So the race to invest with Bill Ackman has started. At a presentation in Omaha the day before the Berkshire AGM, Bill explained that he was planning this issue so that the ordinary man or woman on Main Street America had the opportunity to invest in a hedge fund. I thought what a nice guy.

Just a matter of weeks later, it transpired that Bill had sold 10% of his management company for $1bn, on the basis that he was going to raise $25bn of permanent capital with a 2% management fee – a $500m pa annuity, and likely inflation linked, or at least stockmarket linked.

Bill Ackman – Sales Mode

Source: netroadshow.com video

No question that Bill is a shrewd operator and he is now capitalising on his 1.3m Twitter following. The IPO has a slide deck and a presentation by Bill (photo above) and I thought it might be interesting to highlight a few slides.

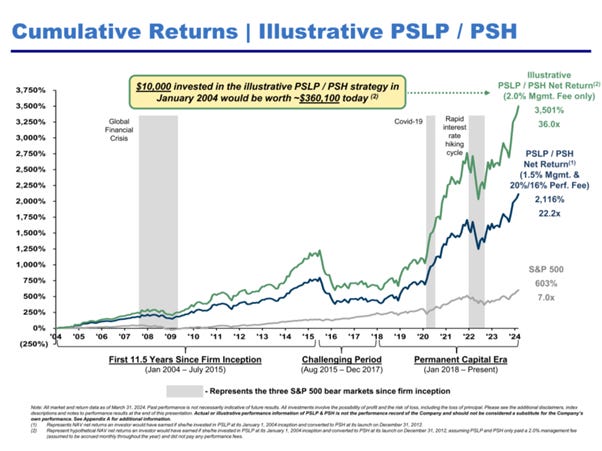

The deck has a couple of slides with illustrative performance, based on the actual historical performance of Bill’s US hedge fund and European quoted vehicle, Pershing Square Holdings, but with the US 2% flat fee structure instead of the others’ management plus performance fees. The returns of course look very attractive as those funds have done well. They are suggesting that investors would have made 36x their money in the new fund structure as opposed to 22x their money in the actual vehicles with the higher fees.

I should point out that past performance is not a good guide to the future and if Bill were indeed to repeat that performance, he would be managing a US quoted fund with $900bn of AUM in 2044. He normally has 10-12 stocks, so his universe would be stocks over $1tn, if he limited himself to sub-10% stakes. He would also be 78. I think it’s more likely that Bill will then be President of the United States.

Illustrative Returns

One of the slides showed Bill’s investment principles which I rather like. I am not sure how Valeant or Nomad Foods cleared the “valuation not reliant on M&A” criterion, but to be fair, that may be a lesson learned.

Pershing Square Investment Principles

Source: Pershing Square Capital Management

USPs

Among Pershing’s “unique franchise”, the company lists

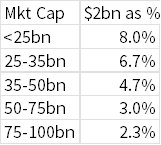

Concentration – 12-15 holdings. The US market is large and liquid, and this is not unrealistic but it narrows the potential universe significantly. Let’s assume that he doesn’t want to own more than 10% of a stock, an arbitrary number and one predicated on his investment in Universal Music. At a $25bn raise, that’s around $2bn in each investment and means his universe is likely to be stocks over $20bn market cap. There are 1000 stocks in the world on AlphaSense with a market cap of over $20bn, with a few duplicates in there. Of these, 425 are quoted in the US. Is 425 enough? I don’t know, and hopefully, Bill has this worked out. But I think this is an interesting problem to consider. First, let’s look at how the stocks are stratified by market cap, as he probably won’t want to own 10% each of 12 stocks.

Large Cap US Universe by Market Cap Band

Source: Behind the Balance Sheet from AlphaSense data

About 50% of the universe is below the $50bn market cap level and about half above it. And here is the percentage stake implied by a $2bn investment at the mid-point of each band:

How Much does $2bn Buy You?

Source: Behind the Balance Sheet from AlphaSense data

I then stratified the list by Market Cap to Revenues for simplicity – it’s not a great parameter and I would normally use EV:sales but this way I at least know the data is correct and it’s a rough cut value filter. Here is the stratification:

US Stocks over $20bn Market Cap by Valuation

Source: Behind the Balance Sheet Calculations from AlphaSense data

Now I don’t know exactly where Bill’s sweetspot is, but I would guess that very few of the stocks under 1x will be interesting and similarly above 7x doesn’t sound cheap enough, although a few will make it in as they will be high margin or high growth businesses.

There are 271 stocks in the 1-7x revenue band. I imagine that at least half the stocks in the 1-2x band will be ruled out. Here is this grouping by sector:

Stocks by Sector in Right Valuation Band

Source: Behind the Balance Sheet Calculations from AlphaSense data

I cannot imagine that Bill will be buying many utilities, 22 in total, nor many financials which will be mainly bank and insurance and that’s another 49 stocks. Some of the materials stocks might qualify (the quarries for example) but at least half of the materials sector will be ruled out as will almost the entire energy sector, 20 stocks. That leaves a universe of 49 consumer staples and discretionary, 23 healthcare, 51 industrials and 27 IT stocks and maybe 15-20 others. A 170 stock universe is a perfectly reasonable target, in my view, and one of my clients limits their research to a similar number. Their stock performance isn’t as good as Bill’s.

If I were investing in this fund, I would want to do some further work to ascertain that this is a feasible target. I haven’t done so deliberately.

Economies of scale – Pershing say that larger ownership stakes enhance influence at portfolio companies. I would have thought that there were significant diseconomies of scale from deploying this amount of capital. And I am not sure that I would describe the ability to exert influence as being an “economy of scale”, perhaps it is a scale benefit.

Differentiated expertise in executing privately negotiated transactions. I assume this refers to their deal to buy 10% of Universal Music and their ability to be a cornerstone investor in similar flotations.

Investor Communications

Investor communications will include an annual meeting investor day and Twitter for timely investor updates. Bill has 1.3m followers and I look forward to hearing the SEC’s perspective on using an unregulated method of communication with investors or perhaps this is fine these days, now that Elon owns Twitter/X, as he gets along so well with the SEC. I particularly liked the following element on the comms slide:

Robust Investor Engagement

So even the Redditors will be targeted. I wonder how the Wall Street Journal and FT will feel about this, but Bloomberg is already keen:

“With lower required costs than his typical hedge fund fees and social media popularity, the US-listed Pershing Square USA Ltd. could become the largest closed-end fund in the country and trade at a premium to its net asset value,” Bloomberg Intelligence analyst David Cohne wrote last month.

I think it’s quite likely that this will become the largest closed-end fund in the world. And it could trade at a premium to NAV for a couple of days post issue, as the European one did. But I doubt that will be sustained – look at the European fund’s trend:

Pershing Square Holdings Discount to NAV

Source: Behind the Balance Sheet from Pershing Square Holdings data

Other

One curiosity: there is an issue of $50m in preferred securities to Pershing Square Capital Management at IPO. They say that this will provide flexibility to use derivatives under SEC Rule 18f-4. I am not clear why this rule is cited as it’s a rule change to allow mutual funds to use derivatives to hedge portfolios. I am not that familiar with the legislation, so I could well be missing something, but the issuance of preferred stock appears something quite separate.

The interest rate on the preferred stock is not specified in the prospectus, but it has preferential rights in the event of a liquidation of the fund, but only to repayment of principal and interest. It also carries rights to block a reorganisation, but I cannot imagine that Bill Ackman needs any position pill protection. It’s very small in the context of the fund, but I am always curious about these types of unusual instruments or prospectus provisions as they can often reveal the intentions of the person on the other side of the transaction.

Premium subscribers can read on for my conclusions and access to the spreadsheet.