Introduction

This conference had 12 professional fund managers from the US, the UK and Australia presenting their best ideas; a panel with three more top managers and a former Government pensions minister; and a fireside chat and Q&A with Joel Greenblatt.

In this and a series of posts (it’s far too much for a single newsletter), I shall run through several great stock ideas, wisdom from Joel Greenblatt and thoughts from a couple of the leading thinkers in the UK investment industry.

The Presenters

Here are the presenters:

Juan Torres and Vera German – Schroders Global Value Team with an intriguing tech idea.

Alex Roepers is the founder of Atlantic Investment Management which has delivered twice the S&P over >30 years, net of management and performance fees. He has some interesting and unconventional thoughts on position sizing and portfolio turnover. He presented a US idea which has already doubled but which he thinks has a lot more to go and an intriguing Japanese industrial which is buying back 20% of its stock.

Cole Smead (his dad, Bill, spoke last year and was a guest on my podcast) explained why they have a quite different outlook on an important and bombed out sector and presented different ways of playing the theme.

Simon Gergel of Allianz Global Investors is a 1980s market veteran and presented a growth stock at a value price in the UK market.

Clive Gillmore, CIO of Mondrian Investment Partners, a $45bn investment firm, recommended a safe Italian stock which he thinks should deliver 7.6% pa compound with little downside.

Sarah Ketterer, co-founder of California $47bn investment firm Causeway Capital, delivered a selection of quality global picks at temporarily bargain prices.

Jacob Mitchell of Australian firm Antipodes suggested an interesting Asian cyclical.

Django Davidson of Hosking Partners highlighted an out of favour sector whose compelling narrative was revealed by the firm’s focus on the capital cycle.

After the conference, Andrew McDermott of Mission Value Partners showed me a note from Warren Buffett. They spent 90 minutes together, discussing the thematic to which his fund is totally exposed. Mr Buffett wants to increase his exposure to the same theme.

Ian Lance of Redwheel highlighted a few out of favour situations in the UK and Europe which are big positions in his £5bn UK-biased strategy.

Brian McCormick, a thoughtful manager who has been on my Forensic Accounting training course, highlighted a stock trading at a 35% discount to NAV with a catalyst.

The UK equities panel included Pete Davies of Lansdowne Partners (a guest on my podcast), Gary Channon of Phoenix Asset Management. Kiran Nandra equities head at Jupiter Asset Management and former government minister, Sir Steve Webb.

Schroders

Juan Torres and Vera German are the managers of the Schroders Emerging Markets Value fund, part of the highly successful Global Value team. They highlighted that value today in EM is similar to the situation which Ben Graham encountered in the 1930s. Compared to the investor in the US today, they flagged the following difficulties:

Highly uncertain

Less competition

Less available information

Difficult accounting

Unreadable annual reports

Non value-oriented shareholders

Challenging currencies

They look at five “flavours” of value:

Hidden angels

Cyclicals

Special situations

Structurally challenged companies

Hidden growth

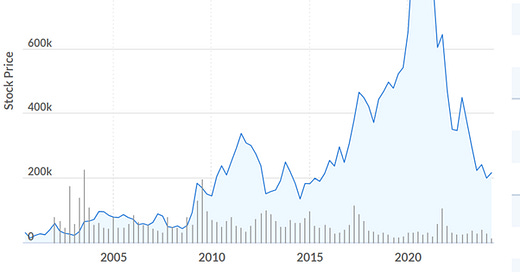

And they identified a tech stock which has been significantly derated and now passes as a value stock:

Premium subscribers can read on for a summary of all these ideas (21 stocks and 2 themes) and my question which floored Joel Greenblatt.

Perhaps you are a professional investor at one of the 1000+ asset management firms who subscribes to the free Substack. Please be aware that some of your competitors (including a number of top hedge funds) feel that the $350 annual subscription is a bargain. They save $1000s of conference fees; more important, they don’t lose time attending; and they get a roundup from a sensible analyst who can filter the best ideas. Thanks for your support.