Fundsmith Unfiltered: Straight Talk on Stocks

Some major stock insights and a surprising private revelation.

I returned to the Fundsmith Annual Shareholders Meeting for the second time last week. It was even better than last year because

I had a chat with Terry Smith before the event and he shared some surprising information.

We both own a stock and Terry had some major bullish news.

Terry and Head of Research Julian Robins gave some interesting insights into weight-loss drugs and the relative merits of Novo Nordisk vs Eli Lilly, both stocks which have been mentioned here recently.

More below. The format was the same: drinks beforehand, an opening address by Terry, and then Julian and Terry responded to pre-prepared questions from shareholders, chosen and delivered by Ian King, a well-regarded UK journalist. First, a quick word from my sponsor:

AlphaSense Market Insights Report

What will shape markets in 2025?

From a newly formed U.S. administration to major macroeconomic shifts, 2025 is poised to set new precedents. AlphaSense insights reveal key investor themes, including IPO and deal activity, shifting trade policies, AI advancements, healthcare regulations, and the future of energy.

Download the report to uncover market-moving trends and expert-driven intelligence to help you navigate the year ahead with confidence.

Performance

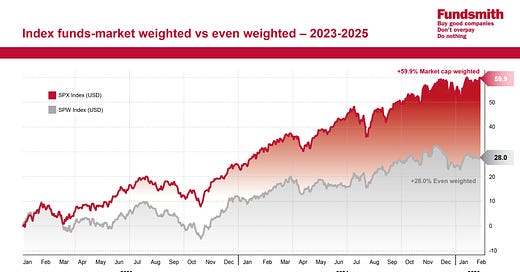

Smith acknowledged that the fund has recently shown some under- performance, with 2024’s 9% return lagging the global index’s 21% (and the S&P500’s sterling return of 27% on my estimates). I show the data since 2018 in the table below.

Fundsmith Total Return Performance

Source: BTBS from Fundsmith, SlickChart, Bloomberg and MacroTrend Data

The AGM slide showed performance over the last 7 years as per the first two lines above, excluding the cumulative column on the right. It also showed bonds and cash. Instead, I have added the S&P500 which I think is more relevant. It also showed the total return since inception to January 2025 with the fund returning 653%, 1.5x the return of the global market’s 425%. But somewhat surprisingly, the fund has lagged the S&P500 since inception. Some 70% of the fund is invested in the US market, so it’s not a totally unfair comparison.

I think Terry Smith is a brilliant individual - he has been a #1 banks analyst, a top-performing public company CEO and he has built a substantial asset manager from scratch. There is no question he is an outstanding investor. That the US market has beaten him since November 1, 2011 is astonishing and says as much about the risk in that index as anything about active management, in my view. Bill Nygren made the point in our recent podcast that the S&P 500 has become a growth stock index.

Smith highlighted that he was particularly pleased with the fund’s Sortino ratio of 0.87 vs 0.6 for the global index, as that highlights that he has delivered a much higher return for a unit of risk or variability. And he explained that he particularly aims to maintain low volatility in the fund as that helps investors hang on.

Another global fund managed from the UK has been delivering superior returns but with greater volatility; personally I am less bothered about temporary volatility and prefer the higher return; and Buffett and Munger have expressed similar preferences. But it’s easier for some individuals to stay invested if volatility is lower, and Smith’s objective is sensible.

Winners and Losers

Smith put up the following data (I added totals) and explained the main winners and losers:

Top 5 Contributors and Detractors

Source: BTBS from Fundsmith data

Excluding these 5 big winners, the rest of the fund lost 0.9% and ex the 5 big losers, the rest of the fund did +4.2%. Smith highlighted that Meta has been a difficult stock for them and that it has attracted a huge volume of criticism, especially after they initially bought in, post the Cambridge Analytica scandal.

Microsoft has made 8 appearances in the top 5, a feat which Smith considers extraordinary for a company of this size. Later, he expressed discomfort with its current valuation - a 38x P/E. ADP does payroll processing and has been a very consistent high single digit grower. Stryker is bouncing back post Covid.

L’Oreal has been disappointing but China is its biggest market and it has problems there. Smith considers the business so good that he is not going to sell. Its management have seen this type of situation before. The shares are back to levels of 3 years ago:

L’Oreal Share Price

Source: AlphaSense

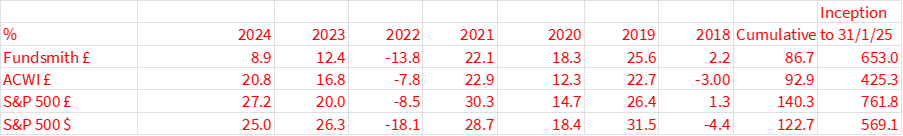

And its valuation is significantly cheaper than it has been for some considerable time:

L’Oreal Valuation

Source: AlphaSense

Revenues are forecast to grow at c.5%, eps at high single digit and there is a free cash flow yield of 4%. That’s surely attractive if it’s still a quality company, as Smith clearly believes. In my Analyst Academy course, we suggest that one way to find ideas as a private investor is personal experience, especially with exceptional brands. There are several L’Oreal products in my bathroom cabinet and it’s a stock I have been looking at personally.

I have recently been doing a series of webinars for the CFA Society in the UK and last week I was asked about finding ideas. I suggested to the participants that they could try our taster course which includes three lectures on how to find stock ideas, including this method of brands you love. We ran this as a competition last year and we had some great results. Feel free to try the mini-course, send in your ideas and we shall send some tasteful merch, or perhaps even a free course, to the best ones.

Idexx in the veterinary diagnostic equipment had a great pandemic as people bought pets, but there is a bit of a hangover now. The fund bought Nike during the pandemic when it was down 40%. Management crushed it in direct-to-consumer, but neglected the traditional bricks and mortar channel. Smith expects the new CEO to sort this out.

Novo Nordisk was at one point down 45% last year and Smith spent quite some time in the Q&A on the stock, so more on this later. Smith retained his holding in Brown-Forman but sold Diageo, again more later. He highlighted that Brown-Forman had been family-owned for over 150 years and that the company survived Prohibition, so he felt comfortable about current issues in the drinks industry.

Relative Performance

Smith highlighted that the distribution of returns in the S&P500 was unusually concentrated. We know this of course, but the table is a copy of one of his slides:

S&P500 Performance Attribution

Source: Fundsmith

I don’t recognise this data and the fund owns both Meta and Microsoft although the latter holding may be sub-benchmark. He displayed a similar chart for the DAX and this was more surprising:

Dax 2024 Attribution

Source: Fundsmith

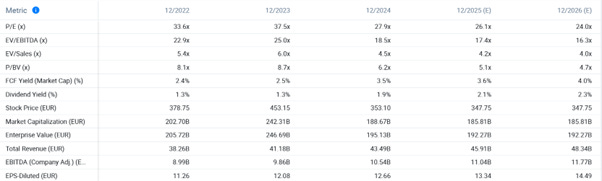

Smith is concerned that the rise of passive has gone too far. Jack Bogle was asked at the 2017 Berkshire Hathaway AGM if there was a level at which passive would distort markets, and he said there was, although he didn’t specify a number. Index funds invest in proportion to market value and create momentum; and fund flows have been exacerbating the problem. He put up this chart of the performance of the S&P 500 index vs the equal weighted S&P 500:

S&P 500 Index Performance vs Equal Weighted

Source: Fundsmith

The market cap weighted index has delivered a 60% gain in the period, over twice the 28% gain for the equal weighted index.

Strategy

Fundsmith’s mantra is

Only invest in good companies

Don’t overpay

Do nothing

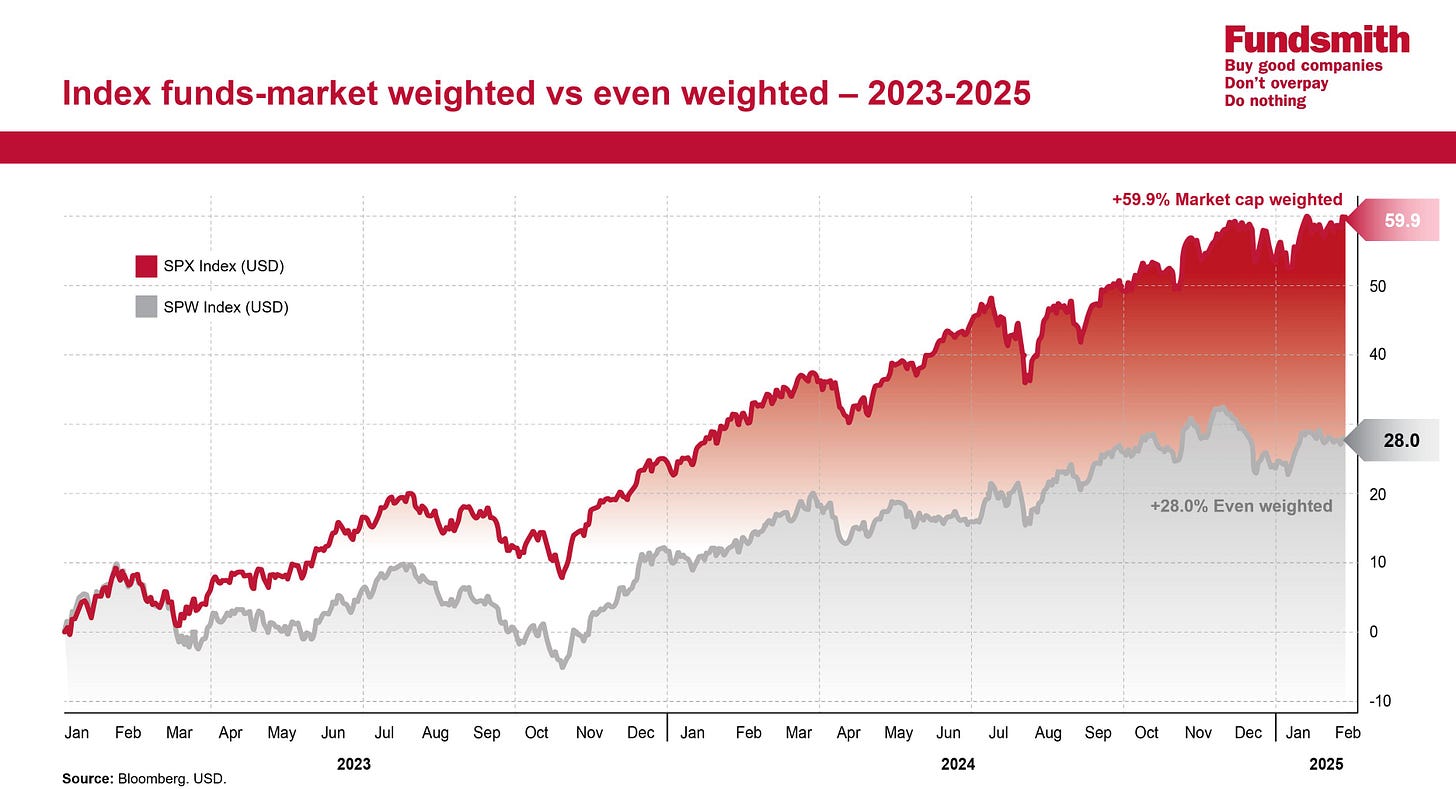

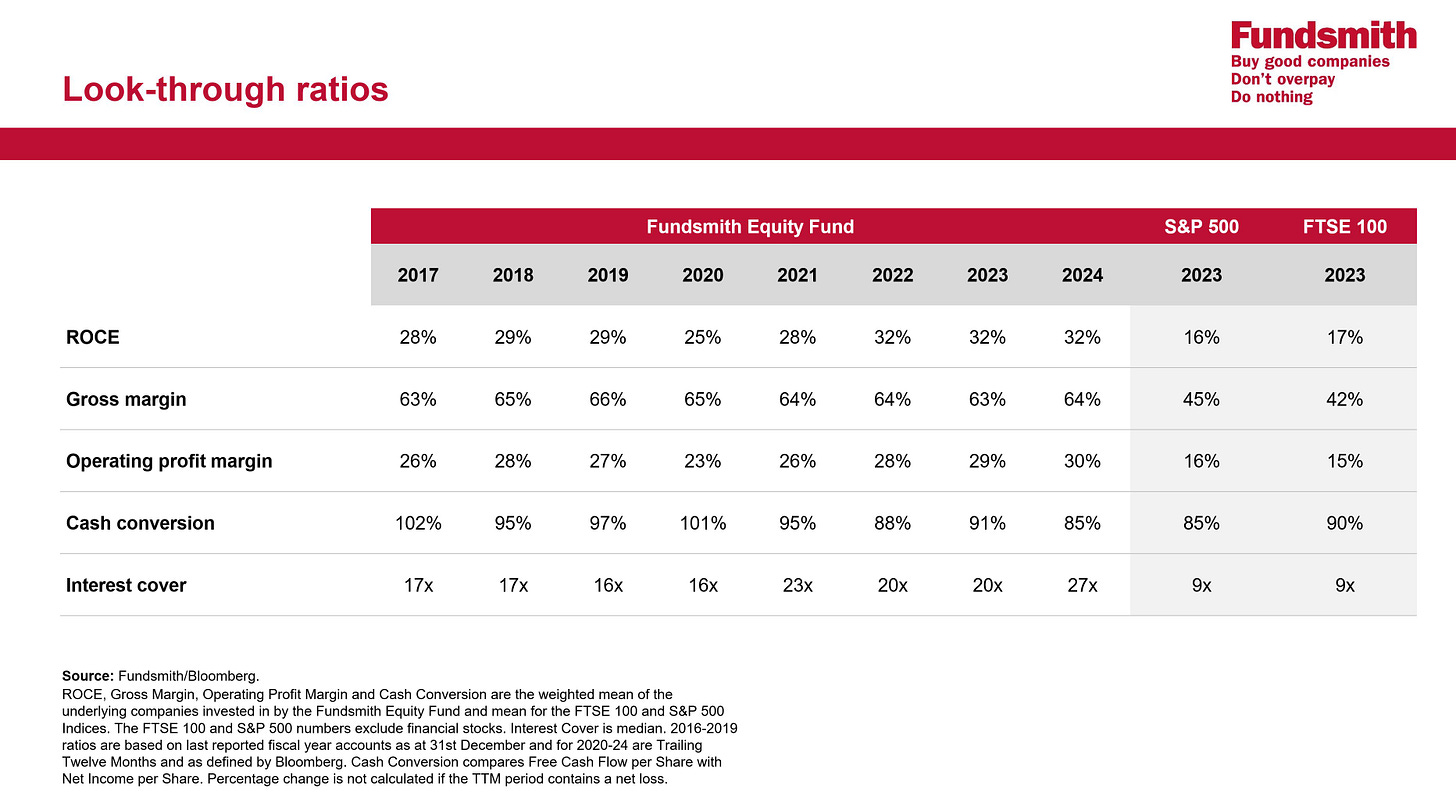

The portfolio is clearly high quality as the attributes slide shows:

Fundsmith Portfolio Attributes

Source: Fundsmith

The quality of the portfolio is apparent:

Returns on capital twice the market

Gross margins 1.5x the market

EBIT margins 2x the market

Cash conversion similar to market (and formerly higher, but for significant investments by tech into AI and Novo Nordisk into manufacturing)

Lower debt than the market

The fund has a FCF yield of 3.1% which is 20% dearer than the S&P 500’s 3.7%.

Activity has been limited to:

Fundsmith 2024 Portfolio Changes

Source: Fundsmith

Texas Instruments is the world leader in chips for analog devices with an average selling price of c.$1. Some 20% of its business is in China where they also manufacture, with most products dual sourced, and hence there is a large element of protection from tariffs.

Atlas Copco makes compressors and power equipment and is highly decentralised. It is controlled by the Wallenberg family which has been in charge for 168 years. Smith likes family controlled businesses as they tend to be longer term oriented. And it’s an assembler rather than a manufacturer so less working capital and higher returns.

It is hard to overestimate the importance of the Wallenberg family for Atlas Copco Group’s development. More than once in its 150 years, the company has had to be reconstructed with the help of the family. For many years, the chairperson has also been a Wallenberg. Today’s Wallenbergs still see Atlas Copco as one of their most valuable – and dearest – holdings.

Source: The Centre for Business History in Stockholm

Not mentioned in the meeting, but noted in a recent filing, the fund has purchased positions in Medpace and Doximity. Medpace is a late-stage contract research organization that provides full-service drug-development and clinical trial services to small and midsize biotechnology, pharmaceutical, and medical-device firms. Doximity Inc is a digital platform for U.S. medical professionals which gives them tools to collaborate with colleagues, securely coordinate patient care, and conduct virtual patient visits.

They sold Diageo, the decision being attributed to weight loss drugs, more on this later, but note they still own Brown-Forman.

He bought a position in Apple at an 18x P/E and expected to increase weighting, as the stock responded badly to expected sluggish sales growth; the growth was sluggish, but instead the price doubled and he sold the small stake.

Condiment maker McCormick suffered input cost inflation post-pandemic and Smith began to question the quality of the business when it lost 3-4 points of gross margin.

McCormick Margin Trend

Source: BTBS from AlphaSense data

Q&A

This is not a Berkshire-style, anything goes session. Instead, questions are submitted in advance, chosen by a journalist and the team prepare answers, often with accompanying slides. The benefit is that there is some editorial applied to the questions and the audience can study the accompanying data in the slides. The drawback is less spontaneity and less fun. Smith has an acerbic wit and I would quite like to see more of that on display, but the format works and there were some interesting questions.

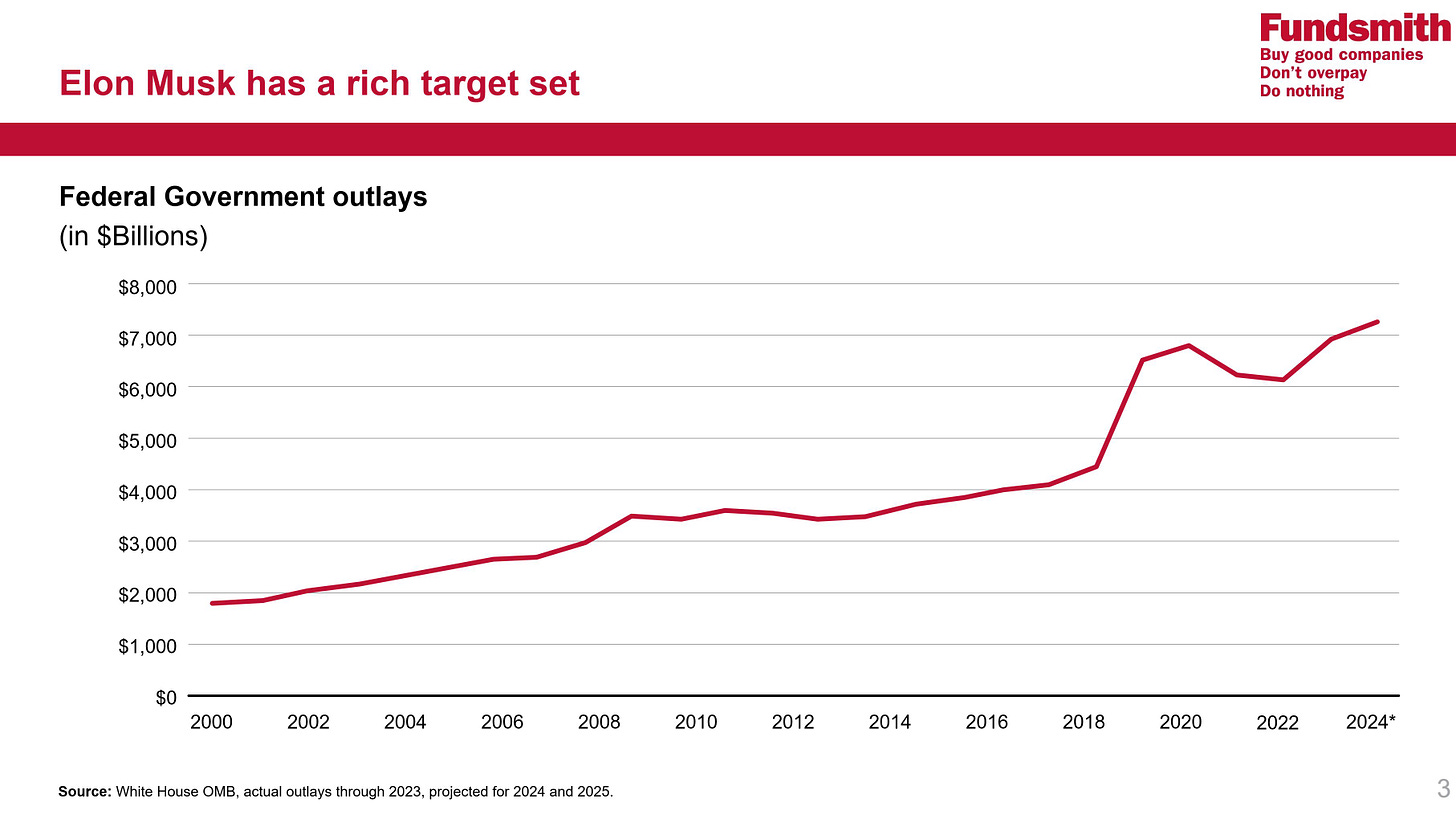

On Musk and the opportunity to rein in the deficit, Smith (who claims that politics and economics play no role in his investing process) thinks the deficit is a spending problem, not a revenue problem:

Federal Government Outlays

Source: Fundsmith

He pointed out that not only is the US the biggest economy in the world, its poorest state is Mississippi, whose median income of $44k is higher than that of the UK. Quite depressing for us Brits. And apparently the Guardian calculated that there had been $72bn of fraudulent social security claims since 2020. That’s the UK’s defence budget!

The team are concerned about the level of capex by the hyperscalers, although the data they put up (sourced from Bloomberg) were lower than the data I have seen and I have therefore used the AlphaSense forecasts below. Fundsmith used a 2024/5/6 progression of $209/258/281bn, slightly lower than below, but yesterday, I saw a $340bn number for this year.

Hyperscaler Capex

Source: AlphaSense

These are of course huge numbers and Smith is rightly concerned that the investments will dilute returns as the group needs to deliver an additional $100bn of cash flow which is a huge ask. And these numbers are only capex, and don’t include the inevitable associated investment in R&D, the necessary additional labour etc.

Just to contextualise this, here is the table showing capex: revenue, which is not quite as scary, but still a huge increase from 11-13% to 19-20%:

Hyperscaler Capex:Sales

Source: AlphaSense

A purely rational Martian might wonder why this spend should result in higher share prices for the companies involved.

The team were asked about management incentives and highlighted Unilever as a good example.

Unilever Short Term Incentive Factors:

40% organic sales growth

30% adjusted EBIT growth

30% FCF growth

They view it as acceptable not to include returns in short term incentives as it takes time to improve returns.

Unilever Long Term Incentive Factors:

25% organic sales growth

30% total shareholder return

30% ROIC

15% sustainability progress

They take voting seriously and always vote. In 3041 votes, they have voted against management 6% overall, but 52% of the time in remuneration votes.

They highlighted how companies often use bad peer groups to compare remuneration. Nike’s peers are American Express, Best Buy, Coke, Kimberley Clark, Lowe’s McDonald’s, Microsoft, Mondelez, Netflix, Oracle, Pepsico, Procter & Gamble, Salesforce, Target, TJX, Walmart and Walt Disney. Missing are Adidas and Puma which are European companies and pay executives less.

I also found it curious that Nike has a market cap of $120bn, and the average of the group has a market cap of $380bn or >3x the size. Those also appear to be quite successful businesses with an average share price of 88% of the 12 month high. Nike is at just 66%. Presumably, CEOs and CFOs of successful businesses get paid more.

Similarly, they flagged the Estee Lauder peer group which didn’t include L’Oreal!

They dismissed talk of the US being much more highly rated and the UK being very cheap with this interesting slide:

UK vs US Valuation

Source: Fundsmith

You can argue about some of the comps but this is quite a good illustration that on a like for like basis, there isn’t as big a premium in the US as people perceive. I think the fact that 3 of the 4 UK companies to relist in the US enjoyed a rerating suggests that there is a premium, but perhaps it’s narrower than market perception.

Conclusion

It’s not Omaha, but you get a free glass of wine and some crisps. I think it’s a really interesting and enjoyable event and it’s a lot cheaper than going to Omaha.

Premium subscribers can read on for

the surprising information Terry shared with me.

the stock we both own on which Terry had some really bullish news which I didn’t know and which makes me more positive.

Terry’s pick for 2025.

the team’s insights into weight-loss drugs and the relative merits of Novo Nordisk vs Eli Lilly.

a stock where I disagree with Terry and why.