Adventures In ESG Land

Where values matter, fees are huge and some of the holdings may surprise you

I intend to cover ESG – Environmental, Social and Governance – in more detail both on my podcast and in this Substack. It has received critical attention in a couple of my recent podcasts:

In Episode 8, Chris Wood suggested that ESG had peaked.

In Episode 9, Jeremy Hosking said that ESG had created a capital cycle opportunity in the energy sector which had been denied capital, laying the foundations for a spike in oil prices.

On the same day that Albert Saporta was decrying ESG and claiming that it should stand for Energy, Soya beans and Gold, I spotted a couple of unusual ESG-type funds whose focus was on the “S”, which tends to get less attention.

For me, Governance has always been an integral part of my process, while E is an obvious risk factor – I think of “E” as Emissions and the risk is climate/carbon costs. Therefore, I was curious about these new funds whose marketing focuses on the “S.”

The Harbor Corporate Culture Leaders ETF has the ticker HAPY and invests in Human Capital:

“The Human Capital Factor strives to deeply understand company culture and intrinsic employee motivation as a potential driver of stock performance.”

The Carmignac Portfolio Human Xperience fund is described in its marketing literature as:

“A thematic fund invested in companies that demonstrate strong customer and employee satisfaction. Companies that provide positive experiences to their customers and employees may be better positioned to achieve superior returns over the long term.”

Harbor claims that its approach is backed by data. “’The Human Capital Factor‘ is grounded in a robust, nonreplicable dataset of both public and proprietary sources, covering 2,200+ public firms, 10m+ employee responses totaling 500m+ data points.”

“The Index is designed to deliver exposure to ’corporate culture leaders‘ based on scores produced by Irrational Capital LLC, companies with high ’Human Capital Factor‘ scores, which are determined by Irrational Capital in accordance with a rules-based methodology that seeks to identify companies that best manage their human capital, resulting in highly motivated and engaged employees.”

Human Capital Factor

Source: Irrational Capital

Irrational Capital was founded by the highly respected behavioural economist Dan Ariely. How his firm derives a human capital score, I have no idea. A JP Morgan research report was highly favourable. But the idea is not daft, as for most companies their greatest asset is their workforce. And the ETF charges 0.50% fees, so it’s not a ridiculous investment proposition. Harbor has launched a second ETF, based on the same strategy, the Harbor Corporate Culture ETF (HCFI) using a 150-stock index.

Harbor may not be so happy with HAPY though. It hasn’t performed that badly, -12.27% since inception on February 23 2022, but its AUM (assets under management) are only $6.9m.

HAPY Stock Price

Source: Stockanalysis.com

The Carmignac Portfolio Human Xperience Fund explains its philosophy in the graphic below but provides limited detail on how it derives data on employee and customer satisfaction.

Human Experience Factors

Source: Carmignac

There is quite a lot of data about the fund on the website, as is usual for a UCITS vehicle. Assets are allocated c.60% US, c.30% Europe and c.10% Asia. The four Asian holdings are Samsung, Hyundai Motor, Lenovo and JD.com – none springs to mind as paragons of virtue in employee treatment and I wonder about the customer satisfaction. It’s hard to judge when we don’t know how Carmignac decides these factors, of course.

Assets by Sector

Source: Carmignac

The fund is heavily weighted towards tech, as can be seen from the chart, and looks to have a zero weighting in energy. I would have thought companies like Shell were models of virtue in dealing with employees and would have quite a high score in customer satisfaction also. I didn’t see much mention of ESG in the literature, but I expect the manager prioritises other ESG characteristics.

ESG Scoring

Source: Carmignac

Interestingly, the largest position is in food company General Mills. A full list of portfolio constituents and a review of changes in the past year is in the spreadsheet for paying subscribers. The weighting of the largest 10 positions is 37.5% and there were 39 stocks in total at end of the last quarter and 40 the year before, so the fund is reasonably concentrated, which I like.

Top Ten Stocks

Source: Carmignac

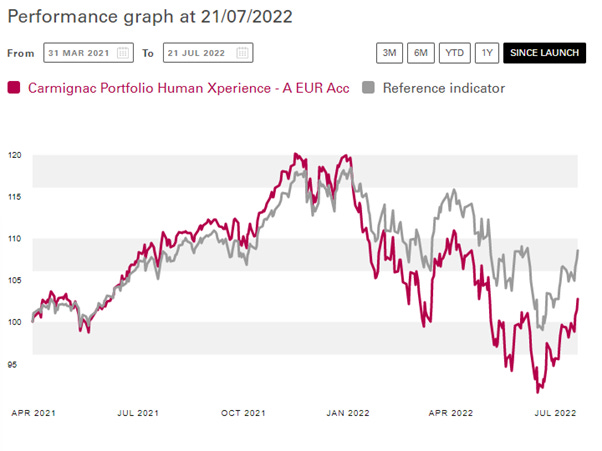

And the performance has not been bad, given the weighting to tech. The manager bailed out of Netflix, which had been a 3% position. There has been a reasonable amount of churn with 17 stocks sold and 12 stocks added, according to my quick review. Here is the performance chart.

Performance Since Inception

Source: Carmignac

Here is the manager’s commentary on performance:

“The Fund posted a negative performance due to volatile equity markets and fears about growth, as consumer confidence indices hit a 40-year low worldwide. The consumer staples industry benefited from the high levels of inflation, whereas our exposure to consumer discretionary – the first to fall victim to inflation – proved costly. Nvidia, a processor and graphics card supplier, Amazon, Hilton and Marriott were among the stocks that weighed particularly heavily on performance. Lululemon and Adidas were also sources of disappointment, but our stock-picking within the consumer staples and healthcare segments, including Procter & Gamble, General Mills, Novo Nordisk and Sanofi Aventis, raised performance. Due to declining social scores, we reduced our exposure to Accenture, which failed to live up to expectations. Conversely, we strengthened our positions in Sodexo, the global catering and prepaid services giant, after it announced better-than-expected revenue and a return to pre-pandemic margins in 2023.”

Wait, Sodexo, the contract caterer . . . is it noted for its excellent treatment of employees? Its inclusions surprised me as did that of Compass. I have done a fair amount of work on Compass and met management and IR several times, and never did they mention employees in a private meeting. Between them, the two contract caterers employ about 1m people – I find it surprising that they would be included in a fund which has a focus on employee satisfaction.

Other stocks included which surprised me were Delivery Hero, Walt Disney, Hilton and Marriott. Again, I should point out that I have not studied employee relations at any of these companies and my surprise is simply from the perspective of a customer and observer.

Perhaps I need to do some more work, but the manager explains how stocks are picked as follows:

“The ratings and selection process are an integral part of fundamental company analysis and is conducted according to our proprietary model based 50% on customer experience and 50% on employee experience.”

And here are the customer and employee experience factors, which they presumably conduct surveys to assess, as I cannot think how else it would be achieved.

Customer experience: client satisfaction, customer welfare, data privacy, quality and product safety

Employee experience: employee satisfaction, corporate purpose, diversity and inclusivity

Delivery Hero riders might be happier than Uber drivers, I have no idea, quite honestly, but would they score highly in employee satisfaction? Maybe their scores are not high in absolute terms but their rivals fare worse, which could give them a competitive advantage?

Walt Disney might have smiling employees, but my understanding is that employee satisfaction is pretty low, especially at the theme parks where most of them work.

And Hilton and Marriott might have happy and loyal customers (I am in both rewards schemes, for example) but when was the last time you saw a hotel chambermaid tap-dancing to work?

I am a little sceptical about their inclusion.

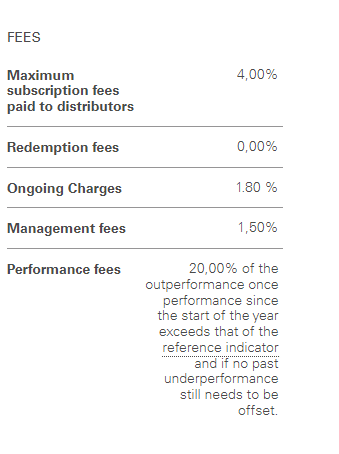

But the real surprise on the Carmignac fund, which looks like a perfectly sensible portfolio with a composition that is easy to see as being ESG-friendly, is on the fees. The schedule is below.

Carmignac Human Xperience Fund Fees

Source: Carmignac

Yes, it’s not quite 2 and 20 but pretty close. I think the benchmark is the ACWI and, to be fair to the manager, the performance has been reasonable given the sector bets and I am not complaining about the stock selection. But I wonder how happy Carmignac is with this fund since it has assets of just €19m.

For a full list of both the Carmignac and the HAPY portfolios, paying subscribers can download our model.