First, a time sensitive bargain

If you want to do analysis properly, learning to read company accounts is the first step.

My course How To Read A Balance Sheet is here to help. By the time you finish it, you’ll be able to analyse all three financial statements like a pro.

Until midnight Sunday, you can save £80 in my once a year Black Friday sale. Just use the promo code FRIDAY80 when you join here.

This takes the price down from £399 to £319 – a small price to learn investing’s most important skill. After all, you probably put much more into a single portfolio position.

A few readers noticed that I got the price wrong in my previous email about this offer. I can only apologise and say that a busy week on the road with clients in Stockholm got the better of me!

Paying subscribers get an even better deal – see the end of this note, but hurry as the offer closes this weekend.

A telecoms stock which could double

One of the more compelling ideas at the Sohn Conference (which I discussed midweek for my paying subscribers) was Bharti Airtel, presented by Shashin Shah of Think Investments. This is not a stock which will appeal to everyone and it’s not investible for many, but I wanted to discuss the presentation, because I think we can all learn from it.

It’s a great story and really simple. The best ideas are often the simplest. I shall return to the Sohn Conference, its purpose and some more of the idea presented in the next few weeks.

The Business

The company gave an extensive CMD presentation back in March, 2022, when it explained not only the opportunity in India mobile but other business opportunities in India (including banking). The slide also illustrates Airtel Africa, quoted separately in London. Shah’s presentation focused on the opportunity in India mobile which he explained is alone sufficient to justify the investment.

Bharti Airtel Business

Source: Bharti Airtel Raise the game presentation, March 2022

India has a young population of 1.4bn people, but only has 25m landlines vs 1.1bn wireless subscribers. Mobile is a large and under-penetrated market. Industry consolidation will lead to higher ARPU, free cash flow and returns; and the regulatory environment has turned more favourable after a difficult 10 years. Government action (2G license cancellation in 2012 and negative AGR ruling in 2020) has helped industry consolidation; meanwhile, the launch of disrupter JIO in 2016 with a free one year voice and data plan created havoc in the industry with many smaller players going bust, accelerating the consolidation process.

Indian Mobile Sector Consolidation

Source: BTBS from Think Investments and TRAI data

The industry has therefore consolidated and this level of concentration in mobile has proved a trigger for improved returns in several countries. But there is a further twist in India as Vodafone-Idea is in a weak position with $27bn of net debt. Shah expects a debt for equity swap leading to the Government holding a 33% equity stake – which will likely prevent the Government taking further aggressive regulatory action. Meanwhile, the number 3 player has limited investment capacity and as 5G is rolled out, cannot afford the necessary investment. This means that the top 2 players, Bharti and Reliance, are likely to continue to become stronger and take market share.

Subscriber Number Changes since January 2021

Source: BTBS from Think Investments and TRAI data

Obviously in a largely fixed cost network, adding subscribers alone should improve margins. But Shah argues that pricing will also improve – indeed there is evidence that it already has turned, as can be seen from the chart below.

Mobile Pricing Trends in India

Source: BTBS from Think Investments and TRAI data

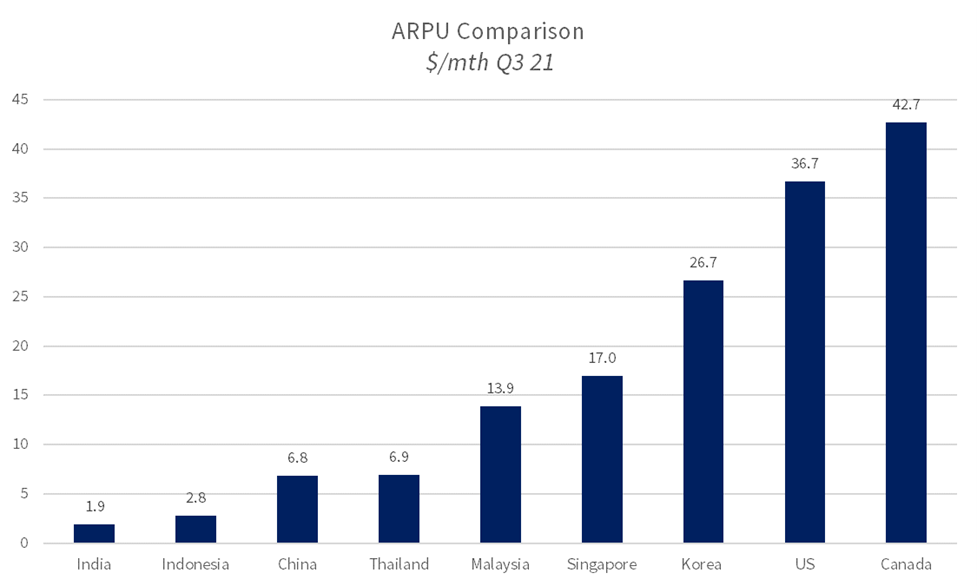

Pricing looks to have bottomed and has considerable long term upside as India remains an incredibly cheap market, even by the standards of other emerging markets in Asia. Shah puts these prices in context – locals spend $6/month on Netflix or $4/month on coffee – a mobile phone is very affordable. The company estimates that moving ARPU from $1.90/month to $3.30/month would improve ROCE from 6% to 20%.

Pricing Comparison – India vs Other Asia and DM (Q3 21)

Source: BTBS from Bharti Airtel Raise the game presentation, March 2022

Three other factors should be positive for ARPU which Shah expects to rise to $3.50/month in 2026:

an expected increase of 200m smartphones in India by 2026

more contractual customers - India is a 96% prepaid market while Thailand is 70% prepaid and Brazil 55%

the move to 5G. Mobile data consumption in India is twice that of the UK at 20GB/month. Today, 40% of customers are 2G only with no data at $1.20/mth; by 2026, he anticipates 20% on 2G contracts.

The company’s CMD presentation highlights many new business opportunities from broadband to banking. Shah only mentioned cloud computing (Google has made an investment in the company).

The company has been quite leveraged but has moved from 4x leverage to 2x now. Shah anticipates $7bn FCF in 2026 and leverage falling to 0.4x – paying subscribers can view a spreadsheet of the financials.

The Investment Case

This is a straightforward story of growth and cash generation with lower regulatory risk thanks to the Government’s interest in the weaker #3 player, Vodafone-Idea. And JIO is incentivised to not be aggressive as it has taken private equity investment at a valuation of $65bn and will IPO in the next few years. Hence the three main players are all likely to focus on profitability growth.

Shah expects Bharti Airtel revenues to grow at 15% pa and EBITDA at 20% pa FY 22 to FY 26, which will deliver a cumulative FCF of $19bn over FY23-26 after $17bn in capex. He sees the downside as a flat share price in the next three years.

A partly paid share offers a 3x return if the stock doubles, which is quite a realistic target of the stock is to trade on an EV/EBITDA multiple of 9x.

Paying subscribers can read on for my take on the valuation and to download the spreadsheet.