Apple’s $14 Billion Back Door Loss

Exploring SVB-Style Losses at Apple, Microsoft and Berkshire

Silicon Valley Bank failed because the rising yield environment led to losses in its bond portfolios that wiped out its equity base.

It might surprise you to learn that bosses at Apple, and to a lesser extent Microsoft, were experiencing similar losses. The only difference was their stronger balance sheets. In contrast, Berkshire Hathaway saw minimal losses.

I want to explore here the extent of the pain experienced by these companies. I also want to show how these losses were accounted for, so that investors can more readily identify them. They are not exactly hidden, but you do need to know where to look.

For simplicity, I am using the last fiscal year for each example. This is slightly unfair as the three companies have different year ends − Microsoft’s fiscal year ends in June, Apple’s in September and Berkshire’s in December. But it’s easier to explain this way and to show the tables in the 10-Ks. I am not trying to compare the three stocks.

But first, a word from this week’s newsletter sponsor…

This issue is brought to you by Kepler Trust Intelligence. In their latest feature, they look at why US small caps are undervalued by investors and why there may be opportunities as a result.

Get in touch if you are interested in 10,000 investors, professional and amateur, reading about your product.

Back to the main event………..

Silicon Valley Bank

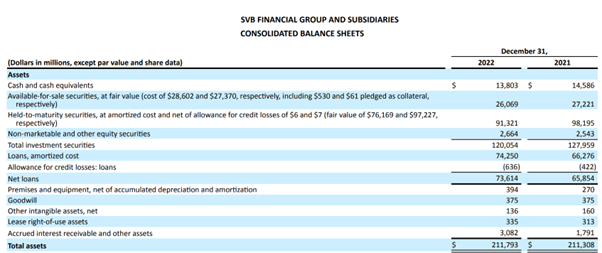

First we’ll look at the Silicon Valley Bank balance sheet.

Let me start by saying I know next to nothing about banks. Yes, I used to be a partner at what was then the world’s biggest financials hedge fund. But I was there to look after their investments outside the core bank, insurance and property plays.

Luckily, you don’t need to be an expert to see the pain in SVB’s balance sheet.

Silicon Valley Bank Balance Sheet at end-2022

Source: Silicon Valley Bank 2022 10-K

The available for sale securities have seen a mark to market loss of $2.5bn or 9%. This has been booked in the balance sheet. The held to maturity bonds have seen a $15.2bn loss or 16.6% (the $91,321m less the $76,169m fair value in the third line), but this has not been booked. Equity was $16,004m at the balance sheet date.

Silicon Valley Bank Share Price

Source:barchart.com

SVB’s 10-K was filed on February 24, and the shares were $285.93 the day after. With 59m shares in issue at the year-end, that’s about $17bn market cap and there was also preferred stock outstanding. It sounds like a smaller premium to book than I would have guessed, but the balance sheet was telling you a very clear story.

You don’t need to be an analyst to understand this – it’s in plain sight on the balance sheet. I wish I had looked at this before last week’s column. It would have been a good illustration of the advantage you can get from simply looking at a company’s 10-K. Now let’s look at Microsoft.

Microsoft

The numbers at Microsoft are less spectacular. The unrealised losses were lower, at just $2.8bn on the June 2022 balance sheet date.

Microsoft Unrealised Losses FY 2022

Source: Microsoft 2022 10-K

The datapoint for Microsoft at 12/22 was $4.7bn of unrealised losses or about 5% overall and 6% on the US treasury bond holdings. Large sums but not in percentage terms, and certainly not significant to the business.

Microsoft December 2022 Unrealised Losses

Source: Microsoft 2023 Q2 10-Q

Apple

Apple had an unrealised loss of around $14bn on its bond holdings at its fiscal year end in September, 2022. You can find this in two main places in the 10-K.

In Note 3, Financial Instruments, the unrealised losses are noted in the third column and represent 8.6% of their total bond holdings. The bulk of these losses were in corporate bonds, with a loss in value of 8.8%. Losses on mortgage and asset backed securities amounted to 11.5%.

Apple 10-K Note 3

Source: Apple 2022 10-K

The other place to find this information is the Comprehensive Income Statement:

Apple 2022 Comprehensive Income Statement

Source: Apple 2022 10-K

The eagle eyed among you will note that the two data points are not identical, as they are not measuring identical exposures. The Other Comprehensive Income Statement is measuring the losses in the last 12 months while Note 4 is measuring cumulative losses since inception.

Berkshire Hathaway

At end-2022, Berkshire had cash of $36bn, US Treasuries of $93bn and investments in fixed maturity securities of $25bn, a total of $154bn. Unrealised losses in the Other Comprehensive Income Statement were “just” $713m:

Berkshire 2022 Other Comprehensive Income Statement

Source: Berkshire Hathaway 2022 10-K

Berkshire gives much less granular information than these other stocks, although it has a much more complex business and balance sheet. This is due to various idiosyncrasies that come with running insurance operations and a regulated utility, amongst other things.

From the disclosures, the $25bn in fixed maturity securities has seen a small mark to market and there is no fair value disclosed for the $93bn in short term investments in US Treasury bills. Presumably Buffett is too smart to lose money through the revaluation of treasuries from rising interest rates.

Speaking of Berkshire, I have booked up to attend the AGM for the first time. I hope to meet many of you there – if you are going, please get in touch and tell me how to find you. Also if there are any events I should attend around the AGM, do let me know!

Conclusion

Companies with large holdings of treasuries will inevitably lose money in a period of rising rates. That is, unless, they are smart enough to shorten duration. Even companies with treasury operations managing in excess of $100bn are not that smart − Silicon Valley Bank lost almost all of its equity on a 1/6 hit to its bond holdings.

The key takeaway is that it isn’t hard to detect big balance sheet problems like this. For SVB, even a lay person could have spotted it. Paying subscribers can read on for a stock idea that may be worth researching further. I know I said I wouldn’t be doing that sort of thing, but hey…