Spies, Artists, and Economists. And AI.

Takeaways from some of the brightest minds in finance and beyond

One of the USPs for my premium subscribers is that I go to several investment conferences and report back – I always learn something and I share the learnings which saves them time, as well as the entry cost. One is a partner at a multi-billion hedge fund in London and he says it’s a no-brainer – he pays $350 pa (or you can pay $20/month) and he knows what stocks have been tipped at a conference and why – he can investigate if he finds something interesting. He isn’t bothered about spending the £$5k that I spend on attendance fees, he wants to save a week of analyst’s time.

The FT Weekend Festival, the subject of this week’s Substack is not typical of these events in that there is less stock-impactful information imparted than for example the Sohn London Conference which has a number of attractions beyond the early bird ticket pricing until 27/09/24.

Inspirational Speakers: Hear from some renowned hedge fund managers who share their best ideas.

Valuable Connections: Network with like-minded professionals and potential collaborators in an engaging environment.

Cocktail Hour: Unwind and socialize during our cocktail hour, the perfect end to an afternoon of learning and networking. Who doesn’t like a free drink?

And of course, it’s in a great cause with all proceeds going to Great Ormond Street Hospital. I have two friends whose daughters’ lives were saved by this amazing institution. Register here.

Perhaps you cannot make it because you are based in New York or are busy on November 20. Next best thing is to become a premium subscriber to this Substack and get my take on those ideas the following Sunday.

The Unintended Consequences of AI

Tim Harford, economist, author and journalist/FT columnist, always opens the FT Festival. He speaks without any prompts (his slides are usually just pictures and this time he didn’t have any). His topic was The Unintended Consequences of AI and he told the story of the tragic crash of the Air France A330 flight from Rio to Paris when 228 people lost their lives.

This was in spite of the A330 never having crashed previously. This was at least partly attributed to its fly by wire technology - the flaps etc are not manually operated by the pilot; instead, instructions are given to a computer which uses AI to interpret those instructions; it can suggest modifications as necessary to the pilot. Harford amusingly likened it to Grammarly for pilots.

The aircraft flew into a storm, and the inexperienced co-pilot put the nose up which created a stall condition. And in spite of the computer sounding the warning STALL, STALL some 70 times before the plane crashed, the pilots ignored it, because they “knew” that the assisted fly by wire technology meant that the plane could not stall.

Harford also highlighted an academic study in which Chat GPT was used in brainstorming. The team which had the technology didn’t produce many ideas and none were good. The control group without a PC did much better. The team with Chat GPT, like the pilots, handed over responsibility to the machine.

This was the moral of Harford’s story. When using AI, be cognisant of the risk; keep your skills alive; think of it as a partnership between the machine and the AI; and ask the right questions – stay open and curious.

Stuart Kirk’s Portfolio

Stuart Kirk shot to fame when he made a speech stating climate change was overstated as a financial risk. He was subsequently suspended before leaving HSBC where he had been the bank’s head of responsible investing. Some of his comments, for example, we didn’t need to worry about Miami being underwater, were insensitive but I didn’t think what he said otherwise was that controversial and he spoke a lot of common sense.

Today he is an FT columnist and writes about his pension portfolio which he is trying to double from £0.5m to £1.0m by the time he is 60 in 8 years, using only ETFs. He is super smart, used to write for the Lex column and then wrote a weekly for Deutsche Bank (which I found seriously thoughtful).

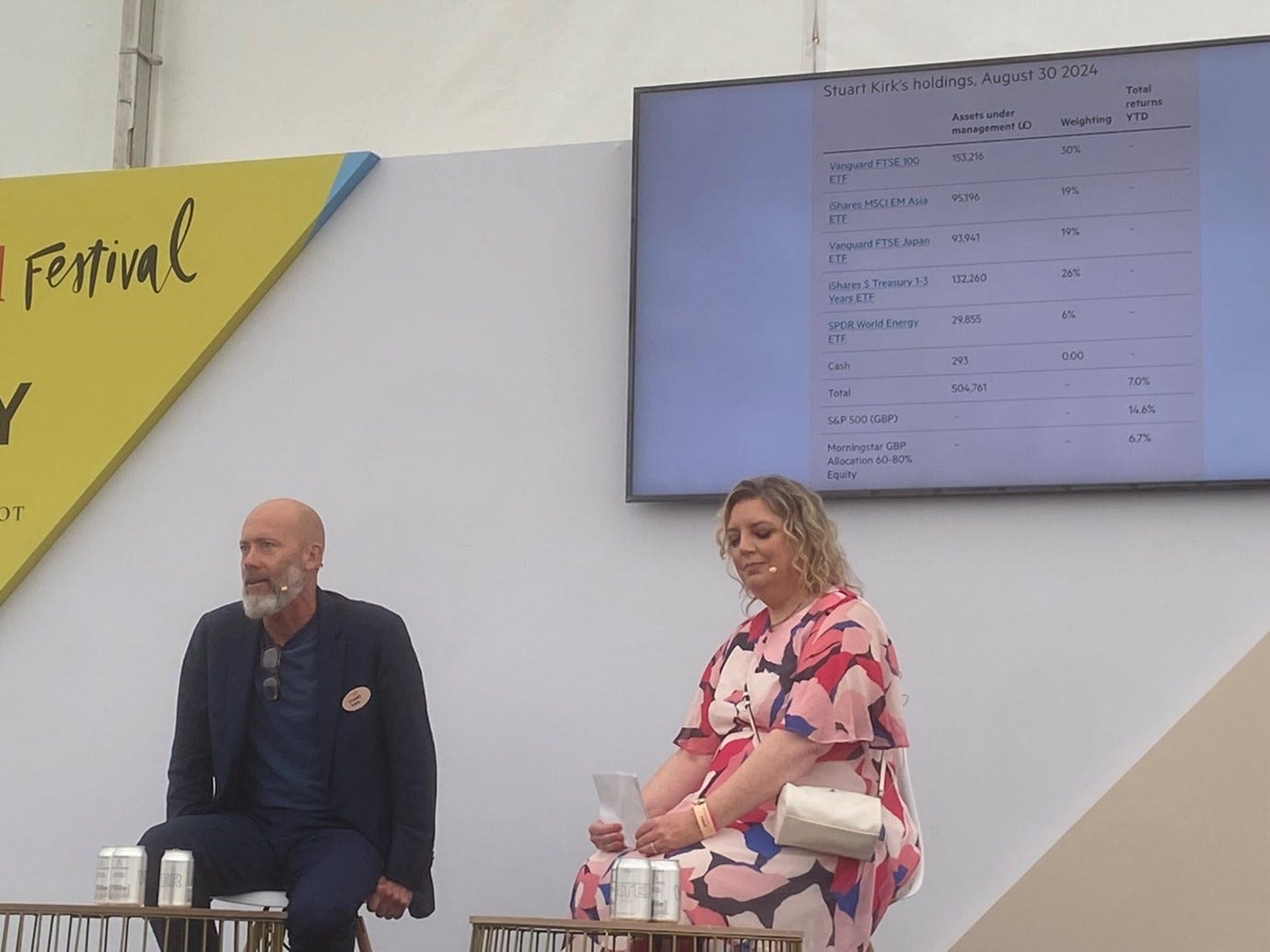

Stuart Kirk and Clear Barrett

In his resignation post in 2022, Kirk alluded to a major new sustainable investment idea with a “crack group of like-minded individuals”, proving that “that human ingenuity can and will overcome the challenges ahead, while at the same time offering huge investment opportunities.” So far, he has only made public his role as an FT columnist. His portfolio is in the picture above but is easier to read in a table:

Stuart Kirk’s Portfolio

Source: Financial Times

He owns the FTSE 100 because he thinks the UK is cheap. I would have thought the FTSE 250 would be a better way to play this. He thinks Japan is cheap and was a Japanese fund manager in his first role at Morgan Grenfell. I agree with that analysis, although I initially adopted the hedged version of a similar ETF. I am now bullish on the yen, so the hedge is not required.

I asked Kirk about his purchase of the EM Asia ETF which he explained as a play on his view that China was lowly valued. That’s true, of course, but that ETF is not the best way to exploit the theme as the same provider has a pure China ETF.

My analysis suggests that his vehicle has no RMB denominated stocks and the combination of HK dollar and US dollar denominated stocks (they look to be mainly Chinese) is 31%, while India is 25% of the ETF, Taiwan 23% and Korea 14%. Other contributors are Thailand, Indonesia, Malaysia and the Philippines. Interestingly, this is a tech-exposed ETF, although its performance has been lacklustre (10 years +5.7% pa , 5 years +3.4% pa). The top 10 holdings are:

IShares EM Asia ETF Main Holdings %

Source: Behind the Balance Sheet from Company Data

His bet on short dated T-bills is an interest rate play and I guess a hedge against US recession risks, although I am not clear why he is buying the dollar when he professes a preference for sterling assets, in order to protect his exposure to sterling liabilities. His energy investment is an inflation protection and has done badly – he would have been and in my opinion would be better off in gold or in other commodities.

I think Kirk is really smart and it’s mad that giving his opinion led to his departure from his employer - we need more commentators who speak their mind and give an honest opinion. I am less enthusiastic about his portfolio.

How to Sketch It

The FT weekend supplement in the UK is titled How to Spend It and is great fun to read. This was an activity class in which artist Nancy Cadogan helped participants draw still lifes. I really am clueless at drawing. At school, the art teacher never spoke to me and I certainly didn’t learn anything; interestingly, I love visiting art galleries and like to collect art. I explained this to Nancy and she tried to help me, but I just don’t know if I could develop any aptitude. The nice Scottish lady next to me did a fantastic sketch of the coffee pot and lemon we were trying to draw, but complained she didn’t feel anything. Nancy was very encouraging, but I gave up and headed for lunch.

Listen to the Song, 2024, by Nancy Cadogan from FT How to Spend It

Mishal Husain

Mishal is a newsreader on BBC TV and one of the lead presenters on the BBC Radio 4 Today programme, the most influential news show on UK radio. The FT journalist complained about having to interview Britain’s best interviewer, but Husain is a superb guest as well as interviewer.

She has written a book chronicling the experience of her 4 grandparents during India’s transition to independence – part biography, part history, and part memoir. I got to know her a little, as I used to be a regular on the Today programme, and she always says hello. She explained it brilliantly and I am sure it will be a great book as she is a fantastic journalist.

Buy “Broken Threads” on Amazon

Michael Palin

My overseas readers (who outnumber those in the UK) may not have heard of Mishal but will surely be familiar with Sir Michael Palin, former Python turned TV globetrotter. Palin probably invented the celebrity travel programme with Around the World in 80 Days, although he confessed . He has also written a dozen books, including the new edition of his diary just out.

He is now 81, but you wouldn’t know, and he is just as kind and funny as ever. I was delighted to see him speak as he is one of my heroes – his TV programmes helped fuel my love of travel. He feels that some of the adventure has gone out of travel today, as you only need to go on the internet and you can read something about your next port of call.

When asked if there was anywhere he wouldn’t go, for fear of legitimising a repressive government – this is after all a man who has filmed in North Korea and Iraq in recent years – he joked “parts of Surrey” (a quiet English county, formerly beloved by stockbrokers in the City of London). He feels that you need to see for yourself and that you should travel with an open and curious mind.

I asked him about how he connected with people so well – if you have seen any of his programmes, you will know what I mean - and if he had any advice for interviewers. His response was that he listened and he enjoyed what people told him. I think that’s great advice.

Buy “There and Back” on Amazon

Dame Sharon White, Chair of John Lewis

She was interviewed by Martin Wolf, the eminent economist and FT columnist (they are personal friends), for Lunch with the FT in Saturday’s paper and again in person at the event. Lewis retired from her role at John Lewis last week, and many both inside and outside the organisation breathed a sigh of relief.

John Lewis is the employee owned UK company which is parent of the eponymous chain of 30-odd department stores and upmarket food retailer Waitrose. Lewis joined as Executive Chair from regulator Ofcom and before that she had a senior role at the Treasury. She is an economist and her retail experience was confined to shopping. She said she took the job because she liked the ethos of a company whose purpose is not simply to make a profit but to provide for its employee partners as well.

I would have liked to ask her why as Executive Chair, she appointed a Chief Executive with a similar lack of retail experience (other than CEO if a business with a subsidiary chain of fast food restaurants I believe). Retail is a sector in which management can effect faster change than many and I believe that sector experience is essential – and that the skills are less transferable than in many industries.

John Lewis is a British institution but has been mismanaged and has failed to capitalise on past misdirection at Marks and Spencer. Now M&S has got its act together and is likely causing John Lewis more problems. Hopefully her successor will do a better job than White – John Lewis will likely become a casebook study of retail mismanagement.

Kids and Compounding

Toby Nangle incentivises his kids to invest their pocket money in the Nangle Bank, which pays 10% interest a week – this is a clever idea to persuade the kids of the merits of compounding.

This is a subject I struggle with, perhaps the mechanic’s car syndrome. Schools don’t teach kids properly about money which is a serious omission in my view. I have therefore been a supporter of the FT FLIC charity which is promoting financial literacy.

I would love to hear from readers if they have ideas on how to teach kids about money and particularly specific advice on what parents should do – having your father’s Uber account and your mother’s black Amex on your phone probably doesn’t teach you much about budgeting.

Premium subscribers can read on for my takeaways from 3 fascinating discussions:

The CIA Director and MI6 Chief discuss foreign policy and security

Daniel Susskind and Martin Wolf on how we should develop a new model for economic growth

Gideon Rachman, Anne Applebaum, Edward Luce, and Sir Simon Schama on the US election

Before that, a word from my sponsor, as I forgot the link last week!

Exposing Corporate Deception: How To Detect Fraud Before It’s Too Late

Protecting your portfolio from fraud is more important than ever. That’s why I partnered with AlphaSense to create this mini-guide, sharing some of the key strategies I use to spot red flags in financials. In this guide, I break down methods I rely on to detect fraud and safeguard your investments.

Key Takeaways:

How I compare margins with industry peers to find inconsistencies

My approach to using working capital ratios to flag potential risks

The cash conversion analysis I use to uncover fraud indicators

Download the guide now and discover how AlphaSense can help you stay ahead of the game.