In the May 12 newsletter, I recounted most of my trip to Omaha but as it was getting way too long, I decided to write separately about Guy Spier’s Value X Conference. It was a blast.

Value X BRK

This was an awesome conference. My thanks to Chantal in Guy’s office for accommodating me. The speakers mainly talked about their personal associations with Messrs Munger and Buffett. This is not the kind of thing I generally enjoy, but the quality of speakers and delivery made it incredibly memorable.

Monsoon Pabrai

First up was Monsoon Pabrai, daughter of Mohnish, and founder of Drew Investment Management (named after the fictional character, Nancy Drew). Her thesis was that in a bull market, investing in asset managers will be more profitable than their funds which makes sense as they are geared market plays. She quoted Peter Lynch on the 8 asset managers in the US market:

“If you had divided your money equally among these eight stocks and held them from the beginning of 1988 to the end of 1989, you would have outperformed 99 percent of the funds that these companies promote. During periods when mutual funds are popular, investing in the companies that sell the funds is likely to be more rewarding than investing in their products. I’m reminded that in the Gold Rush, the people that sold the picks and shovels did better than the prospectors.”

Financial assets in India are $500bn or c.15% of GDP vs over 100% of GDP in the developed world.

Indian Brokerage Accounts

Source: BTBS from DREW IM data

She recommended Indian stock brokerage firms as the number of accounts in India has been growing significantly, as shown in the chart. She doubts that penetration will reach US levels but it doesn’t need to – there is ample opportunity for significant growth.

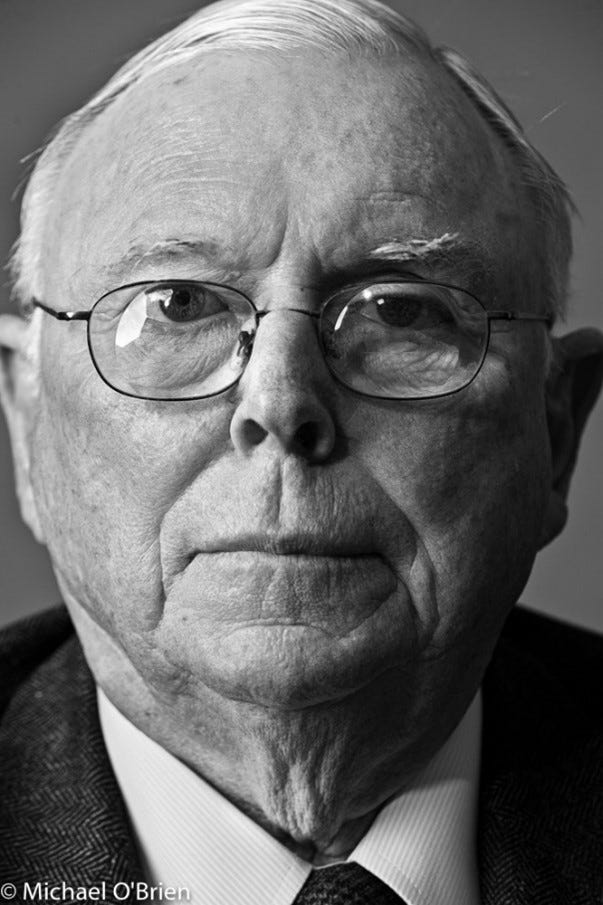

William Green and Michael O’Brien

I had the good fortune to meet William in person for the first time at the event. I have long been an admirer and I really enjoyed our conversation on my podcast. The duo are the co-authors of the book The Great Minds of Investing and photographer O’Brien talked of not sleeping the night before he shot Munger as he only had 10 minutes, although he was allowed one hour. It’s a great photo - he didn’t let any of the subjects in the book smile.

Source: Michael O’Brien

William explained that Charlie Munger told Chris Davis, now a Berkshire board member, to put photos of people you admire in your office as you won’t want to let them down.

Luca Dellanna

When I visited Guy Spier in his Zurich office (it looks more like a library) 3 weeks ago, he kindly gave me Luca’s book, Ergodicity, and by coincidence I had been reading it on the flight from Chicago to Omaha the previous day. His presentation was on a separate although related subject, his new book, Winning Long Term Games (on order).

The bottom line is that optimising for the long term can involve making sacrifices in the short term. If we optimise each day, we don’t build the assets required for long term success – skills, trust, relationships.

Optimising for the short term means that we take more risks than is optimal for long term success. For example, we may be more inclined to lie; there is a 99% chance of getting away with that in a day but a very limited chance if you do it every day for a few years. Luca therefore advises playing interactions not to win in the short term, but to make the next one better.

I was delighted when he recommended that bosses train their people, even if it never seems like the right time. He highlighted Amazon as a company which plays for the long term.

Chris Sparling

Chris is the co-founder of Tiny Capital which at one point was set to merge with the Daily Journal. He and his co-founder met several times with Munger and he gave a brilliant presentation on their interactions.

Tiny Capital is an unusual VC/P-E firm which buys businesses that have sustainable high margins, a simple business model, a high quality team, a 3+ year successful track record and profits of $0.5-50m. In the pandemic they raised a public fund but it’s just $200m and the private capital is their main business with revenues of $200n and $29m adjusted EBITDA.

They are based n Victoria, British Columbia, where we holidayed last year, partly prompted by the British TV programme, Race Around the World, where one series covered a race across Canada. I have no idea why that series has not crossed the Atlantic.

Robert Hagstrom

Hagstrom highlighted that in no other sphere of endeavour would such a high proportion of market participants underperform the average. It could only happen in money management. He analysed the history of value investing and Modern Portfolio Theory, as shown in the table:

1934 Security Analysis – Graham & Dodd

1938 The Theory of Investment Value – John Burr Williams

1940 Security Analysis 2nd edition

1949 The Intelligent Investor Benjamin Graham

1951 Security Analysis 3rd edition

1956 Ben Graham retires from Columbia. Roger Murray teaches his course

1961 David Dodd retires from Columbia. Roger Murray adds his class.

1974 The Journal of Portfolio Management Peter Bernstein

1977 Roger Murray retires, Value Investing Class and Seminar ends.

1984 Superinvestors of Graham and Doddsville Warren Buffett

1991 Bruce Greenwald joins Columbia

1993 Bruce Greenwald becomes Robert Heilbrun Professor of Finance and Asset Management, Director of the Heilbrun Center for Graham & Dodd Investing

Today Tano Santos, Paul Johnson, Michael Mauboussin at Columbia

Hagstrom proposed that Modern Portfolio Theory filled a void left by the value investing academic community post the 1973/4 bear market. Investors returned to stockmarkets, and he posited that MPT took over the money management industry with the invention of risk tolerance questionnaires, an emphasis on short term performance, low price volatility, broad diversification and conservative returns – the approach which he believes is persuasive today.

Hagstrom concluded with a slide on a new approach to business-driven investing, using the Berkshire model. His slide called this a “unique investment approach”.

Investment Objective: Long Horizon Arbitrage

Portfolio Construction: High Active Share >80%

Portfolio Turnover Ratio: Business turnover ratio <20% average annual

Performance Reporting: Primary – Economic Returns (Look through earnings)

Secondary- Price Returns

Performance Objectives: Batting Average vs Slugging Percentage

Frequency vs Magnitude

I don’t understand why he thinks this is a new approach. The majority of my clients do this or most of it. Admittedly it’s a self-selected group who are seeking to improve by training, and it may not be the majority of actively managed money.

One point I disagree with is the obsession with low turnover. We cannot all be Warren Buffett. And Mr Buffett doesn’t have clients who will pull their money if the performance lags. I discuss this in the section for premium subscribers at the end.

Hagstrom is certainly smart and I believe has written some excellent books, but I didn’t fully agree with the premise of his presentation, or more likely, I didn’t properly understand it (although I watched it a second time on YouTube). And of course, there are a lot of great investors outside the USA and much in-depth investment thought outside Columbia University, (which appears to be the centre of the world for some US value investors for some reason).

Gillian Zoe Segal

Segal is the author of Getting There: A Book of Mentors, in which she interviews Warren Buffett, Frank Gehry, Michael Bloomberg and similar luminaries. She requested an interview with Buffett, was rejected, tried again and was ignored. She then cornered him at a charity event and he agreed to give her 10 minutes. But when she arrived, he said don’t worry, I have loads of time and gave her an hour. Her book was sold at the AGM and she has come to the AGM every year since.

Source: Gillian Zoe Segal, from the book Getting There

She also took her own photo of each interviewee and this is her portrait of Mr Buffett. His desk is reassuringly messy and the Too Hard pile is rather low. My takeaway was that a combination of persistence and charm goes a long way but as Guy Spier highlighted, Segal over-indexes on charm - it would take an exceptional person to achieve that time with Mr Buffett. I met her and was really impressed. I even ordered her book.

Doerthe Obert

Mr Munger’s personal assistant for 30+ years gave a deeply personal account of the great man. A year after he hired her, she asked why he had done so – “I like Krauts” was the answer. She obviously has a tremendous affection for the man, unsurprisingly, and in response to the question about what was the one thing about him that made him stand out, she responded that he was the most focused person she ever met.

It was really quite moving, seeing this little old lady stand there in front of a live audience of a few hundred people and doubtless thousands more on the livestream, and recount her memories. How many executive assistants could do that? She was something special. I don’t know how much was innate and how much was 30 years of working with Munger. A bit of both, probably.

Ariel Hsing

Hsing is a former professional table tennis player who played for the USA at the London Olympics in 2012. She used to refer to Messrs Buffett and Gates as "Uncle Warren" and "Uncle Bill". She met Buffett at age 9 when someone decided to have her play Buffett as a joke at his seventy-fifth birthday party. She has been invited to the Annual Shareholders Meeting each year to play table tennis with Buffett, Bill Gates and others. She was a late addition to the lineup and was an incredibly impressive speaker for a university student.

Sheena Iyengar

Sheena is a blind Indian woman who is a Professor at Columbia Business School and the author of the Art of Choosing and Think Bigger. The latter book offers a tool for evaluating options and she ran us through an example which uses AI to help analyse a problem and develop a solution in 6 steps:

choose the problem (people often pick the wrong one)

break it down – into sub-problems

compare wants – what’s the big picture who are you, who is your target audience, who are the third parties involved?

For each sub-problem, search in the domain and out of the box or parallel domain solutions to give a series of choices

Combine the choices with the sub problem

Evaluate if others see what you see

I quite like the idea of having a road map to solve problems in an organisation and the demonstration of the AI tool was impressive. This sort of demo raises questions for me as to how the older generation will keep up – I barely use AI and just this morning rejected a solution from a software supplier which will generate content for me. How long will it take for the AI to be better than I am? Probably not long…

Rose Rios

Rose is the former (43rd) Treasurer of the United States and her signature is on the dollar bill; indeed, on $1.8tn of the $2.2tn of notes in circulation. “Nobody has made more money” she joked. She gave an amazing account of her relationship with Warren Buffett where they competed to give each other more interesting presents. Buffett owned the Omaha Royals baseball team and sent her a signed baseball bat; she sent him a dollar bill baseball. For the Berkshire 50th anniversary, she sent him a personalised 50 dollar bill with the serial number 1965, the year he bought the company. And so it went on.

She has since been appointed to lead America’s 250 anniversary celebration, a job which sounds staggeringly difficult. I asked her how you would start on your first day with a blank sheet of paper. Anyway, I guess I will be there for July 4, 2026 – I like fireworks.

Andy Slavitt

Slavitt is a healthcare VC who went to Harvard with Guy (and introducer Bryan Lawrence of Oakcliff Capital). He was the CEO of Optium, a subsidiary of United Health and overaw its growth from $1bn to $35bn in revenue. He served as the acting administrator of the Centers for Medicare and Medicaid Services from March 2015 to January 2017 and as a temporary Senior Advisor to the COVID-19 Response Coordinator in the Biden administration. He led the team that fixed the healthcare.gov website after its initial rollout and was a Senior Pandemic Advisor to President Joe Biden’s COVID-19 pandemic response team.

He was offered the role as CEO of the healthcare joint venture set up by Buffett, Bezos and Dimon but predicted that it would fail – he didn’t think their commitment was sufficiently strong as it wasn’t a top priority of the three companies. It has since been disbanded.

Most of his own wealth is in healthcare, whose investment attractions include:

Reliable cash flow; healthcare is a $7tn system in which, in the last decade, $2tn pa spend has moved from public to private.

You will age; you will get ill.

Degree of difficulty in doing good is limited - in the US, only one-third of spending is on primary care, which is half the rest of the world.

140m Americans don’t have access to the best healthcare system in the world, only those who can afford it, do.

He raised his $1n fund in 2017 and 7 of the 18 investee companies have become unicorns, the largest valued at $13bn. He has partners who helped him with the VC expertise; he has the healthcare expertise and they operate in a very narrow field.

The US healthcare system is a mess, in my view, and will become more so as the burden falls on an increasingly narrow working population which will have to support an increasingly large, longer living and more expensive to keep alive retiree group. I wish I understood more about healthcare as it’s an obvious theme.

Paul Johnson

Johnson was mentioned by Robert Hagstrom in his speech and has been an adjunct professor at Columbia for 32 years. He was mentored by Bruce Greenwald and in the 1990s, Warren Buffett came every other year. He talked of being in the green room with Mr Buffett and Seth Klarman and his excitement.

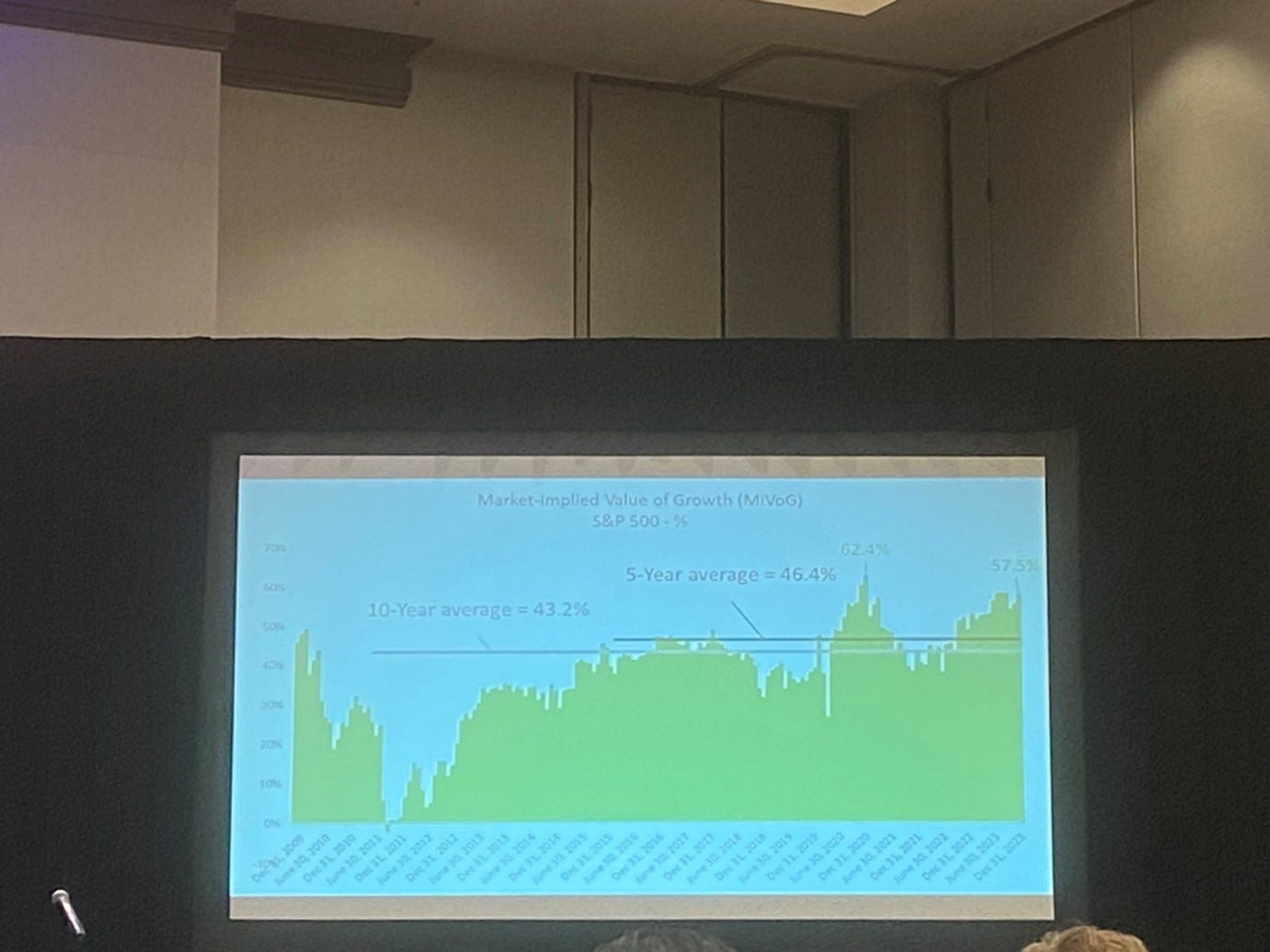

He presented on the difficulty of valuing growth. We have established principles for valuing annuities but the growth component of value is much more difficult. His solution has been to value the existing cash flow stream and the growth in those cash flows separately. He has done this for the S&P500 and the numbers look like the following:

Market value allocated to growth

Source: Paul Johnson, Columbia University

The split history is shown in the following slide:

Source: Paul Johnson, Columbia University

At the peak in October, 2020, 62.4% of the value was in future growth and that is at 58% today. What I thought was particularly interesting as that at the end of 2011, the future expectation of growth actually had a negative value as seen in the following slide:

The Value of Growth

Source: Paul Johnson, Columbia University

I am due to follow up with a Zoom call with Johnson as it’s an interesting analysis and I must be able to learn something, although I wonder about growth having a negative value.

Mohnish Pabrai

Pabrai gave an account of his close relationship with Charlie Munger and he learned most from how he interacted with everyone, his family and business partners alike. He explained that at his and Guy Speir’s lunch with Mr Buffett, he was horrified to see a shrimp on his plate. In contrast, Mr Munger just ate what was put in front of him and would eat anything.

He loved peanut brittle (he was only allowed it twice per month) and would devour the dessert in a few seconds, but he never asked for more. I hadn’t previously appreciated this facet of Mr Munger’s character – he had a lot of bad things happen to him in life which perhaps made him accepting of his fate.

Pabrai remarked that he was an exceptional parent. Perhaps that is the quality we should all try hardest to emulate.

The 5K Invest in Yourself

I didn’t have kit last time, but registered in advance this year. I am no runner. At school, some of us used to slope off mid-run for a cigarette! In Covid, I took up running using the BBC Couch to 5K app which I would recommend. I got my time down to 30 minutes in a few weeks which seemed fine for my age and fitness. Then Covid struck and I was hospitalised with pneumonia, and my lungs are definitely impaired. I now take 35 minutes to do the same run, although in Omaha, I was a whisker faster. It’s a fun event, especially if like me you have never run with others, although I must have run further than 5K, as there was a lot of running around people walking and strolling. The fastest time (15:24) was posted by John Bleday of Giverny Capital.

Conclusion on Value X BRK

All these stories about Buffett and Munger are similar – both men are/were genuinely kind personalities. And I kind of knew that. What was unusual about these presenters was that they were all impressive characters, not just high achievers, but with grace and gratitude and a sense of giving. Segal said that “coming here has changed my life”. And I believed her.

If you haven’t watched the conference on YouTube, it’s worth 4 hours of your time at 1.25x speed.

I hope you have enjoyed my Berkshire musings. I have done a photo album on the Substack site.

Premium subscribers can read on to find out why I think Robert Hagstrom is wrong in advocating for sub-20% portfolio turnover.

Finally, can I just mention my friend Herb Greenberg’s new venture? Herb is offering my subscribers a special discount….

Wall Street Beats is an innovative online investment platform, founded by journalist Herb Greenberg and Beats by Dr. Dre co-creator Steven Lamar. This team is STACKED with successful buy-side and former sell-side professionals... the kind we can all learn from.

Wall Street Beats’ mission is to provide access to the process and insights of experienced investment pros, empowering active and curious investors like you to make better informed decisions in today's dynamic markets.

Here's what Wall Street Beats offers:

Thought-Leading Commentary and Analysis: That includes expert commentary, ideas, and analysis curated by Herb and seasoned professionals who have spent a lifetime navigating the markets.

Daily Beats Roundtable: Stay updated with our daily webcast and podcast, where our experts dissect market trends, share actionable insights, and discuss their investment strategies.

Interactive Client Portal: Our client portal is your gateway to a wealth of resources, including our private interactive chat.

As a special offer for Behind the Balance Sheet subscribers, click here and simply use the coupon code BTSH20 during checkout to receive 25% off your subscription to elevate your investment game with Wall Street Beats today!