminder from me. I shall again run my Forensic Analysis Workshop in a midtown location in New York on Thursday, July 24. We have limited spaces and they are selling fast, so please sign up early:

AlphaSense is now core to the workflow at 75% of the world’s top hedge funds. Why? Because it combines high-quality content—company filings, broker research, and expert interview transcripts—with AI that’s built to think like an analyst.

They’ve just rolled out something new: Deep Research. Unlike other tools, this one is purpose-built for investment professionals. It runs multi-step, iterative analysis using AlphaSense’s own expert content library—over 200,000 transcripts—and pulls insights in minutes that would normally take days or multiple interviews to uncover.

It’s like adding ten analysts to your team, helping you move faster, go deeper, and make sharper decisions. See it in action.

Contents

Roger L Martin: marketing strategy

Rory Sutherland: behavioural science

Maz Farrelly: storytelling

Dr Katie Slocombe: how chimps behave

Dr Martha Newson: importance of rituals

Dan Davies: failings of systems in organisations

Prof Charles Spence: multi-sensory experiences

Michael Gove: politics

And for premium subscribers:

Daniel Hulme on AI

and two fascinating behavioural science case studies

Roger L. Martin

Power and Paralysis: Why Hierarchies Hate Innovation was the title of his presentation. Martin was described in the programme as “the renowned CEO Whisperer, strategic thinker, and former Dean of the Rotman School of Management”. Rory Sutherland termed him “a god”.

His presentation dissected a critical paradox: why organisations, despite needing innovation to survive, often actively stifle it. There is a parallel here to Dan Davies’ presentation from his book The Unaccountability Machine.

Martin described [marketing] strategy as “an integrated set of choices that compels desired customer action and planning as a set of laudable and doable initiatives in areas under control” and he explained that companies control lots of variables – the number of employees, the area of office space they occupy, their capex investment, their inventory (at least partly) etc etc. But the one thing they cannot control is their customers.

The dominant model for decisions is to crunch data – when you produce a revenue forecast, 100% of the data comes from the past; the inference therefore is that the future will be the same as the past. All revenue forecasting is therefore a fantasy and there is no correlation between the forecast and the actual. He explained that they [marketers] should attack their [accountants] misuse of analysis of data.

He cited 3 possible creative triggers:

Spot an anomaly

Use an analogy

Find a tradeoff

I thought this had an interesting parallel in investing, as did this question to ask:

“what would have to be true for this to happen?”

I used to use that question a lot in thinking about game-changing investments.

Ian McGilchrist, author of The Divided Brain, said there are four ways to the truth: science; reason; intuition; and imagination.

As an analyst as well as a marketer, you need to hone the last two skills – they can sometimes be more important than the first two, which are usually in the price.

Rory Sutherland

If Roger Martin diagnosed how corporate structure can kill innovation, Rory Sutherland offered the antidote: creative thinking that defies spreadsheets.

Sutherland is Vice-Chair of Ogilvy and the man behind their behavioural science practice. He has written an excellent book, Alchemy, and writes a bi-weekly column for the Spectator magazine (now owned by Sir Paul Marshall, co-founder of Marshall Wace). He is always entertaining and has fascinating insights into sometimes otherwise mundane topics.

Either/Or Not Always a Solution

Sutherland opened his talk with the story of the poor Decca executive who signed Brian Poole and the Tremoloes, not the Beatles. Sutherland argues that it wasn’t a stupid choice, given the criteria he was using. He only had budget to sign one band; while the Beatles had raw talent, the Tremoloes were a finished product. They would go on to produce two number 1 hit singles, Do You Love Me in 1963 and the classic Silence is Golden in 1966. Rory reckons the deciding factor may have been that the Tremoloes were from Essex (a tube ride from central London) and the Beatles from Liverpool, so the cost of travel to recordings likely clinched the deal.

I love how Sutherland thinks – this type of lateral thinking is incredibly helpful in investing. Poor Mike Smith should have signed both bands, but he wasn’t allowed to. It would have seemed extravagant - nobody considers the unquantfiable opportunity costs, they focus on the actual costs they can measure.

We often frame decisions as either/or in business and that’s not always the right approach, but companies are constrained by the straitjacket of quarterly reporting.

Family Businesses Think Long Term

Sutherland went on to praise the virtues of family-owned businesses (we have too here and here). He highlighted the 2024 IPA Effectiveness Awards winners – McCain (French fries), Laithwaites (wine), Specsavers (opticians with a fantastic series of TV ads), Yorkshire Tea and Guinness, of which four are family businesses, able to think and invest long-term. (Three more family businesses won bronze awards).

He recently visited Texas where family-owned Buc-ee's is a chain of large format travel centres, known for the cleanliness of their bathrooms and number of gas pumps. Also in Texas, HEB Fresh Foods is a mid-market retailer founded by HE Butt with fresh organic and local produce. They are so good that WalMart avoids competing with them. Sutherland also extolled the virtues of Friends of Fortnum’s, the family-owned Fortnum & Mason loyalty program.

He highlighted a quote from John Kay’s recent book, The Corporation in the 21st Century, which is on my list, but I have not yet read:

“…responsiveness to the needs of customers is a preoccupation. And that responsiveness is the key to the durability of these companies”

He highlighted how Quakers are also good at marketing brands, notably Mondelez. Cadbury used to put the price on the wrapper of its Dairy Milk so that retailers would not be able to overcharge. I wonder if this might have been introduced in the 1930s, in response to the Depression:

Source: PInterest

Explore vs Exploit

Some 20% of bees don’t do the waggle dance but go off randomly to explore for new sources of pollen and this is the right approach in business too – Sutherland contrasted the need to explore (a marketing function) with the need to exploit (an accounting function).

Source: Rory Sutherland, Ogilvy, Nudgestock 25

Finance is focused on exploit and applies the wrong maths to marketing, focusing on the cost and forgetting the income. As Bezos said, business is fat-tailed – in baseball, a home run is 4 points; in business, it can be billions (AWS is valued at $750tn today and looks set to hit $1tn before 2030 if markets hold up).

Marketing is also fat-tailed – David Ogilvy said he only had 5 big ideas in his career. Sutherland thinks that Starbucks’ Pumpkin-Spiced Latte has generated $500bn of revenue but didn’t score on the normal selection criteria; fortunately, the marketing team went with their gut.

Imagination vs Efficiency

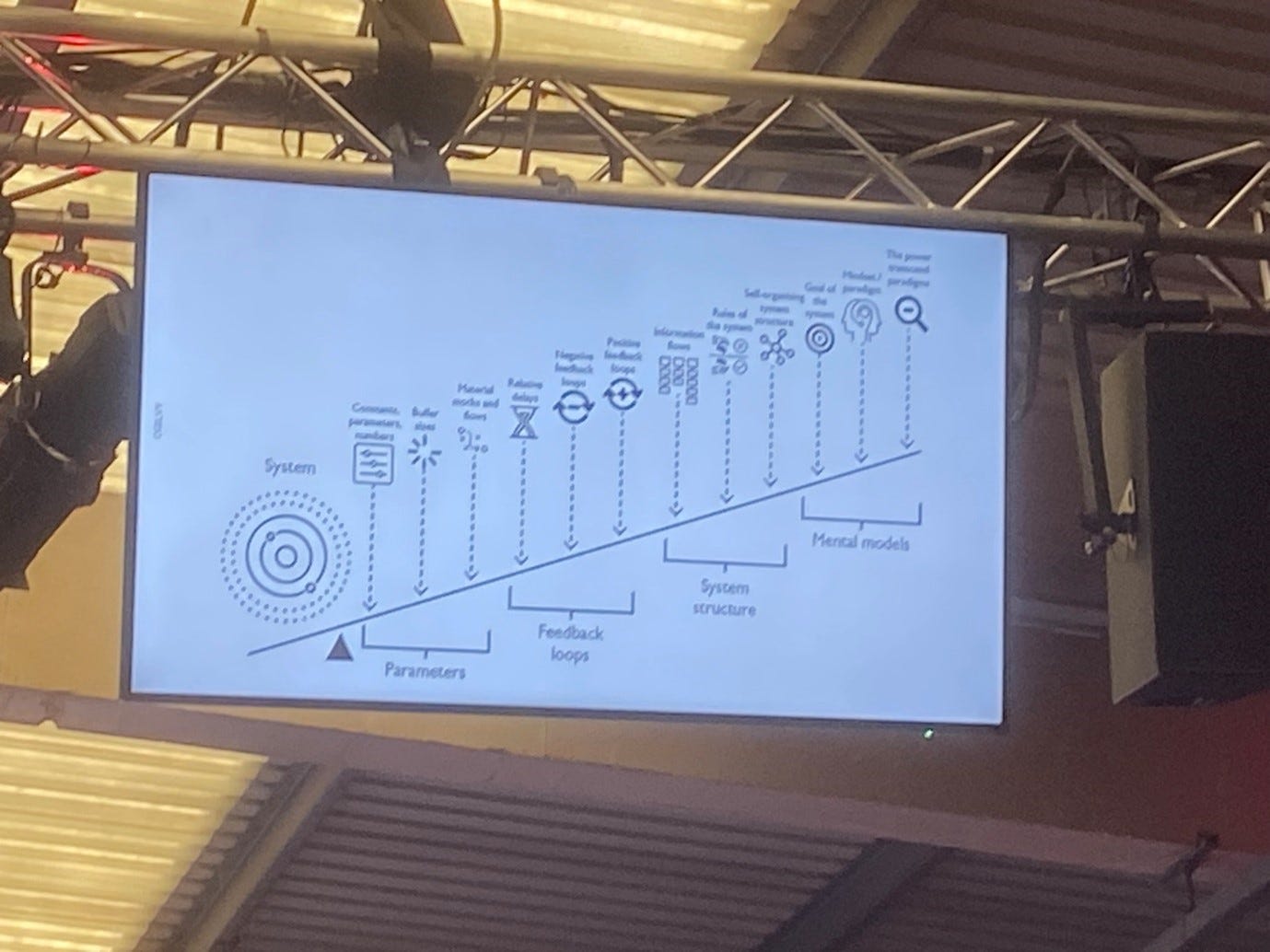

Sutherland is a great believer in the power of mental models, a term probably coined by Charlie Munger who was also a great advocate. Systems have structures and are effective, but mental models are even more powerful:

Source: Rory Sutherland, Ogilvy, Nudgestock 25

Sutherland compared the cost of London’s new Elizabeth line with the printing of the London Overground map. They carry similar numbers of people – before the tube-style map of the Overground was introduced, it was much less popular – the map simply made it more accessible.

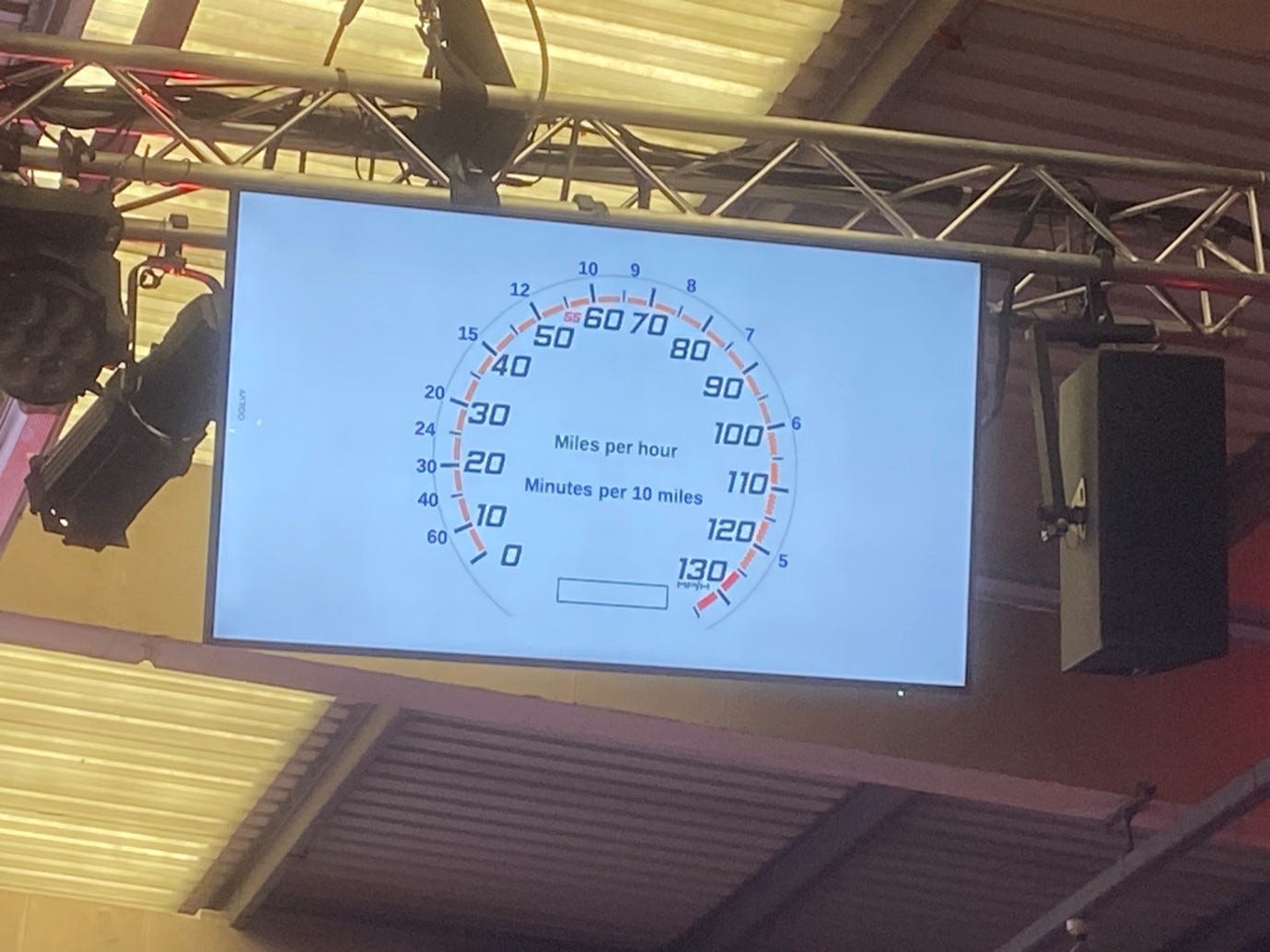

He used the analogy of a speedometer vs a paceometer:

Paceometer Beats Speedometer

Source: Rory Sutherland, Ogilvy, Nudgestock 25

As you go faster, the incremental unit of speed has a diminishing return. Why drive at 80mph to save a few minutes when you can drive at 70 mph and be safer, use less fuel etc? We don’t frame decisions correctly.

Framing is of course a brilliant tactic in investing – looking at something in a different way can give you a better appreciation of value. Sutherland highlighted the use of the term “pool access” room by the hotel industry – framing the same product in a different way allows you to charge a premium.

His conclusion: amplify rare brilliance vs replicate mediocrity.

This was a brilliant talk, and it was a powerful illustration of the power of storytelling – it’s hard to translate that in a newsletter, but you can view his talk on YouTube.

Maz Farrelly

Former TV producer, claiming 8 billion views of her shows, the title of her talk was “How to get people to do exactly what you want, and make them want to do it”. She has produced a huge range of reality TV from Big Brother to the US Apprentice with Donald Trump, via Richard and Judy, Noel’s House Party and the X Factor (the majority of you live outside the UK – you haven’t missed anything).

This was a brilliant talk, so I am not going to do it justice by explaining it, but let me try – it was that good. She explained that we should strategise like a TV producer, because they are brilliant at changing behaviour. She started out as a journalist and on her first day had to write the obituary for Laura Ashley – her headline was “It’s Curtains for Laura”.

Hence, luckily, she went on to become a TV producer. She then proceeded to offer up her 10 Com-Maz-ments and I will simply share the memorable tips and a few of the stories –there were a dozen fantastic ones in this presentation.

Hope is not a strategy: she used to think harder than anyone else in the room. And she told several funny stories about how thinking laterally can help change a customer’s or co-worker’s behaviour. My favourite was the policeman who sent birthday cards with the message “you are always in my thoughts” to known criminals in his neighbourhood.

Another of Maz’s rules is “It’s not my job to be interested in you – it’s your job to be interesting”. You cannot bore someone into changing their behaviour – how do you make your pitch interesting? You also need to know your audience – do you think about what’s important to them? She talked about organising the Celebrity Apprentice TV show in Australia with Donald Trump. The celebs were all getting along too well and she wanted to create some friction. So she got a photographer and asked the celebrities to stand in the order of how famous they were – she had identified their weak spot.

Make Some Noise or get their attention. She talked about Shed (Sheridan) Simove, a marketing genius who produced the book What Every Man Thinks about apart from Sex, translated into multiple languages – it’s 200 blank pages. He crafted a beer “Responsibly” after the ad for “drink responsibly” and my favourite was his cheese grater – Make America Grate Again:

What’s your strategy to make people talk about you? She wanted to get an idea taken up so she bought cake, not just for the meeting she was pitching to, but for the whole building – everyone asked why there was cake in the kitchen and then it was explained that Maz came to pitch her idea.

Know what you are selling – you need to get attention; you are not selling a product, you are selling emotions. More young people voted for the winner of Britain’s Got Talent than voted in the General Election.

De-dull your data: she talked about a medicine which had a 3% chance that it would kill you, yet everyone takes it. To bring this home, she put 100 guns on a table, told the group that 3 were loaded than asked them to pick one at random and shoot their neighbour – suddenly 3% seemed a high number.

She then quoted a Tim Ferriss hack to make you less embarrassed. She reckons the embarrassment muscle weakens with use. Next time you ask for a coffee, ask for 10% off – she tells the barrista “I’m saving up for a messy divorce”.

Her rules were fun and interesting, her storytelling masterful – it obviously doesn’t translate nearly as well to the written page, and I recommend you watch it here. But her talk and Rory Sutherland’s brought home to me the power of storytelling. I already use this quite a bit in my training programmes – my forensic accounting course has over 150 real life examples of accounting chicanery, as actual companies are much more memorable than model examples; but I must try to do more on the storytelling front.

Dr Katie Slocombe

An evolutionary psychologist, she spends time studying chimps in the jungle in Uganda and she had some fascinating insights into the behaviour of alpha males, which has so many parallels to S&P500 CEOs. There is a clear alpha male in the community and then a linear ranking of dominance – all chimps aspire to be the lead male.

There is also a clear alpha female, then a tier of successful rearing chimps, then female chimps without children. The alpha males get the sweeter higher fruit and get more offspring although the females will mate with all males to maximise their chances of children.

To become the alpha male, the chimp engages in a combination of:

Physical intimidation and aggression: this can take the form of outright fighting to beat another candidate, random aggression to demonstrate physical prowess, or displays of strength which are more energy efficient.

Relationship building and coalition formation: this can be social bonding through mutual grooming, supporting partners in fights, sharing meat, advertising high value food to partners, and getting the support of the females and lower ranking chimps by acting as a policeman in breaking up fights or by playing with a female’s kids.

The combination of the physical intimidation and social interaction is more powerful and leads to longer lasting alpha roles. The alpha males win beyond sex, in that they get a lot of grooming and are shown a lot of respect.

These chimps are very social creatures You really should watch some of her videos as the behaviour is fascinating – also on BBC iPlayer if you are in the UK or watch her Nudgestock speech here.

Dr Martha Newson

An academic who focuses on football fandom, she spoke on the Power of Us – what it means to belong, to be part of a group. She talked about the importance of rituals in modern society, and likened Glastonbury to a pilgrimage. She thinks ritual gives us “social glue” and pointed out that our ancestors depended on community, and on handed down wisdom from past generations - for example, in knowing what not to eat.

She has studied football fandom in Brazil where it’s quite extreme:

The Man with the Football Strip Tattoo

Source: Vice

Negative experiences bond us, as well as euphoric experiences - she highlighted that fans of losing clubs have a closer relationship with, and are more willing to sacrifice themselves for, their fellow fans:

Source: Martha Newson

I spoke to her after, as I was intrigued by the recent spike up in church attendance by young people, both in the US and less so in the UK, particularly in males, albeit from a lower base. She thinks this, like rituals, is about creating a sense of belonging. I haven’t anything to share with you on this at this point, but it’s of investment significance.

Dan Davies

Dan and I worked together many years ago on the sellside and we occasionally see each other at events. He has an amazing brain – both his books are really worth reading, his Substack is great and he is amusing on Twitter/X. He spoke about the main theme of his new book, The Unaccountability Machine, which examines why companies and institutions systematically generate outcomes that everyone involved claims not to want. He re-examines the writing of Stafford Beer, a legendary economist who argued in the 1950s that we should regard organisations as artificial intelligences, capable of taking decisions that are distinct from the intentions of their members.

His talk was titled How Organisations Make Weird Decisions and he talked about POSIWID – the Purpose of a System Is What It Does. In the book, he uses the most awful example which created a hush in the room as he explained it – 400 squirrels were being shipped from China to Athens via Schiphol; they were stranded in KLM’s cargo warehouse because they didn’t have the right paperwork; they couldn’t go on to Athens, and the shipper either wasn’t going to pay for them to return to China or couldn’t be tracked down. They ended up in an industrial shredder. This was awful for everyone, particularly the squirrels, and KLM had a PR crisis after questions were asked in the Dutch parliament.

A more palatable example was the A-level system in the UK in the pandemic. A-levels are England’s school leaving certificates, and the system ended up biased in favour of private schools and the middle class – the Covid algorithm had two real biases, in favour of small classes and against schools with bad historical records. Meantime, middle-class parents knew how to game the appeals system.

Economist Stafford Beer argued that organisations have behavioural biases like people; they are information processing systems and the signals need to arrive in time, in the right place and in a form where they can be understood.

The workers in KLM’s cargo shed are not bad people; they just aren’t empowered. The system could empower them – in KLM’s engineering shed, a mechanic who drops a spanner in a jet engine is empowered to prevent the plane taking off and to rejig the timetable; obviously, safety comes first.

Organisations have become more complex and we need to pay closer attention to the design of the decisions that they empower. Dan is a former Bank of England economist and he complained that financial data is a single representation of a company, but it throws away huge amounts of relevant information – and a company which manages itself by purely financial data will lose sight of its business.

He commented on the vagaries of the UK planning system. If you want to build an infrastructure project, you can consult the planners but the planner is then deemed to have a conflict of interest so they are disqualified from judging it –the person who makes the decision cannot be a person who knows about the project – hence we have a bureaucracy that slows things down. Dan has lots of Catch-22 examples.

A company which is driven by its customers cannot lose sight of reality while a company which is driven by finance can cause huge issues – Dan laughed about revenue forecasting and claimed that there was more fiction written in Microsoft Excel than in Word. Once a number is in a spreadsheet, it’s often treated as fact. Investors know how dangerous that can be.

Professor Charles Spence

Spence spoke on Sense-hacking: How to Use the Power of Your Senses for Happier Healthier Living. He is a cognitive neuroscientist and an expert on how the combination of senses can enhance your perception – in an experiment, wine experts were fooled by red dye in a glass of white wine. He also demonstrated how vision can overcome hearing and showed how the shape of a chocolate bar could influence perception of sweetness.

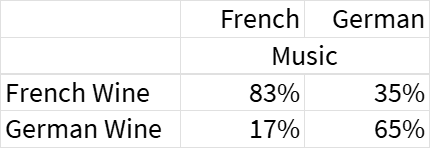

In an academic paper, North et al in 1997 tested the sales of French and German wine in a supermarket when French accordion music was played vs German bierkeller music:

Wine Sales

Source: Prof Charles Spence from North et al, 1997

He talked about the influence of sound on taste – apparently one quarter of airline passengers order a bloody mary in the air but not on the ground. Heston Blumenthal was an expert in using sound – “sound is an ingredient that the chef has at his disposal”. His “sound of the sea” seafood dish came with earbuds which transmitted exactly that and apparently it made diners cry. At the Xin Café in Beijing, they sue a sonic sweetener to allow them to reduce the sugar content.

British Airways in 2014 introduced a "Sound Bites" menu, pairing in-flight meals with specially selected music tracks to enhance the dining experience. This concept, inspired by Spence’s study on "sonic seasoning," aimed to improve the perception of food flavours by using music. The playlist included tracks like Paolo Nutini's "Scream" for Scottish salmon and Coldplay's "A Sky Full of Stars" for a British main course.

Campo Viejo experimented with a colour lab – lighting changed the taste of the wine in an experiment on 3000 people. We were then treated to a live experiment. Coca Cola is cleverly marketing Sprite as an alternative to milk to cool down spicy food. It works, although the multi-sensory experiment passed me by, possibly because my mouth was already on fire.

Michael Gove

The conference ended with Rory Sutherland interviewing his editor at the Spectator, former cabinet minister Michael Gove. A long-time fixture in British politics, Gove is probably best known as the man who dramatically withdrew support from Boris Johnson during the 2016 Conservative leadership race—a political betrayal that many saw as both calculated and self-serving. To some, he embodies the more Machiavellian traits of Westminster: ambitious, untrustworthy, and supremely adaptable. Yet others might argue he’s a pragmatist - shrewd, resilient, and remarkably adept at political reinvention.

The fireside chat was titled Inside the Corridors of Power: The Psychology of Influence from the Newsroom to No 10. Amusingly, the two agreed that Trump is the ultimate alpha primate. His bullying tactics such as the use of nicknames like “Lying Ted” is a demonstration of control, similar to the chimps. Politics has become presentational and theatrical and Trump, with 15 seasons of the Apprentice, knows how to communicate with an audience – that’s an essential skill in politics.

I was horrified, although not totally surprised, to hear Gove recount that in Cabinet, proposals are not debated – you have to be a good chap and not muddy the waters or you will make enemies and then when it’s your turn, you will get a similarly easy ride. Gove said you cannot be the grit in the oyster or you will be briefed against.

There should of course be a collective debate but candour is rare. Only George Osborne, a Chancellor close to the Prime Minister and politically agile, could interject; it was very rare for others to do so. Even then, the Treasury has the smartest civil servants and usually have the ear of the PM so they tend to win the arguments.

I thought no wonder the country is in such a mess. This was a grim reminder that even at the highest levels, systems often prioritise harmony over truth—a problem not limited to politics. Investors should be alert to the same dynamics inside companies.

Daniel Hulme on AI

Regular readers may recall that I met Daniel at the WPP Investor Day and we shall be doing a webinar with him for founder members of this Substack and my students in the autumn. He is an AI genius as he can explain it in simple language. Premium subscribers can read on for his insights and two case studies of behavioural science in practice.