🔍 A Value Trap in Action: Lessons from A Painful Post-Mortem by Schroders

Plus 36 Actionable ideas from 12 Investment Pros at this week’s Value Conference

This week, I was due to attend the Sohn New York conference for the first time, but I had to be in London for various reasons. But that at least allowed me to attend the London Value Investor Conference which had a mix of value and quality ideas from a dozen professional investor presenters who paid to pitch their best ideas to an audience which included the two largest allocators in the world. Plus there were two fireside chats, with former podcast guest Sebastian Lyon and financier and former White House Communications Director, Anthony Scaramucci.

Before I get into the lineup, I still love this quote from the 2025 Berkshire annual meeting which I highlighted last week:

“I spend more time looking at balance sheets than I do income statements…. I like to look at balance sheets over an 8 or 10 year period before I even look at the income account…There is a lot to be learned and you learn more from the balance sheets than most people would give them credit for.”

Warren Buffett

I should have included an offer last week but will do so this week. My course How to Read a Balance Sheet (and the Other Statements) covers the entire financial statements plus modules on financial ratios and accounting shenanigans, but the name was founded on the same principles that Mr Buffett highlighted. It’s normally £399 or $499 but if you use the code PREMIUM24 for the sterling or PREMIUMM24 for the $ version, you will get 30% off. (Simply hit Enrol and choose £ or $).

Hurry! The offer closes soon.

The London Value Investor Conference

The presenters were as follows:

Simon Adler, Schroders: Learning Hard Lessons

Simon Adler is a fund manager on the Schroder Global Value Team. He is a co-manager of the Global Recovery, Global Income, Global Sustainable and International Value strategies. He presented a past idea which had gone wrong and ran through his process and I have outlined this below.

Daniel J. O'Keefe, Artisan Partners: The Arthur Miller Moment

O’Keefe is a managing director of Artisan Partners and founding partner of the Artisan Partners Global Value Team. He is lead portfolio manager of the Artisan Global Value and Artisan Select Equity Funds. He presented one main idea and covered two of his past ideas, which he still owns.

Alissa Corcoran, Kopernik Global Investors: Not Dead Yet: The Immortality of Value Investing

Alissa Corcoran is Deputy CIO, Director of Research, and Co-Portfolio Manager of the Kopernik Global All-Cap and International strategies. She has been in the investment industry since 2012 and presented several ideas, some of which I covered in the New York Value Conference where her colleague David Iben, founder of the firm, presented.

Charles Heenan, Kennox Asset Management: Kennox Value: The First Three Decades

Charles is one of the founders of Kennox Asset Management and is responsible for the firm’s distinctive philosophy and process. He has value investing in his veins, and presented 4 interesting ideas.

Freddie Lait, Latitude Investment Management: Growth Within the Margin of Safety

Freddie is the Managing Partner at Latitude and the Portfolio Manager of the Horizon and Global Funds. Before founding Latitude, he was a fund manager at Odey Asset Management, prior to which he worked at Rothschild & Co and Goldman Sachs. He is a serious investor and presented 3 quality ideas, all of which I know and like.

Alex Roepers, Atlantic Investment Management: Concentrated Mid-cap Value Investing – Four Compelling Stocks

Alex Roepers is the CIO of Atlantic Investment Management, a global public equity investment company which concentrates its capital and research on mid-cap value stocks in the US, Europe and Japan, typically investing in 8-10 companies in each region. Alex has presented at this conference before and always has interesting slightly left-field ideas. One of his ideas had been presented by one of the speakers at the Columbia diner in Omaha two weeks ago. I am looking forward to digging into all four of his stock pitches.

Jonathan Spread, Mondrian Investment Partners: Surviving the Cycle: Driving Long-Term Returns With Defensive Value Investing

Spread joined Mondrian in 2005 and is a member of the Global Equity Strategy Committee, and his research focus areas are primarily the USA and Canada. He presented an attractive and surprisingly cheap stock quoted in New York.

Kamil Dimmich, Pacific Asset Management: Value Investors Take the Bus: You Wait a Decade and Then Two Come Along!

Kamil is a Partner and Portfolio Manager at North of South Capital, the manager of Pacific Asset Management’s Emerging Market Equity strategies and presented two bus stocks in emerging markets.

Sarah Ketterer, Causeway Capital Management: Deep Research, Decisive Action: An Active Approach to Value Creation

Ms. Ketterer is the chief executive officer at Causeway and fundamental portfolio manager. She co-founded the firm in June 2001. She presented four ideas from around the world, two of which she had presented the previous year, but one she still thinks is cheap, 24% higher, while the other has collapsed. Another of her picks the previous year was up 85%!

James Wilson, Phoenix Asset Management Partners, The Huginn Fund: Heavy Crude & Hefty Returns

James joined Phoenix in 2013 and became a partner shortly after. Before joining Phoenix, he worked as a Pan-European equity analyst. He presented an energy stock which sounds ridiculously cheap.

Jonathan Boyar, Boyar Value Group: Finding Opportunities in Trophy Assets and Non-Traditional Value

Jonathan Boyar is President of Boyar Research, an independent research boutique established by his father in 1975 whose subscribers include some of the world’s largest sovereign wealth funds and hedge funds as subscribers. Jonathan is a smart cookie and presented 6 stocks in all, 1 of which was tipped by Mario Gabelli at the Columbia Dinner in Omaha. Four were quality stocks, in fact trophy assets, and the other two were growth stocks.

Andrew Hollingworth, Holland Advisors: Think Harder and Pay Up (Sometimes)

Andrew is the founder of Holland Advisors and Portfolio Manager of the VT Holland Advisors Equity fund. Andrew looks for businesses with Sustainable Competitive Advantages, knowing that such companies can offer great compounding returns to investors. He pitched a UK growth stock.

Sebastian Lyon of Troy Asset Management was the first Fireside Chat and Audience Q&A

Sebastian is Troy’s Chief Investment Officer and is responsible for Troy’s Multi-Asset Strategy. He is the Senior Fund Manager for the Trojan Fund and Investment Manager of Personal Assets Trust.

Anthony Scaramucci of Skybridge Capital was the second (virtual) Fireside Chat and Audience Q&A

Anthony Scaramucci is the founder and managing partner of SkyBridge, a global alternative investment firm, and founder and chairman of SALT, a global thought leadership forum and venture studio.

There were 37 ideas, of which 36 are actionable (more on this later). I would classify 13 as less value and more quality or growth. Premium subscribers will get the full list after the paywall and that will make for almost 80 different stock ideas from professional subscribers in the last 8 weeks.

I cannot guarantee that they are all good ideas. Indeed, I explained that one I wrote up in the last article for paying subscribers was shocking, but I would be amazed if you cannot find enough decent ideas here to populate a portfolio from scratch. It’s less than a dollar an idea for this week’s new ideas alone!

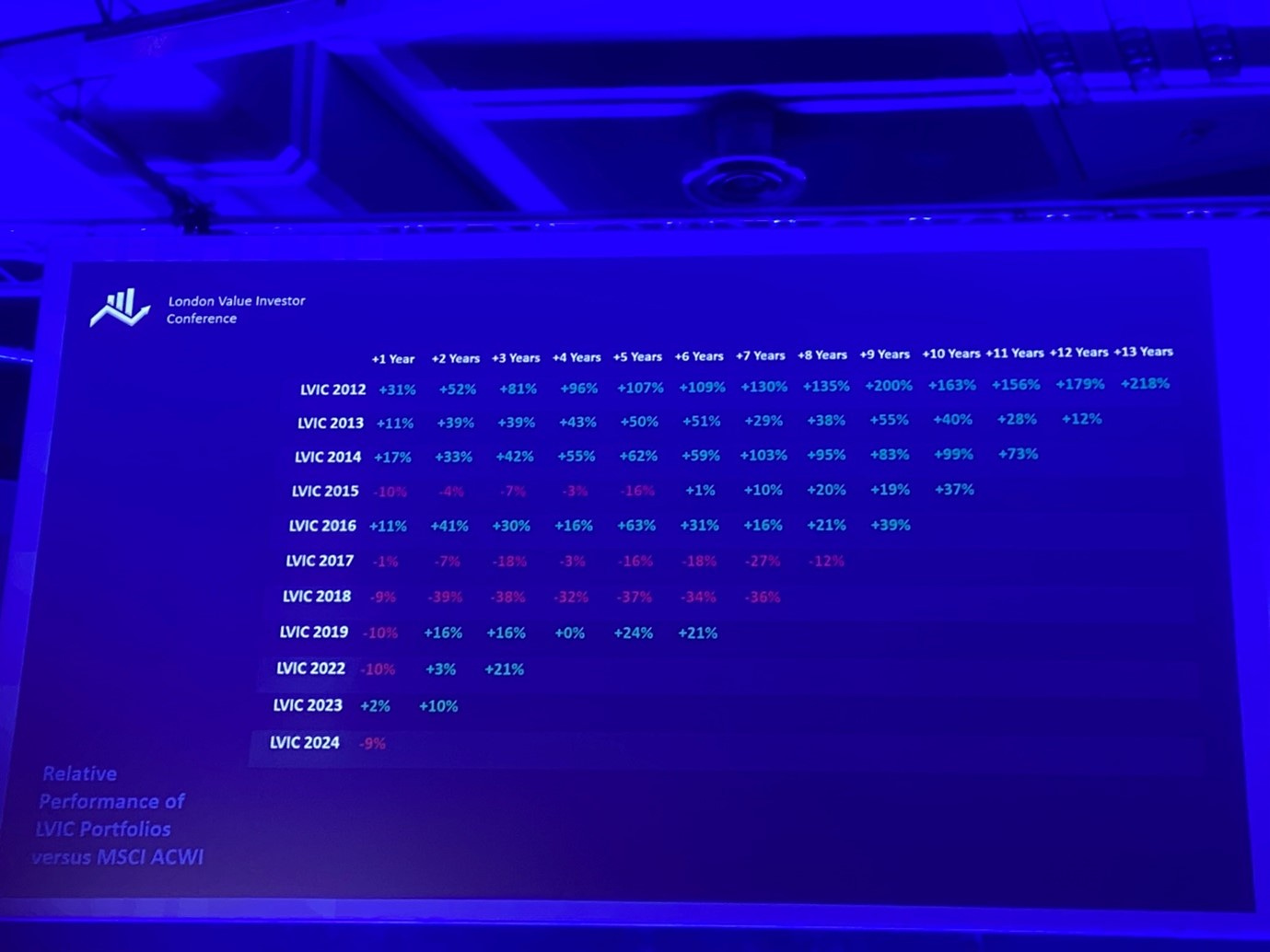

And the ideas from the Value Conferences have a good historical record, as shown by this chart:

London Value Conferences Relative Performance

Source: London Value Investment Conference

Last year was an outlier with 10 stocks underperforming and only 8 beating the index. Three were oil plays, underperforming by 34%, 43% and 63% respectively, and one was a quality growth name which fell by 45% and was pitched again this year by the same presenter.

I don’t know the reason why 2017 and 2018 were bad groups. I have asked organiser Robert Hunter. Richard Oldfield suggested that it might be that 2016 was a very strong year for Value, counter-trend, so when the trend resumed it needed to make up for lost ground – perhaps value was no longer as cheap?

Learning Hard Lessons

This week, I write up the Schroders presentation by Simon Adler. He wanted to show their value team’s research process which he described as disciplined, forensic, rigorous, objective and aiming for improvement. He explained how they document every idea so that they can go back and learn from their mistakes and also pick up a stock later if it falls to their target purchase price.

Chatting to him later, I explained that a number of my training clients have a similar process, which surprised him. Obviously my training clients self-select as being smart and in pursuit of continuous improvement, but I imagine this is not that rare – I used to maintain files on ideas researched and rejected and would try to make it easy to pick up an idea again later. I would love to hear from readers as to how they do this, or why they don’t.

Adler explained that the only place they find ideas is in quantitative value screens. Their principal metrics are EV/10 year average NOPAT, Schiller P/E, with some use of spot P/Es and price:book for banks.

Once an idea pops up in the bottom 20% of cheapest stocks, they then

Build a formal model with 10 years of historical data. They reframe the financial metrics in their own format.

Value traps are managed through their 7 red flag questions checklist.

Stocks with an attractive risk-reward are purchased, but 90% of the stocks are discarded.

The decisions and models are saved in a database.

They usually do the screening on a Monday morning and have a meeting to decide which stocks to work on. At the hedge funds, I would never run a screen on a Monday morning for a number of reasons:

Acquisitions are often announced on a Monday

I would be full of ideas to investigate after my weekend reading

Sunday papers in the UK are full of leaks

I often used to observe major price moves on a Monday so the screen would be out of date before I started as it would use Friday’s closing process.

I didn’t make much use of screens but would run them mid-week as a matter of course. Schroders perhaps have their weekly meeting on a Monday so they have the maximum time to execute the plan. I quite like having a meeting at the end of the week, so you can compare notes on what has happened, not that I think a weekly meeting is a requirement.

They use a 7 point checklist to score each stock and be on the lookout for potential value traps:

Missing liabilities

Misleading profits

Structural changes

Profit conversion into cash

Financial stress

Business quality

Non-financial risks

In the case of the example, they found that

Missing liabilities – they had to make adjustments to the value of associates and for minorities and for a recent M&A deal.

Misleading profits – sale and leaseback profits were included in operating income.

Structural changes – customer consolidation was resulting in a deterioaring Porter’s framework while online was beginning to compete in the space

Profit conversion into cash was strong

Financial stress – their time horizon is 5 years and there were some good terms on the debt, flexible arrangements and core debt levels were reasonable except for the large lease liability.

They look at net debt to trough EBITDA, which is something I also recommend in our online courses. In this case it was 2.4x, but an associate holding in a quoted company if treated as cash brought that down to 1x, ie manageable. The fixed charge cover was 2.4x and if lease liablities were treated as debt, the net debt:trough EBITDAR was 4.2x. But an asset sale was rumoured which would have eliminated the debt.

Their risk score was 6/10 as although there was limited balance sheet risk, there was structural risk and there was some litigation risk. Also the company was investing outside its core business but was vertically integrating so this was a well-thought-out plan.

Business quality – they are happy to buy crap (I paraphrase!) at the right price but here the business quality was good with 25% return on capital

Non-financial risks – there was a major family shareholder with an excellent track record but they had total control.

They passed on the stock in May at 54.43, but bought in December, 2021 at 49.26. Their clients lost 75%.

The Post Mortem

Three things went wrong:

The M&A resulted in huge value destruction.

Margins fell to 1.3% last year.

The litigation risks resulted in massive fines.

The lessons they have learned from this are:

Major M&A is a red flag.

They should be more wary of litigation.

They should be more conservative in assessing margins.

The average margin they used to value the company was 5.2%. In year 3 they were 12% too high vs consensus 16.5% too high. In year 4 they were 9.5% too high vs consensus 20% and in year 5, 5% too high vs consensus 24%. Adler expressed surprise that the consensus was so optimistic but that should not be a surprise as in year 5, the number of analysts estimates is low and the probability of being right is really pretty low. I used to think I was a pretty good analyst but I would not forecast beyond year 3.

They now have about 3000 case studies of stocks they have assessed and either bought or passed on in their archive and they can use this database to learn and improve their process. For example, they can assess their risk scores and subsequent performance, which I thought was an interesting and useful exercise:

Schroders Risk Scores vs Performance

Source: Schroders

There is clearly a significantly higher median drawdown with the higher risk scores, although I don’t know what that tells you about actual stock performance – I would focus less on drawdowns and more on outcomes, but of course it’s difficult to normalise point of time outcomes across a large sample over a long period.

Adler then assessed the portfolio performance and with the ACWI at 17% rolling 3 year return over the period start-2016 to May 2025, which is when the strategy has been going, the cheapest 20% of the market – their pool – has delivered an equivalent 15%. They are clear about their strategy and customers know what they are buying. Their pass notes delivered 13% and their buy notes delivered 28%, both over the 3 years from the decision.

The 188 stocks which they have purchased and either held or sold have delivered 24% while the 133 stocks they have bought and sold have delivered 39%. My maths isn’t brilliant, but I think that means that the 55 stocks they own in the portfolio must have gone down.

Adler didn’t tell us the name of the stock which lost 75%, nor did he say whether it was still in the portfolio. I asked him the question and he would not name the company, which seems odd to me. I have included the name for paying subscribers below.

I think his presentation was interesting as it’s rare that a fund manager will show you how they actually do their stock selection and there were some useful lessons – like the risk score and the debt to trough ebitda. As I mentioned earlier, this is one of the parameters I use and Schroders are a client - I have delivered my Forensic Accounting Course to more than one team there, although not this value team; although I imagine they do share some learnings across teams. Adler told me he thought their database was unique, although some of my clients use a similar learning process.

Premium Subscribers can dive deeper to explore the idea that went wrong — a valuable lesson in spotting value traps before they hurt your portfolio. Plus, get the full list of he other 36 actionable stock ideas pitched at the conference, including:

A luxury stock trading at a ridiculously low P/E, with its market cap in cash and investments

A local sports media monopoly available on a single-digit P/E

A European services leader trading at less than 30% of the multiple of its US peer

Unlock all these ideas and more in the premium edition — your shortcut to ideas most investors haven’t seen yet.