Introduction

Sometimes, having decades of experience in the stock market feels uncomfortable – it can make you too fearful. If you haven’t read The Money Game (amazon.com or amazon.co.uk) by Adam Smith (real name George Goodman), then read Chapter 12, where he explains the phenomenon far better than I ever could. It’s about history. Those of us who lived through it have vivid memories of the dotcom crash and as a consequence were far too conservative in the Covid tech bubble. Now, it’s all unwinding, much like last time, but faster, and in greater size, as the stocks are bigger.

Here is Bill Gurley, one of the best tech investors in the world, on the subject:

Gurley is spot on. The believers will anchor on the 12-month price high, a dangerous strategy. Twitter’s board sent a clear message about that approach when they accepted Elon Musk’s bid. That should, but probably won’t, discourage those who follow Cathie Wood of Ark Invest.

I have been chuckling recently as the value investors have started to sniff around tech – a big-name investor and someone I respect emailed me last week to ask which tech stocks I would buy on a five-year view. Schroders value team put out a blog “Is misfiring Netflix now a value stock?”

Nick Kirrage, co-head of the Schroders Global Value team (a former client of mine and a smart investor), said: “Areas of the market that have the biggest chance of falling in value are those that are the most expensive . . . There are some phenomenal tech businesses out there, and the time will come when value investors like me will have the chance to buy them. It’s just a matter of being patient.”

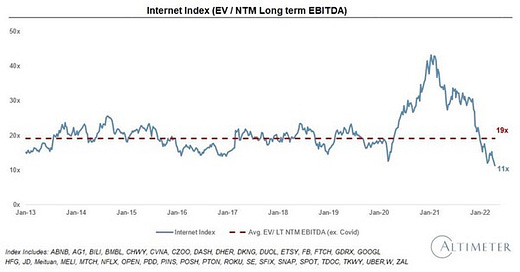

Given the pace of some of the declines, he may not need to be too patient. David Sacks highlighted some of the falls using data from tech-focused investment fund Altimeter Capital. The de-rating of the internet index vs its long-term average, let alone the fall from the eye-watering peak, is enough to arouse interest.

Source: Altimeter Capital

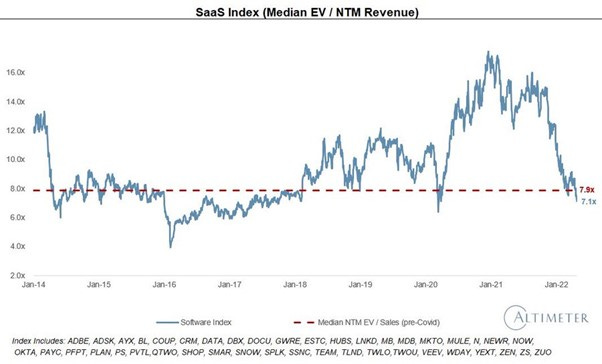

EV:sales is one of my favourite valuation parameters and has become the fashion for loss-making tech stocks. I shall return to this in a future article. The SaaS Index has now dipped below its pre-Covid median EV: Sales, having seen a 50%+ decline from the peak. It’s still not exactly a bargain at 7.1x forward sales:

Source: Altimeter Capital

In the dotcom bust, “value” buyers would sniff around a stock that had been cut in half only to see it fall in half again. And then again.

Definition of a stock that’s down 90%? One that fell by 80%, then halved.

And you don’t need me to remind you that 40x Ebitda and 16x revenues are daft valuations. There are of course companies which justify that – one in 100 tech stocks. If you buy stocks at those sorts of prices, the odds are you will lose money. At 8x revenues for a software stock, the odds were in your favour for the past few years, but that was an unusual time. It’s conceivable that it’s repeatable, but it’s far from a low-risk strategy. The fall from an overpriced top is never a useful guide to where value lies.

There is one factor which Nick Kirrage, and you, should bear in mind. And that’s stock options. I have written in the past about stock-based compensation and the pitfalls for investors and I am now writing a three-part series for this Substack (interspersed among normal service, as not every investor is an accounting geek). I start by looking at the reaction of companies to the fall in their share prices.

What now, after the fall?

Everyone in the tech companies loved stock options when the stocks were going up – employees got free options, the stock price was going to the moon, and they became rich. Management loved them because they got LOTS of options; and staff were happy because they were being paid often a ridiculous amount for their efforts. Shareholders couldn’t really complain much because the stocks were doing well – who cared about the 5% dilution when you had a 100% capital gain in a year or less?

Source: Lamborghini

Fast forward 12 months and the picture doesn’t look quite as attractive to tech employees. That Lamborghini you bought on the back of a week’s gain in the stock price may have to be paid for in real dollars. Your options are so under water that there is no chance that they will make you any money. Employees can then become so unhappy that they look for another job with stock options which are actually worth something – because if you start at a new company, they will offer you options based on today’s stock price.

So you certainly should not be surprised – and you should perhaps show a little understanding – when management reprice employee options. In reality, they have little option (sorry) if they are to retain staff. This is probably already happening. Here is Coinbase, the crypto platform, which reported Q1 results recently and its stock-based compensation charge had gone from $105m in Q1 last year to $352m; it was $263m in Q4.

Source: Behind the Balance Sheet from Sentieo data

Meantime, its revenues are falling and the stock price has collapsed:

Source: Behind the Balance Sheet from Sentieo data

So the market cap has shrunk 80-odd per cent, while the stock based compensation charge has gone up more than 3x. One reason might be more staff. This will not be true for all tech stocks. Many of them will be laying people off instead. Investing app Robinhood has one of the highest ratios of stock-based comp to revenue (87% last year in our screen!) but has apparently laid off about 9% of its employees.

More common, I suspect, will be that companies issue additional options – if the share price is falling fast enough, employees may be spooked and management may feel the need to issue even more options to retain them.

Where options are repriced, the accounting treatment is to value the new options and amortise the difference vs the original over the remaining vesting period. So we may well see a pickup in stock-based comp, but as every company seems to add it back to adjusted earnings, and analysts seem to ignore it, I am not sure there will be the share price reaction that would result if companies switched from issuing shares to paying in cash. Although that will likely also be a trend.

Therefore, this is a pattern which is unlikely to be unique to Coinbase. If we look at options struck at Alphabet and Meta, to pick two random examples:

Alphabet Restricted Stock Units

Source: Alphabet 2021 10-K

The Alphabet stock price when I wrote this was $2256, down 22% from $2897 at December 31, but still well in the money at 39% above the average strike price. But I bet the coders feel poorer. So far, no need to change any valuation calculations for the company. But it’s something to watch – will there be creep in the number of options granted?

Meta Restricted Stock Units

Source: Meta 2021 10-K

The Meta stock price when I wrote this piece in mid-May was $190. It was $336 at December 31. The average options are worthless and need a 30% hike in the share price to be worth anything. Expect Meta to reprice those units, representing 3.6% of shares in issue. It’s not the biggest issue for Meta right now, of course, but I would factor in 5% dilution into my valuation calculation and I would do some more work to calculate the annual dilution, although 5% is probably a safe number.

Conclusion

Bob Farrell’s 10th rule:

Bull markets are more fun than bear markets.

Hopefully, the correction (or dose of reality) in the tech sector will mean a greater differentiation between strong businesses and fads going forward. The fads will fade away and there will be a lot of zeroes – among them will be outright frauds and some simply over-hyped situations where there was no intention of theft. For many companies, impoverished shareholders will see further declines in the value of their holdings as stock options are used to retain talent.

For the stronger companies that are left, there will be cutbacks – I was surprised that at its Q1 results, there was little mention of cost-cutting at Netflix, for example, as that is one obvious way of addressing their profitability issues; subsequently, they cut Harry and Meghan while 150 employees have been laid off (more on Netflix coming here soon). But the norm will likely be the repricing of stock options across the sector. This will make shareholders even poorer, but managements have few choices.

Paying subscribers get a screen of the main stock option offenders in the US and Europe. There are even some quoted stocks whose stock-based comp is greater than revenue! The list includes a well-known household name with a market cap in the tens of billions which looks at risk here, but I flag more than a dozen names whose stock prices are down 70% or more where SBC looks to be a significant risk.