Introduction

In April, 2021, I wrote a critical piece on Ferrari expressing concern that its 43x P/E was too high. This was despite the fact that I had - and still have - confidence in the 2023 outlook, as I am sure the Purosangue (the new Ferrari SUV and its first volume 4 door car) will be a success.

Unfortunately, Ferrari has longer term issues which make me less comfortable. After reading today’s article, you’ll understand why. But first, let’s look at the bull case for Ferrari.

Ferrari Purosangue

Source: Ferrari.com

The Bull Case for RACE 0.00%↑

When a Ferrari IPO was first discussed, I knew it would go well. Mostly because I am a car enthusiast that is very familiar with the marque (I have owned more Ferraris than any other make).

Dureka Carrasquillo, a Senior Portfolio Manager at the Canadian Pension Plan Investment Board, made a convincing argument for the stock at the 2018 Sohn London conference. I suggested to the hedge fund manager next to me that he could pair it with an Aston Martin short, which I had been proposing at the time. Looking back, that would have been a highly successful pair trade.

Note that the chart below plots AML in declining sterling and Ferrari in appreciating dollars – the real gain is even higher.

Ferrari in $ vs Aston Martin in £ as Indices since the AML IPO

Source: Behind the Balance Sheet from Sentieo data

As I said, Carrasquillo’s pitch made a strong case for owning Ferrari. So to review the bull case, I thought I’d add a few comments to the following points from her presentation. My comments (with the benefit of some hindsight) are in italics, otherwise they are her forecasts.

The $570bn luxury car market was expected to grow at about 9% pa for the next 5 years.

Ferrari is an experiential luxury good, a category projected to grow at an even higher rate.

She expected Ferrari to increase price by about 4-7% pa.

Special cars have historically been c.2% of sales but she estimated that by 2022, they would reach 20% of revenues. These limited-edition cars are exemplified by the 500 Monzas (>$1m) which she said sold out on the first day.

Spoiler: a few weeks later I bumped into Max Warburton who for a long time was the #1 rated autos analyst when he worked at Bernstein. He told me that you could still get a Monza at list price as they had not sold out. This was a quite critical piece of information. If Ferrari could not sell all of its limited-edition models, it showed the market was approaching saturation and perhaps had already peaked.

Gross margins on limited-edition cars are about 3x base cars, and Carrasquillo forecast EBITDA margins would increase from 33% to 38%. Sentieo consensus 2024 EBITDA margin was 39% when I first wrote and is now 37%.

She estimated the current capacity (in 2018) at c. 16,000 units pa but supply (production) was limited to 9,000. Ferrari sold 11,155 cars last year while Porsche sold 38,464 of their 911 model alone.

Ferrari Monza

Source: YouTube – Nico Rosberg at Mugello driving the €1m+ Monza.

Carrasquillo suggested that Ferrari could increase production to 16,000 cars pa and still sell them. My feeling was (and continues to be) that there would be significant demand in emerging markets, especially in China, for the SUV. On BBC Radio 4, when asked about the Aston Martin float, I said that the float would likely go well in spite of all the accounting shenanigans, because there were a lot of rich, fat, old men who couldn’t fit in an Aston Martin but would buy the new SUV model. The same is true for the Ferrari SUV, but additionally there are a lot of Chinese who prefer to be driven and Ferraris are the ultimate status symbol. A Rolls Royce says you are rich, but a Ferrari says you are rich AND cool.

She outlined 3 potential risks to the Ferrari growth thesis:

1. Do wealthy millennials want a Ferrari? Do they even want to drive at all? Ferrari’s sweet spot is in the 35-50 year age range. Although fewer millennials drive during their 20s than previous generations, by age 30 they tend to catch up. I wonder if successful young people today may have a different view of Ferrari - a Tesla is not a substitute but it has a different cachet.

2. Are there enough wealthy buyers? Ferrari buyers tend to be high net worth individuals with investible assets of >$1m. Ferrari sells cars to 0.5% of this group. In the ultra-high net worth bracket they have 3.25% penetration. Carrasquillo concluded that there is a good runway for growth. Clearly there is a large and growing highly affluent market for this product.

3. Changes in consumer preference. Consumers may become more environmentally conscious? They might prefer to use autonomous cars? The most bullish forecasts suggest that EVs may become 30% of the fleet by 2030. In addition, Ferrari were aiming for 60% of their new cars to be hybrid by 2022. And that the hybrid cars will have higher price tags and be more profitable. It looks like Ferrari currently have just two hybrid models, the SF90 Stradale and the 296. In a recent interview, I thought new CEO Benedetto Vigna was unconvincing on the transition to electric – he talked about working on the noise, but how can an EV sound like a Ferrari?.

At the time of Carrasquillo’s pitch, luxury goods companies with a similar financial profile to Ferrari had an average P/E of 27x. Putting Ferrari on a luxury multiple implied 60% upside, according to Carrasquillo. Valuing Ferrari based on cashflow implied a growth requirement of 3.5% per annum, yet it had been growing its top line at 10% per year for the past 20 years.

Ferrari Stock Price

Source: Behind the Balance Sheet from Sentieo data

This was a convincing presentation and Carrasquillo was proved right. The chart above shows the performance of Ferrari shares since float – it almost doubled since the presentation on 29/11/18 to my first article in 2021. Since then, it has weakened with the market’s move away from growth stocks.

Valuation

In my original article, I explained that Ferrari was no longer being valued as an automotive manufacturer, but more like a luxury goods stock. Here is the Sentieo print of $RACE valuation metrics as of 26 April, 2021:

And here is the similar print today:

The price is about 10% lower now in Dollar terms. But it is 20% higher in Euros, despite the Euro estimates coming down for this year. Consensus 2022 EBITDA has fallen from €2106m in the first table to €1649m in the second (-22%).

EBITDA estimates for 2021-23

Source: Behind the Balance Sheet from Sentieo data

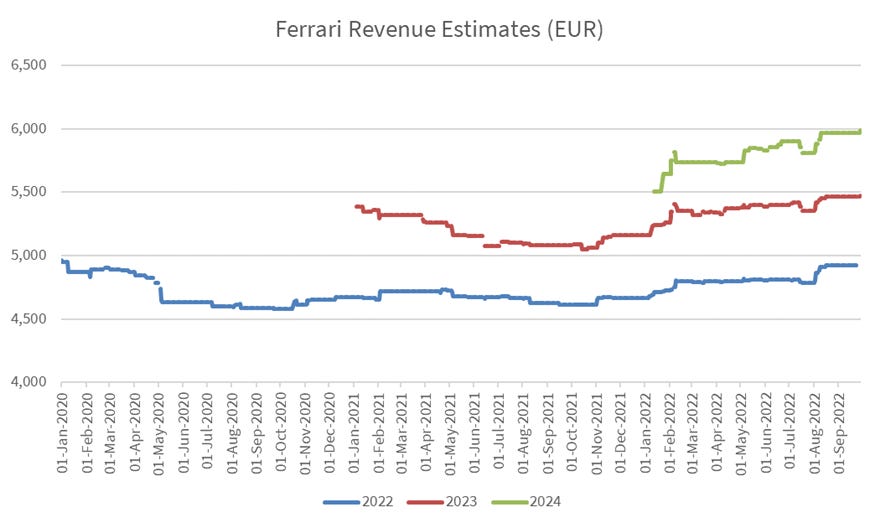

While EBITDA estimates for 2022 have gone down, those for 2023 have increased, as seen in the chart above. It’s important to note that 22% of revenues were earned in the US last year with Asian dollar-linked revenues (Hong Kong, for example, is an important market) taking the total to nearer 30% in dollars. That has probably added c.5% to 2023 forecasts. The following chart plots the revenue estimates for which we also have 2024 data. It’s clear that revenue forecasts have increased by around 10%.

Revenue estimates for 2022-24

Source: Behind the Balance Sheet from Sentieo data

Last April, a P/E of 43x and an EV/EBITDA multiple of 23x seemed like racy valuations. Today, with a lower ($) share price and much lower current year forecasts, the multiples shown by Sentieo have “only” shrunk to 40x and 22x for the new current year of 2022. Forecasts for the current year show growth on 2021 but are now lower than when I last wrote.

Last time I compared Ferrari’s multiples to those of LVMH, which were slightly lower than those of Ferrari (37x P/E and 19x EV/EBITDA). Today, LVMH is on just 22x P/E and 13x EBITDA as per Sentieo. These are now considerably lower than Ferrari and show a significant derating in the last 18 months.

My overall conclusion last time was that I thought Ferrari’s valuation was too steep long term, but that the new SUV could be a medium-term prop. Paying subscribers can read on for my conclusions today.

Footnote: the Sohn London Conference is both a great event and a great cause. This year, it takes place on November 16 and the organisers have a few special presentations – you can book here and in a rare example of deflation, the price is lower than it was at the first event in 2013.