New website

I always hate being told about companies’ new websites. The pronouncements are usually self-congratulatory and contain no benefit for the customer. It’s understandable – a new site seems like running a marathon, or in my case, two. (I have never run more than 5km, a practice initiated in the first lockdown.) But this time, it’s truly different. My new site has an Investor Content Hub – a jump-off page for a review of nearly 100 investing newsletters and enough free training material to keep any keen investor amused for days and possibly weeks. I will tell you more in future letters, but please check it out.

Not all my readers are lovely

Of course you are all lovely, but this week I had to fire a reader and refund their $150. This individual signed up and the next day sent an email to his company’s list which proudly included content from my paid letter. To be fair, he did apologise and he deleted the offending web page. I am waiting to see how much he ponies up for the FT’s charity before deciding whether to name and shame him (or worse). This is a commercial exercise for me – thousands of you benefit from the free content but without several hundred subscribers, it will become difficult for me to justify the time and expense.

This is not the first run in I have had with people breaching copyright:

The Hong Kong company which “published” a PDF of my book;

The one-hour-plus podcast episode on the article Marc Rubinstein and I wrote about Greensill without once crediting us for the content; and

The Substack writer who wrote an article criticising a company’s accounting, which was entirely based on a YouTube video on my channel.

What I don’t understand is how anyone in financial services can fail to appreciate that integrity and reputation are your most important assets. As ever, Warren Buffett summarises it clearly:

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently.”

If you see my work being published elsewhere, please let me know. Thanks.

Founder members got an email this week about a share trade.

Related party transactions

On to the more interesting subject of related party transactions. They are interesting because they are often an important warning signal of risk in an investment. In accounts prepared under IFRS, they are usually one of the last items in the notes, which is one reason why I generally start from the back when looking at a company’s accounts. (Watch out for our upcoming introductory course on how to read a 10-K.) Under US GAAP, you will find this information in several places in the 10-K, both in the notes to the financial statements (but not necessarily at the end, as under IFRS) and under risk factors. One random company had 34 mentions of “related party” in its 10-K, while WWE, known for the practice, had a single note in its 2021 10-K.

You may think this is a highly technical issue which you can safely ignore – you can’t. This technique has real practical value which I can demonstrate with two simple examples.

Samsonite

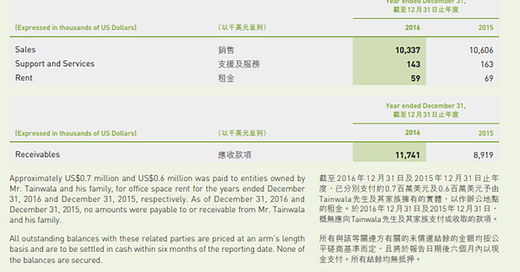

I should have known better after looking at Samsonite, which I recommended as part of a wealth manager client’s model international portfolio. I saw Samsonite as a play on Asia and particularly on Chinese outbound air travel, a market which five or so years ago seemed bound to grow significantly. I saw this related party note, but I dismissed it as an acceptable risk:

The note continues:

There were further quite extensive disclosures of the interests in the directors’ report and I took comfort from the facts that:

Sales were $2810m, so this was minor

Capital and Fidelity were major shareholders and would surely have done due diligence

The non-executives included Keith Hamill, a well-known UK director who again was deemed highly reliable and would not have been involved if he suspected anything amiss.

I later attended a broker lunch with the CEO and an old friend. Both of us emerged shaking our heads about the man. He seemed, well, how can I put it, a little weird. He spent far too long on a story about how one Japanese customer could not understand that there was not a specific use for every pocket in a Tumi backpack. The 15 investors at the lunch wanted to know about revenue growth and margins and came away little the wiser.

The stock subsequently became the target of a short-seller attack and although there was only limited substance to some of the accounting accusations, they had discovered that the CEO, Ramesh Tainwala, had lied about the doctorate he claimed from Cincinnati University and he was forced to resign.

My client didn’t lose money, fortunately. The stock was recommended in the low 20s and peaked at $35 18 months later. We got out on the short-seller attack but the stock fell to $19 pre-Covid and then collapsed to $6 in the pandemic. It’s now trading at $16 and on 12x 2023 earnings. It’s probably worth looking at again.

Terry Smith and Fundsmith

About a year ago, I posted a video on related party transactions on my YouTube channel. I was rather surprised on the same day to see this article on the front page on the online FT:

The reason was that my video explained how investors should not overlook the related parties note which always requires careful scrutiny. The video described how a reader of Fundsmith's accounts could be fooled into thinking that Terry Smith was taking home less than he really was. Let's see how the FT made this elementary mistake:

Fundsmith LLP is a UK partnership and it clearly states the pay of the highest member. Limited companies may pay a founder director in a combination of pay and dividends, but for partnerships it's a profit share. It was quite reasonable for the journalist to assume that Terry Smith would be the beneficiary of the £30m payout as the founder. In this case it's wrong, as I shall explain, but be aware that the highest paid member in this type of structure is often a limited company.

Any analysts reading this would of course have started at the P&L, which is shown below:

It's a highly profitable business with £228m of sales and profits of £48m, but those admin expenses, £180m, sound awfully high for a business with 23 staff and eight partners. And the £41m increase sounds pretty high for a business which has a fixed-cost structure. The reason is contained in the related parties note. Students of my How to Read a Balance Sheet course would have known that this is one of the FIRST things that they should look at.

Some £156m was charged by FISL, a related party. This is, as I explain in the video, a company registered in Mauritius, where Terry Smith now lives. It appears that this is his true take home pay. He may of course ALSO be the recipient of the £30m, or that could have been paid to a colleague, say his research head and right-hand man, Julien Robins. But this is something we can't determine from the accounts.

Reaction to my original tweet on the subject included an understandable moral concern that one person could take home £150m. I have no problems with this – Smith has built a great business and has done really well for his investors. Many less enduring fund managers have made similar amounts and LOST money, so I feel Terry Smith deserves his rewards. There was also some upset that an offshore vehicle could be used in this way, but if Terry Smith chooses to live in low-tax sunny Mauritius, good luck to him.

So good luck Terry, bad luck the FT, whose report card would read "needs to try harder". I shall be returning to Terry and Fundsmith in a future article, as part of a series on asset managers. You can also watch the video on my new website.

I have written previously (Be careful who you get into bed with) about why I like founder- and family-led companies. Several studies show that they outperform and I am firmly in the supportive camp. But when you get founders, you sometimes get quite messy relationships between the company and its owners. These are specified and explained in the related parties note and this can therefore be a useful indicator if someone is playing too close to the edge.

The bottom line is that it pays always to read the related parties note carefully. Paying subscribers can read on about a current real-life example which caused me to write about this now.