25 Quality Compounders from Top Investment Professionals

And my favourite. Unpacking stock picks, strategies, and surprises at a London conference

I attended the Quality-Growth Conference in London again this year. I really enjoyed last year’s event and wrote about how the different participants defined the two elements of quality and growth. Less of that this time round, but just as many interesting stock picks.

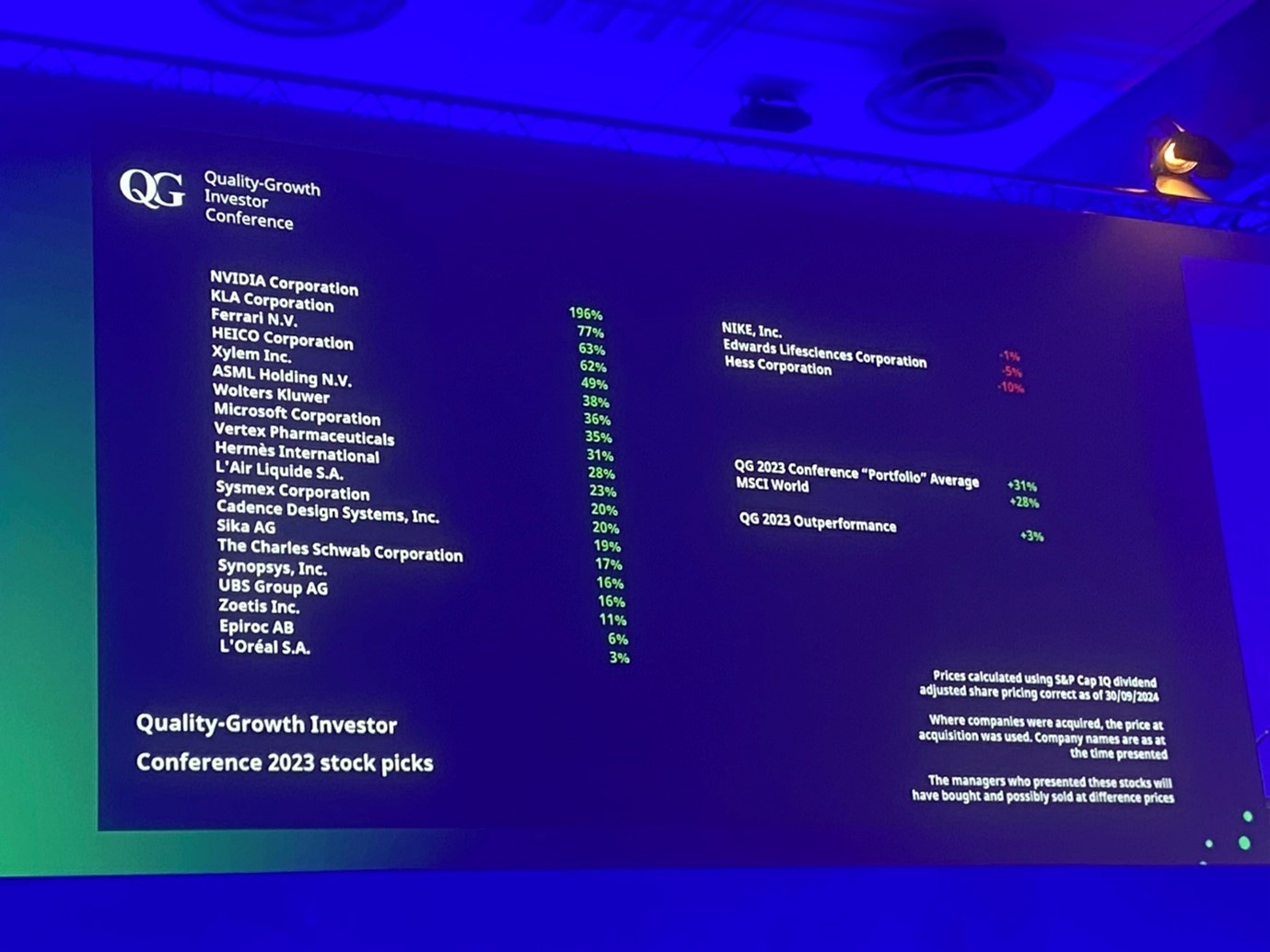

The moderator, Fabio Cecutto who heads the Listed Manager Research team at Willis Towers Watson, gave the scorecards for this conference for the last two years.

Performance of Stock Picks from Previous Conference

Source: Quality-Growth Investor Conference, presented by Willis Towers Watson

I had a slightly different universe - Nike is not in my contemporaneous notes nor in the presentations. I make the average 26% which is slightly below the global index as they define it. Excluding Nvidia (pitched by Baillie Gifford), the average is 19.3% which highlights a key takeaway: winners are even more important in a growth portfolio.

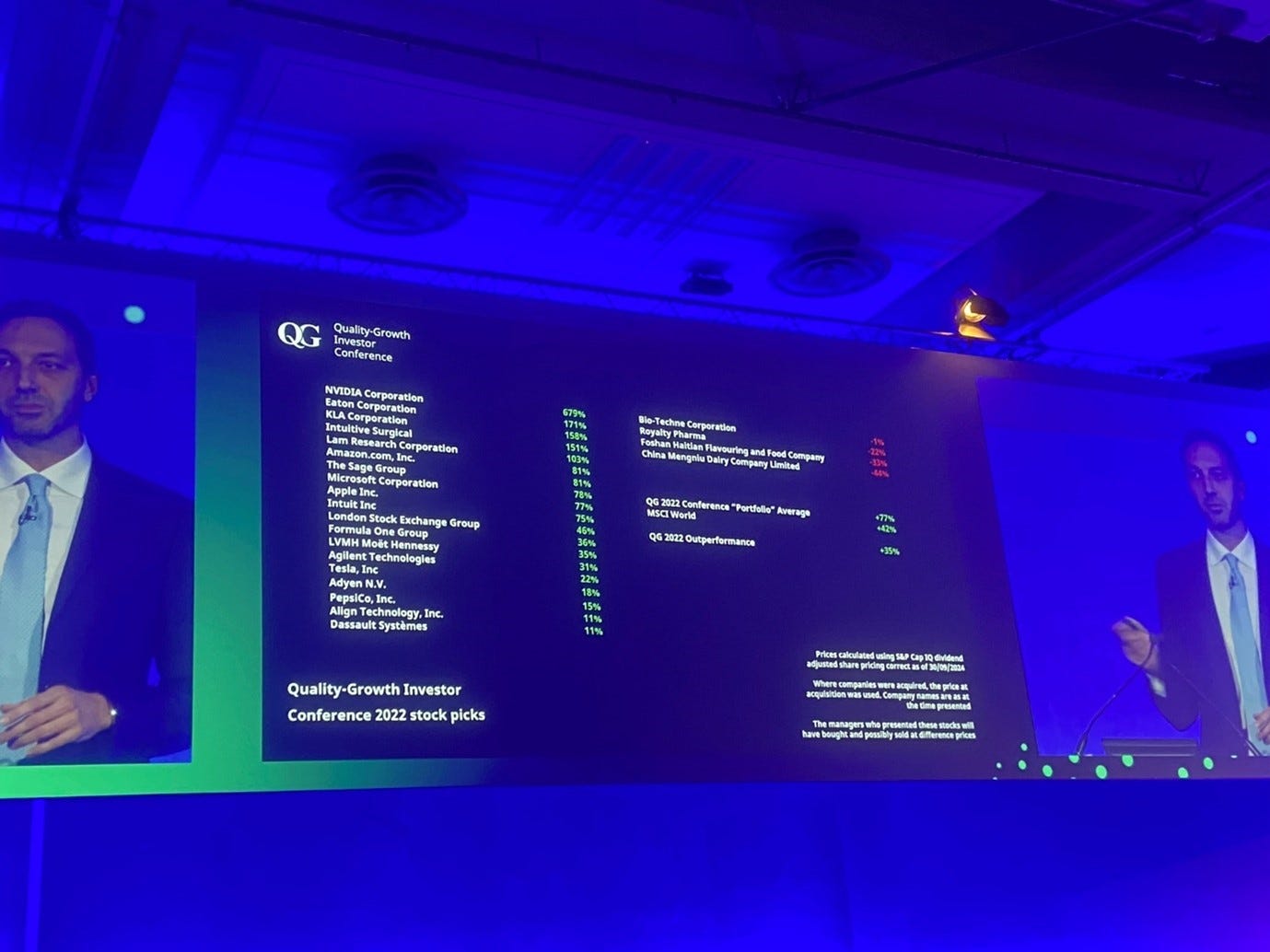

Performance of Stock Picks from Conference -2Y

Source: Quality-Growth Investor Conference, presented by Willis Towers Watson

Interestingly, the previous year, Nvidia was also the top pick (pitched by my pal Stephen Yiu of the Blue Whale fund) and the outperformance was even more significant. Note that KLA was also a top 3 for a second time.

Here is my list of the picks (blue means I added these and tan means I missed these) and the related performance:

Picks and Performance

Source: Behind the Balance Sheet/AlphaSense data

I hadn’t included Nike and my list last year didn’t include Edwards either but it was in the presentations so perhaps it wasn’t pitched to the audience. But I also picked up Mercado Libre and Wolters Kluwer as recommendations, not in the presenter’s slide above, although these may have been in response to questions (what’s your next best pick?). I thought at the time they were interesting to share, even if not part of the formal presentations.

This year, the closing fireside chat was with James Anderson. Former Senior partner at Baillie Gifford, the man who made more money out of Tesla than anyone but Elon, and someone for whom I have an enormous respect. I shall write up that interview separately for free subscribers.

ICYMI

We have two training programmes coming up which you should be aware of:

October 21 - the Forensic Analysis Bootcamp starts. Improve your analytical skills by learning how to be faster and more effective at anlaysing financial data and valuing businesses. This is a Zoom-based course and anyone can participate.

November 13 - our Forensic Course is open to analysts in New York City. It’s an all day event and we have multiple signups already. People are even flying to New York to take this course, although it’s easier if you are local. This is a one-off.

Book now, places are limited.

Can I also mention my friend Russell Napier’s Practical History of Financial Markets course in London 5-7 November. I paid to do this course and thought it was fab. Contact sofi@didaskoeducation.org for more info.

The presenters at The Quality-Growth Conference 2024 were:

Nick Train, PM & Co-founder, Lindsell Train

Rebecca Irwin, Global Equity PM, Jennison Associates

Christopher Rossbach, Co-founder and Manageiing Partner and CIO, J Stern &Co

Laure Negiar, Global Equity PM, Comgest

Andrew Brenton, Co-Founder and CEO Turtle Creek Asset Management

William Low, Global Equity PM, Nikko Asset Management

Kinal Desai, Co-PM Global EM Equities, GIB Asset Management

Stephen Yiu, Founder and CIO Bluw Whale Capital

Ronald Chan, Founder and CIO Chartwell Capital

Angela Wu, Analyst, Artisan Partners

Alx Lee, Principal and PM Sustainable Gorwth Advisers

Stephanie Niven, co-PM Global Sustainable Equity, 91 Asset Management

James Anderson, Managing Partner, Lingotto Investment Management

I haven’t repeated the commentary about what constitutes quality growth as I did that last year. As you would expect from what is effectively a marketing event for fund managers, there was considerable emphasis on what made that manager’s selection process different.

More than one manager had also presented at the sister value conference and one admitted that he had pitched the same stock at both conferences. This highlights the futility of labelling in the investment business - I haven’t met an investor who isn’t a value investor in that everyone wants to buy stocks for less than they are worth.

A few process highlights are informative, however:

An emphasis on the long term – this was notable from Nick Train of Lindsell Train and James Anderson of Lingotto.

A different emphasis on assessing disruption from Jennison Associates which I shall outline in greater detail.

A pitch that optimising position sizes can add massive value to performance from Turtle Creek.

A plea for China from Chartwell, although CIO Ronald Chan feels the market may have run up too far to chase short term.

A pitch for a proprietary culture assessment framework from 91’s sustainable investing team.

I spend c.$5,000+ pa and close to 2 working weeks, attending conferences like this, and reporting back. I write probably 60-80 stock ideas each year from industry professionals (or occasionally informed private investors) which I reserve for my premium subscribers. I feel that $20/month is good value - this article is 3200 words with over 20 charts and tables (that’s 19 pages when printed).

If you are a professional investor from one of the over 1000 asset management companies who read this, I encourage you to upgrade to the paid tier. You will then be able to read on for all the 25 stocks tipped and a write-up of the first few, explaining the manager’s investment rationale and my take.