Introduction

Big tech has been showing exceptional earnings growth. Not all of it is real, I believe. A good illustration of this is these companies have trouble working out how long a server should last.

Strange, as these are the largest tech companies in the world and the biggest providers of cloud computing services. I would hope they would know precisely how long their principal capital equipment assets last.

There are two ways of looking at this – these companies are making real technological advances and it’s simply the accountants who have trouble keeping up. Or the explanation I lean towards:

One accountant had the bright idea of extending the server life and reducing the depreciation charge to boost reported earnings growth and help the company meet its targets (oh, and coincidentally collect a bonus).

Other tech accounting departments saw this and either said oh that’s a good idea, let’s copy them and boost our earnings too. Or perhaps they were less enthusiastic but felt they had to follow suit or be unfairly penalised.

The rationale doesn’t matter – this is accounting shrinkflation. A bit like how you pay the same price but get a smaller Snickers bar these days, this time you pay up for a larger, but lower quality, eps number.

I covered this in passing when looking at Amazon’s cash flow last year but now that Amazon has revised server life for a third time and Meta has joined the party, I thought it was worth revisiting.

Before getting into the detail, don’t forget you can learn to carry out this type of analysis by joining my Forensic Analysis Bootcamp. The next one starts on March 4 and one world-famous institution has sent six (!) of their analysts on the course. For more details and a full schedule of workshop topics, please go here.

Alphabet

Alphabet has “re-lifed” its servers twice, in January 2021 and in January 2023. The first change increased EBIT by $2.6bn (vs an original estimated impact of $2.1bn) and net income by $2bn. The second change boosted EBIT by $3.9bn (vs an estimate of $3.4bn) and net income by $3.0bn. The difference between the EBIT impact and net income impact is presumably deferred tax.

It’s perhaps worth mentioning that the difference between the estimate and the actual is less significant as the estimate is based on the end-2022 assets before 2023 capex and the 2023 earnings release disclosed the actual impact.

I don’t want to overstate this but the cumulative benefit to profitability is significant. These impacts are cumulative – but it would be unfair to simply add the two disclosed effects and conclude that net income has been boosted by $5bn in total, as it’s more complex.

Alphabet grew adjusted net income from $40bn to $74bn between 2020 and 2023, an 83% increase, so that calculation would reduce the growth to +71%, which is still impressive. I estimate the actual impact is slightly lower. Taking a stab at requires takes a lot of estimates. It took me a whole morning and I got +74% like for like adjusted net income growth.

But it affects the multiple and latest eps growth. Last year, net income growth was reported as 23%. Without this change, it would have been 19% - a difference which affects the multiple investors would pay, in my view. Obviously, there is no cash flow impact, so investors are likely to be tolerant.

The overall impact is clear from a look at the trend in depreciation and amortisation to sales:

Alphabet Depreciation Relative to Sales

Source: BTBS Calculations from Sentieo data

This is ironic as the company was 50% more capital intensive in 2023 than in 2012, although sales have been increasing faster than investment mor recently. The capex: depreciation trend is steadily up, as shown in the chart below. Note that this “software” company has over $200bn of assets on its balance sheet.

Alphabet Capex to Depreciation

Source: BTBS Calculations from Sentieo data

I am not trying to imply that the Alphabet CFO is up to mischief. As far as I am aware, there is no EPS incentive in the management compensation. It appears to be based only on the total shareholder return vs the S&P 100 – hardly a challenging base hence the CEO was paid $226m last year.

But the extension of asset lives must mean that Alphabet’s quality of earnings has been diminished. The earnings multiple contracted from 30x to 24x in the period, driven by AI fears. Had the multiple increased, that might have been a concern.

Amazon

Amazon has revised the life of its servers three times. Here is what Amazon said in its 2020 10-K:

“We review the useful lives of equipment on an ongoing basis, and effective January 1, 2020 we changed our estimate of the useful life for our servers from three years to four years. The longer useful life is due to continuous improvements in our hardware, software, and data center designs.”

The impact on 2020 EBIT was $2.7bn and on net income $2.0bn.

In their 2021 10-K, they updated the policy:

“…in Q4 2021 we completed a useful life study for our servers and networking equipment and are increasing the useful lives from four years to five years for servers and from five years to six years for networking equipment in January 2022, which, based on servers and networking equipment that are included in “Property and equipment, net” as of December 31, 2021, will have an anticipated impact to our 2022 operating income of $3.1 billion. We had previously increased the useful life of our servers from three years to four years in January 2020.”

The actual impact on the 2022 results was a boost to EBIT of $3.6bn and a benefit to net loss of $2.8bn.

And in a third move, Amazon disclosed in its earnings call for its 2023 results that the server life would now be 6 years:

“One thing I'd like to highlight in our first quarter guidance is that we recently completed a useful life study for our servers and we are increasing the useful life from 5 years to 6 years beginning in January 2024. We will have this anticipated benefit to our operating income of approximately $900 million in Q1, which is included in our operating income guidance.”

Presumably, this will have an impact of at least c.$3.6bn for the year.

Meta

Here is what Meta disclosed in its 2022 10-K:

“In connection with our periodic reviews of the estimated useful lives of property and equipment, we extended the estimated average useful lives of a majority of the servers and network assets from four years to 4.5 years, effective the second quarter of 2022, and further extended the useful lives to five years effective the fourth quarter of 2022. The changes in estimated useful lives were due to expected longer refresh cycles in our data centers.

The financial impact of the changes was a reduction in depreciation expense of $860 million and an increase in net income of $693 million, or $0.26 per diluted share for the year ended December 31, 2022. The impact from the changes in our estimates was calculated based on the servers and network assets existing as of the effective dates of the changes and applying the revised estimated useful lives prospectively.”

So it changed lives twice in the same year. I simply don’t understand how that happens, and why you would bother revising a second time for a 6 month extension. But the net effect is a positive impact on EBIT in 2022 of $0.9bn and on net income of $0.7bn.

Microsoft

Here is their disclosure in their 2020/21 10-K:

“In July 2020, we completed an assessment of the useful lives of our server and network equipment and determined we should increase the estimated useful life of server equipment from three years to four years and increase the estimated useful life of network equipment from two years to four years. “

The impact was a benefit to EBIT in 20/21 of $2.7bn and to net income of $2.3bn.

In July 2022, they increased the estimated useful lives of both server and network equipment from four years to six years. The effect of this change in estimate for fiscal year 2023 was an increase in operating income of $3.7bn and in net income of $3.0bn.

Conclusions

I think it’s highly unlikely that these companies have different server lives. At the margin, one may have lighter use or higher efficiency or cooler data centres, but the lives of the servers are unlikely to be materially different.

Hence we can take away two things from comparing the lives:

we can see which companies are more and which are less conservative

we can see which companies are accelerating their earnings most by changing policy

Server Life Comparison

Source: Behind the Balance Sheet from 10-K Filings

Meta is the most conservative of the four while Microsoft has gone from being the most conservative to being in line with the other peers.

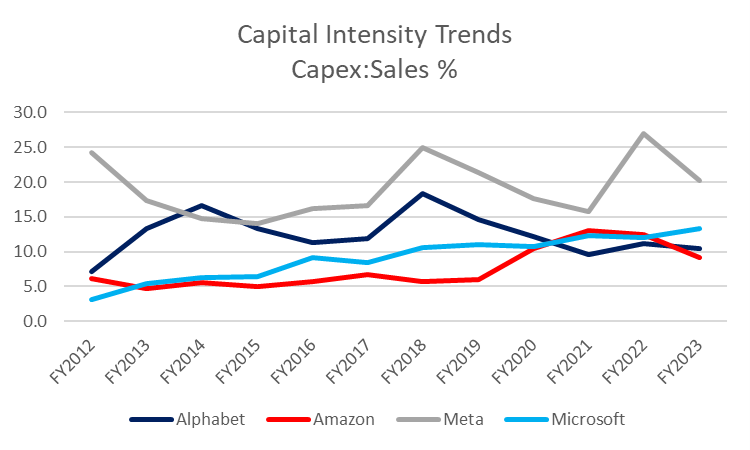

Capital Intensity Trends

Source: Behind the Balance Sheet from Sentieo data

That these companies (with the possible exception of Alphabet) are becoming more capital intensive looks quite clear yet their profitability is carrying a lighter burden from providing for replacement. That’s incongruous. Of course nobody will care and I cannot imagine the sell-side spending two minutes on this but presumably that’s exactly why you are reading this blog.

Premium subscribers can read on for more detail on the financial impacts. If you haven’t joined the hundreds of investors who get the full version yet, don’t forget you’ll also get instant access to the paid version of all 150+ posts I’ve ever published. Including the bumper write up on WPP last week.