Doomed to crash?

This auto IPO (not Carvana) has been a disaster. Luckily, ther accounts told you it was coming

Introduction

Aston Martin is launching another rights issue, to raise £635m, bringing in Saudi Arabia’s sovereign wealth fund as a 1/6 shareholder via a placing; and the Saudis, Mercedes and Lawrence Stroll are investing a further £335m in the rights issue. The announcement was greeted with relief in the stockmarket. But this is just the latest in a long string of financial rescues for the long-time ailing car company which has gone bust almost as many times as its famous customer James Bond has come back from the verge of death.

Aston floated in London in October 2018 at £19/share through a secondary issue in which the vendors raised £1.051bn. No new money was raised for the company. Within 18 months, the Aston Martin returned to the market for £500m of new money, raised in a dilutive rights issue and a placing at £4. The company has also tapped the debt markets.

The day after the initial IPO announcement, I appeared on the Today Programme on BBC Radio 4 to discuss the float. (For overseas readers, this is the most popular news show on UK radio with about 7 million daily listeners). The night before, I had had a quick scan of the private company’s accounts which suggested all was not quite right – massive capitalisation of R&D and limited liquidity were my main issues. When asked about the opportunities for the company, I responded that the proposed SUV should do well – “there are a lot of fat old men who can’t get into an Aston Martin who will buy it” – and let’s see how it is priced.

Source: Aston Martin

IPO and subsequent share price performance

A few months on and I was telling friends and clients to be very careful – the accounting looked terribly aggressive and in spite of the obvious liquidity strains, the IPO was not raising any new money, which seemed mad to me. The chart shows how the share price has fared since the IPO.

Aston Martin Share Performance Since Flotation

Source: Behind the Balance Sheet from Sentieo Data

The shares have been a disaster and there were some very obvious signals. In this article and a subsequent one, I want to look at the treatment of intangible assets. In a later article, I shall look at the liquidity picture, as well as some of the other issues.

The Initial Picture

The Aston Martin prospectus showed that the company was capitalising almost all its R&D spend as shown in the table:

Aston Martin R&D Note

Source: Aston Martin IPO Prospectus

The prospectus explained the high level of R&D: “..continued investment in new core models as part of the Second Century Plan, in particular new Vantage, DBS Superleggera, DBX and increased investment in special projects which include the Aston Martin Valkyrie. During the six months ended 30 June 2018, the methodology applied to the capitalisation of development costs for new cars was refined to more appropriately reflect the point at which the development phase starts in the current development process. The impact of this change on the six months ended 30 June 2018 was that approximately £9 million more development costs were capitalised.”

My impression was that the bulk of the R&D must have been for the new DBX SUV and that there would be a build-up of R&D on the balance sheet. I didn’t realise how fast it would be accumulating. By the end of 2017, capitalised development hit £830m gross and £511m net. By the end of 2018, it reached £653m net after £214m spend and £202m capitalisation. In 2019, the company spent £226m and capitalised 100% and the asset rose to £770m.

Aston Capitalised R&D Movements

Source: Behind the Balance Sheet from Aston Martin Reported Data

When the DBX came into production in 2020, amortisation started to hit the P&L and the asset hit £1.437bn gross and £784m net, still an increase on end-2019, as the £178m of spend was only partly offset by a charge of £93m and impairment of £69m. In 2021, spending continued at a rapid rate, with another £178m added to the asset and only £129m of amortisation, giving an end-2021 picture of a £1.6bn asset, accumulated amortisation of £781m and a net asset of £833m.

But it’s not just the capitalised R&D. Aston’s balance sheet now carries £1.4bn of intangibles. Let’s take a closer look.

Start with the Audit Report

When I open a new set of accounts, I have a fixed sequence that I always go through. One of the first checks is the audit report. Apart from the usual checks:

True and fair view

Going concern

I also examine closely the section where the auditor discusses key audit matters – items where the auditor has had some disagreement or at least some discussion with management. These are the areas where there is perceived to be the greatest risk of error or fraud in the financial statements.

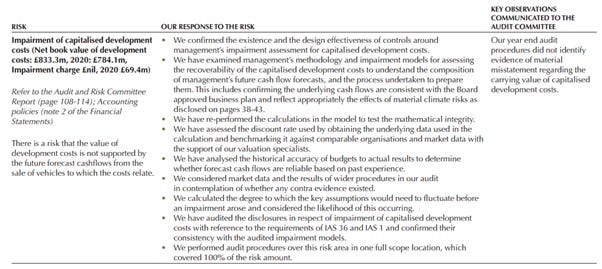

We shall return later to the first point in the Aston audit report, revenue recognition, but there are two comments on development costs. Here is the first, relating to capitalisation and amortisation:

Aston Martin Audit Report Comment on Intangible Assets

Source: Aston Martin 2021 Report & Accounts

There is a risk that costs are capitalised which should not be and that the capitalised development costs are overstated. The auditor tackles this by reviewing the accounting entries and checking they conform with the policies. The second note is perhaps more interesting.

Aston Martin Audit Report Comment on Risk of Impairment

Source: Aston Martin 2021 Report & Accounts

There is a risk that the capitalised development costs are not supported by future vehicle sales and the auditor carried out various tests to ensure the calculations added up and used the appropriate discount rate. I am not sure to what degree the auditor would be qualified to assess the future likely sales, but they gave the company a clean bill of health.

Intangible Assets

At this point, let me show you the full intangibles note:

Aston Martin Intangibles

Source: Aston Martin 2021 Report & Accounts

The company is carrying £1.4bn of intangibles on its balance sheet with a gross cost of £2.2bn and an amortisation last year of just £135m. Hmm. I shall go into a little more detail on the other intangible assets next time, as they are worth discussion. But let’s just close off looking at the capitalised development costs.

I made these a case study in my Forensic Accounting Course, and back in 2019 I pointed out that Aston Martin was storing up a lot of trouble for itself. It had reported sales of £1.097bn in 2018, up from £876m, and its adjusted operating profit was £147m (£125m), which was twice its actual operating profit of £73m.

I pointed out to one class that even if the new SUV was a stupendous success and equalled the total revenue from sports cars, it would barely move the profits needle because of the huge development cost being accrued that would have to be written off over the new model’s life. I estimated a drag of £100m-£130m, ie almost the entire sports car operating profit then. Assuming the SUV made similar margins to the sports cars, the incremental profits would be minimal. This caused a furore with one client who was a heavy owner of the stock – he didn’t have a counter-argument and now probably doesn’t have a job.

Source: Aston Martin

My numbers were not wildly out. Last year, the group with the new SUV, which has been highly successful, produced revenues of £1.095bn, little changed on 2018 and an operating loss of £74m.

Next time I shall return to the other intangible assets. Paying subscribers can read on to get access to an interesting interview.